MEI Pharma Acquires Litecoin as Primary Treasury Asset

- MEI Pharma shifts $100M to Litecoin, a crypto first.

- Charlie Lee and GSR lead investment strategy.

- Impact on LTC market and future trading dynamics.

MEI Pharma, a NASDAQ-listed company, acquired 929,548 Litecoins for $100 million as its primary treasury asset, marking a significant move in the crypto market on August 4, 2025.

This acquisition represents the first instance of a U.S.-listed firm using Litecoin as a reserve, indicating bullish institutional sentiment and boosting market liquidity.

MEI Pharma has invested $100 million in Litecoin (LTC) as its primary treasury asset. The occasion highlights a significant shift towards crypto by a Nasdaq-listed company, facilitated by influential leaders in the crypto space.

The acquisition was led by Charlie Lee, Litecoin’s creator, now joining MEI’s board. Major crypto trading firm GSR will manage the treasury, setting a new precedent for U.S.-listed firms regarding crypto reserves .

The substantial investment is expected to increase market stability and liquidity for Litecoin. Market dynamics show a price appreciation from $107.58 to $124 per LTC, boosting MEI’s asset value to an estimated $110–$115 million.

Market analysts observe potential for increased institutional interest in Litecoin as a reserve currency. This could reshape financial strategies in corporate treasuries, differing from previous focuses on Bitcoin or Ethereum.

This initiative might prompt further diversification within corporate strategies, potentially enhancing crypto market adoption. MEI Pharma’s strategy includes hedging against inflation, indicating a broader movement within financial circles toward crypto assets.

Historically, LTC purchases have lacked the mainstream corporate adoption seen with Bitcoin. Yet, if it follows Bitcoin’s trajectory, it may lead to substantial market gains. Analysts predict potential regulatory evaluation as this strategic shift unfolds.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

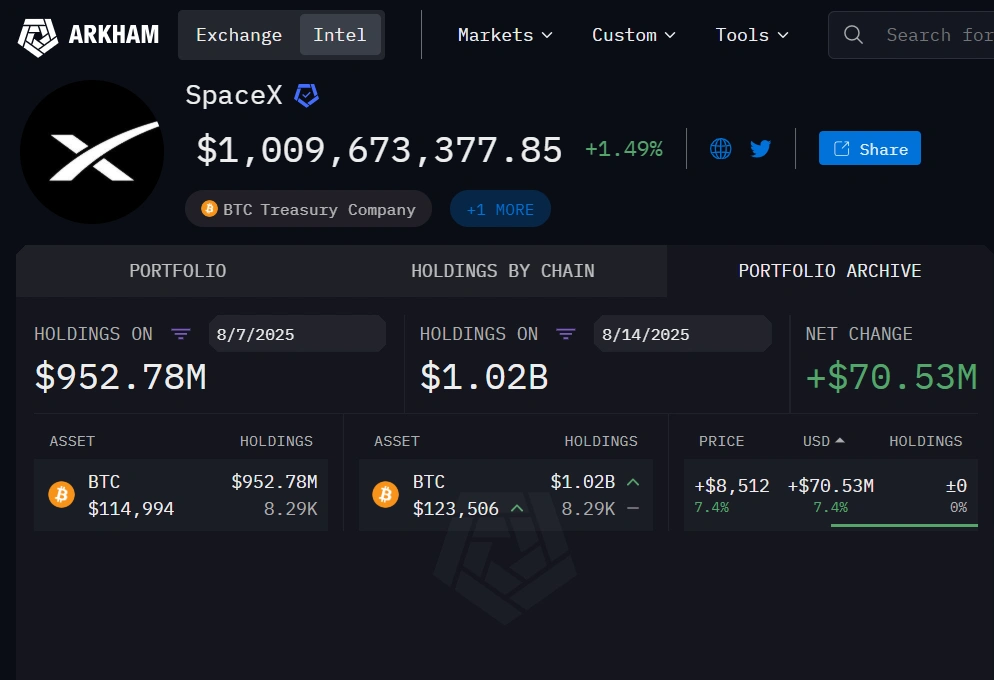

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.