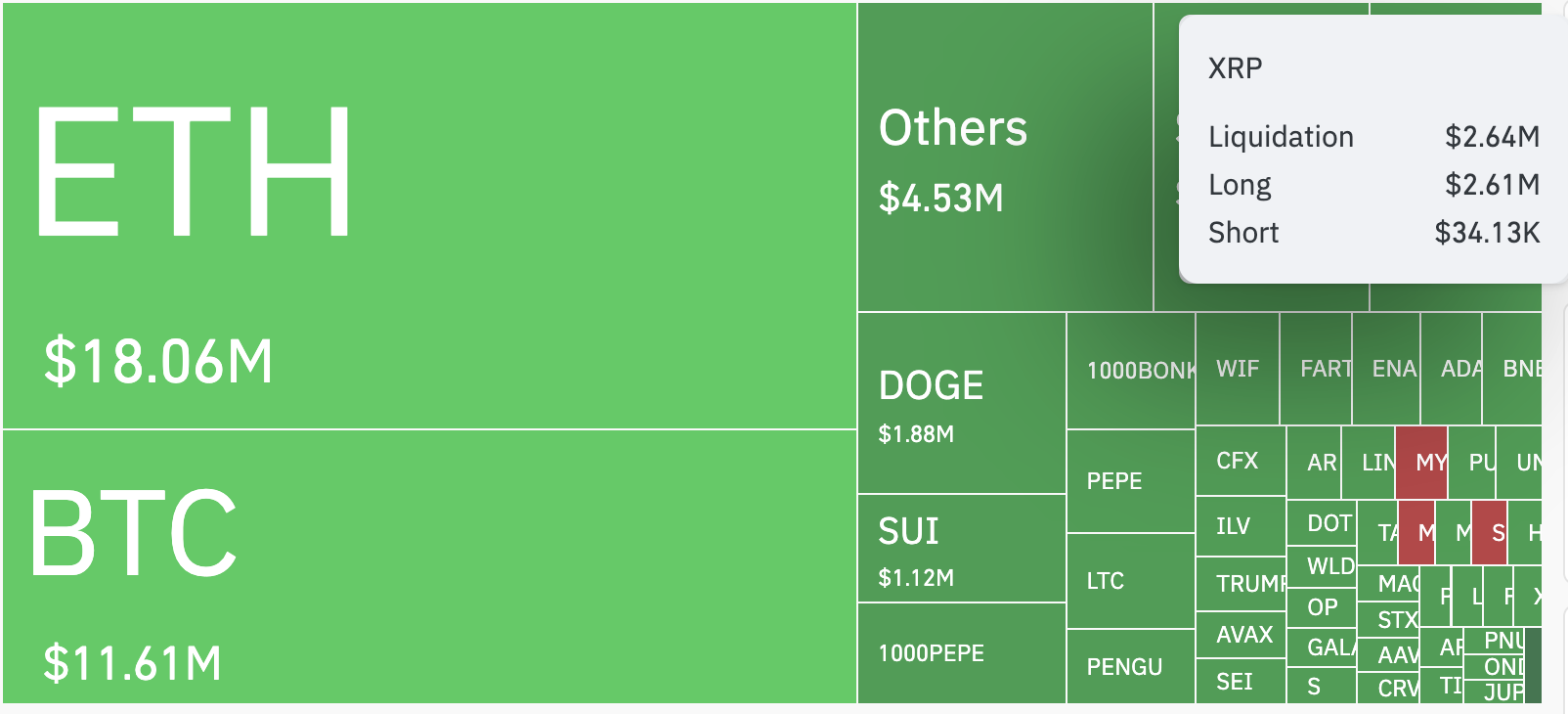

XRP faced a massive 7,676% liquidation imbalance in August 2024, wiping out over $2.61 million in long positions, highlighting significant overexposure amid the crypto rally.

-

XRP’s long positions were disproportionately liquidated compared to shorts, signaling a one-sided market pressure.

-

The price dropped nearly 3% within minutes, breaking multiple support levels.

-

Unlike BTC and ETH, XRP’s liquidation event showed minimal short-side resistance, indicating crowded long trades.

XRP’s liquidation imbalance signals overleveraged longs amid August’s crypto rally. Discover the impact and market outlook with COINOTAG’s expert analysis.

What Caused XRP’s Massive Liquidation Imbalance?

XRP’s liquidation imbalance is driven by excessive long exposure, with $2.61 million wiped out in 24 hours. This sharp sell-off caused the price to drop 2.94% to $2.97, breaking key support levels rapidly. The data from CoinGlass reveals a 7,676% disparity between long and short liquidations, indicating a structurally crowded trade.

How Does XRP’s Liquidation Compare to BTC and ETH?

While BTC and ETH also experienced significant long liquidations—$40.39 million and $70.76 million respectively—they saw notable short liquidations as well. XRP’s event was unique due to the near absence of short liquidations, suggesting a domino effect of long-only leverage collapsing. This highlights XRP’s vulnerability to rapid market shifts.

Source: CoinGlass

Is XRP a Crowded Trade in the Current Market?

Yes, XRP’s liquidation data suggests the market is heavily skewed towards long positions. The persistent one-sided pressure across hourly and four-hour charts indicates traders may have exhausted bullish momentum or piled into XRP too quickly. This imbalance often precedes volatility as the market seeks equilibrium.

What Does This Mean for XRP’s Price Outlook?

Despite the sell-off, XRP remains resilient near $2.97. However, the liquidation event exposes overleveraged traders and warns of potential volatility ahead. The ongoing rally is not necessarily over but will likely face resistance from these structural imbalances.

Frequently Asked Questions

Why did XRP experience such a high liquidation imbalance?

XRP’s high liquidation imbalance resulted from a large number of leveraged long positions collapsing simultaneously, reflecting overexposure and a lack of short-side counterbalance in the market.

How will this liquidation event affect XRP’s future price movements?

This event highlights market volatility and overleveraging, suggesting XRP’s price may face resistance and fluctuations as the market corrects these imbalances.

Key Takeaways

- XRP’s liquidation imbalance reached 7,676%: Highlighting extreme long position exposure.

- Price dropped nearly 3%: Rapid sell-off broke multiple support levels.

- Market shows signs of crowding: Minimal short liquidations indicate one-sided trade pressure.

Conclusion

The recent XRP liquidation event underscores the risks of overleveraged long positions during volatile market rallies. While XRP remains strong near $2.97, traders should watch for continued volatility and structural imbalances. COINOTAG will continue monitoring developments to provide expert insights on XRP and broader crypto market trends.