Can Succinct “PROVE” Its Listing Strength? Bullish Pennant and Accumulation Say Maybe

Newly listed PROVE is showing early strength on the charts and in token holdings. With low float and bullish structure, can it climb higher?

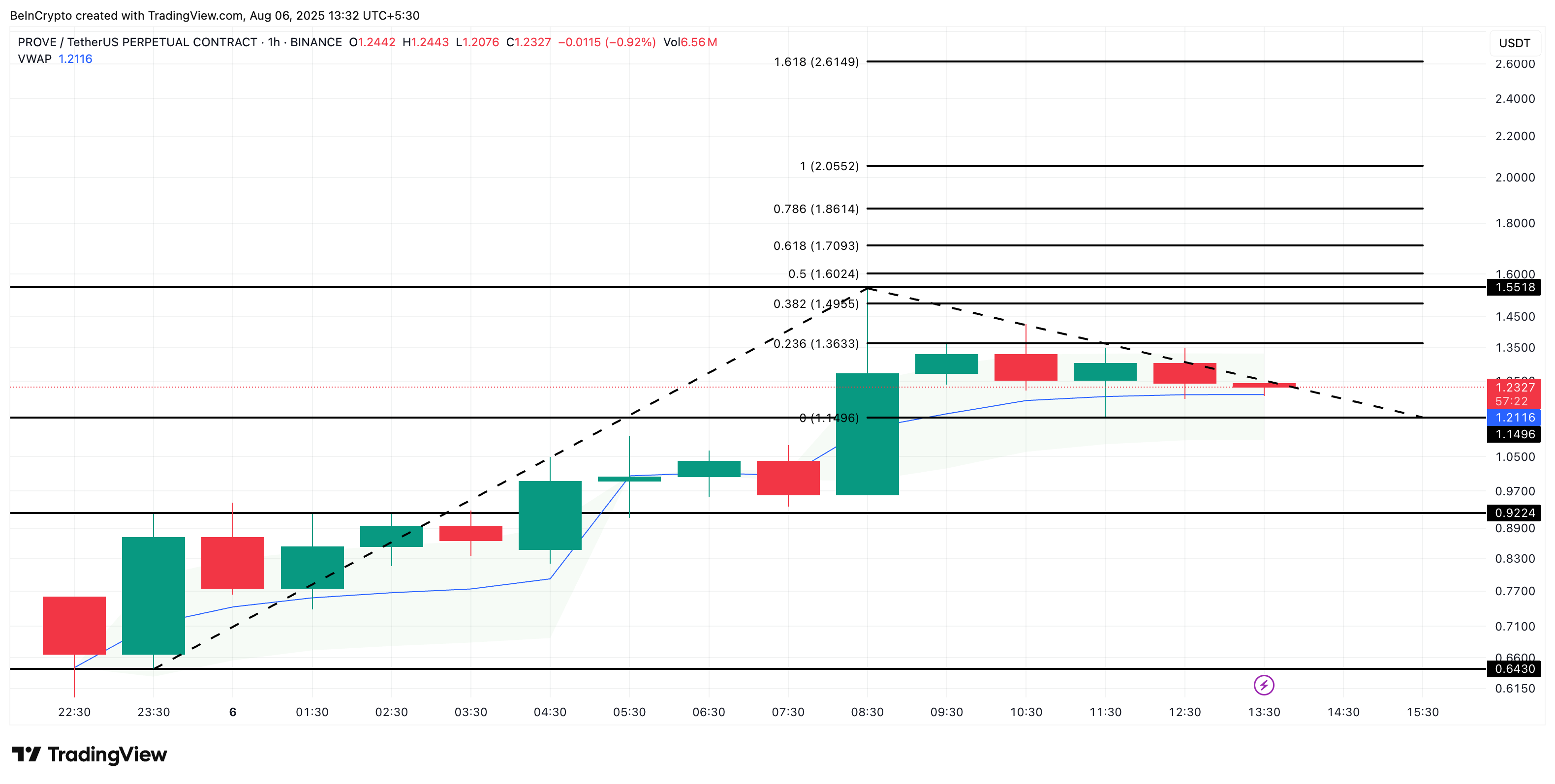

Succinct’s PROVE token was listed just hours ago, and it’s already catching attention with a volatile start. After opening around $0.65 (discounting the low from the first errant candle), the token spiked to a high of above $1.5 before retracing to current levels near $1.2.

That’s a significant swing for a new listing, and now, some early indicators are suggesting it might be gearing up for a recover, or a collapse, if one level breaks.

Cliff Unlocks Are Delayed, While Top Holders Step In Early

One of the biggest fears with newly listed tokens is the looming cliff unlock, when large amounts of tokens are released to insiders and early backers, often triggering steep price drops. But in Succinct’s case, the structure tells a different story.

According to the official distribution, over 65% of the total supply allocated to core contributors, investors, and R&D comes with 0% unlocked at TGE, a 12-month cliff, and gradual linear vesting over 36 to 48 months. Even the incentives and foundation allocations, while partially unlocked at launch, still follow the same one-year cliff schedule before any further supply hits the market.

This means that no meaningful unlock pressure exists until mid-2026, giving the market ample time to absorb the initial token release or float and establish demand organically.

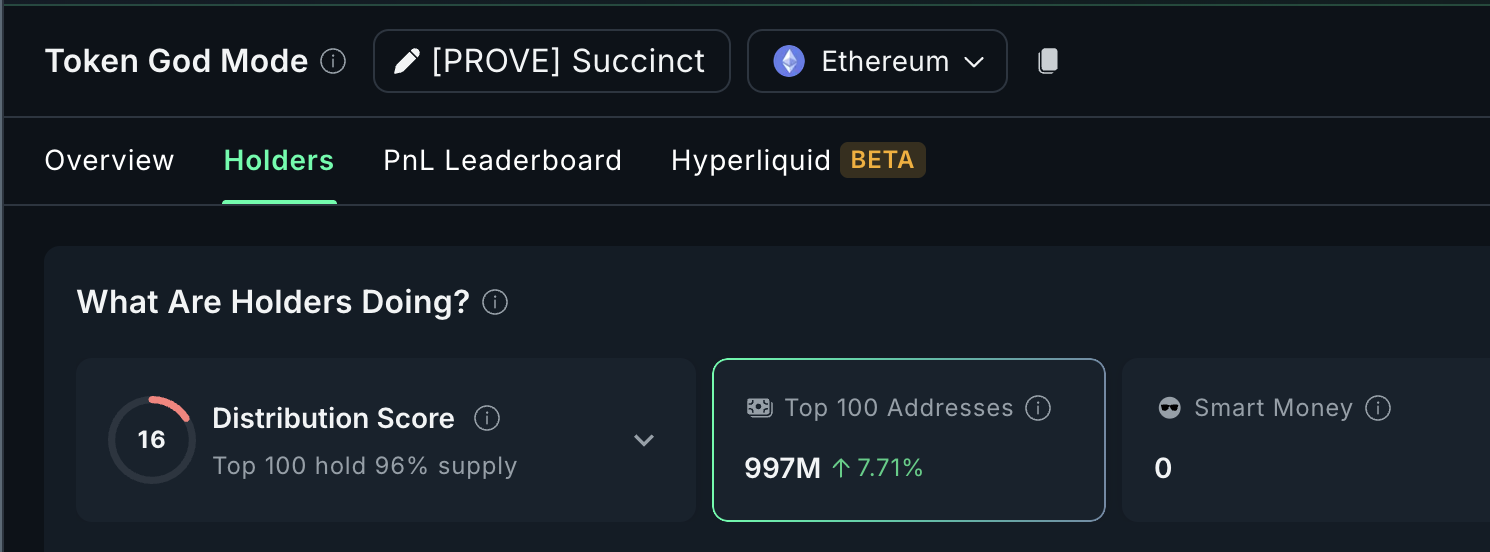

Succinct (PROVE) price and top addresses gobbling up supply:

Succinct (PROVE) price and top addresses gobbling up supply:

Now here’s where it gets more interesting. Despite the early volatility, top 100 holders have added 7.71% more tokens, now holding 96% of the total supply. This surge in ownership concentration signals that early accumulation is taking place. It is likely from long-term participants, either insiders or whales, anticipating strength in Succinct’s token model.

With cliffs keeping most of the token supply locked away and top holders quietly stacking, the risk of a near-term supply shock looks minimal. If anything, current trading is happening on low float, and price action is more susceptible to momentum and sentiment than mass unlocks.

Fibonacci and VWAP Hold; But $1.18 Is the Make-or-Break for the Succinct (PROVE) Price

The 1-hour chart paints a classic retracement story. After peaking at almost $1.55, PROVE retraced cleanly toward the $1.14 level and is now hovering around $1.23. Importantly, this area also aligns with the anchored VWAP (Volume Weighted Average Price) line at $1.21, where price has respected support multiple times.

Succinct price analysis:

Succinct price analysis:

If the VWAP line (blue line) breaks, the next key support is $1.14 and then $0.92. A fall below the latter would risk forming a new all-time low (below $0.64), invalidating the short-term bullish structure entirely.

Note: The first candle from the left was discarded as the low of the Fibonacci extension due to the listing volatility.

VWAP is a popular intraday indicator that traders use to assess whether a token is trading at a premium or discount relative to its average price throughout the day. When the price stays above VWAP, it usually suggests buyers are in control in the short term. In this case, PROVE maintaining above VWAP adds a layer of support beneath the current range.

But if PROVE manages to push past $1.36 and then $1.49, the 0.618 Fib level at $1.70 opens up as the next target. Do note that this trend-based Fibonacci extension pattern might keep shifting as PROVE is still experiencing post-listening volatility.

Bullish Pennant Forms on 15-Min Chart, But 9/15 EMA Cross Still Unconfirmed

Zooming into the 15-minute chart, we see a textbook bullish pennant forming;lower highs converging with higher lows in a symmetrical triangle. This pattern typically resolves in the direction of the prevailing trend, which here is upward from the $1.58 breakout zone.

If the Succinct (PROVE) price breaks $1.49 (per the 1-hour chart), it would also mean a pennant breakout. However, a clear trend-backed breakout level lies above $1.61, which also aligns with the 1-hour Fib chart from earlier.

Succinct (PROVE) price action (15-minute) timeframe:

Succinct (PROVE) price action (15-minute) timeframe:

However, a small caveat: the 9 EMA is approaching the 15 EMA, but hasn’t crossed above it yet. Until that crossover confirms, momentum remains neutral on the very short-term scale.

If the crossover happens and the price breaks the upper pennant line ($1.49), it could trigger a short-term rally. That would push the price toward $1.61 or higher. On the flip side, if the pattern breaks downward and $1.18 gives out, sub-$1 becomes a real risk.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Cobie: Long-term trading

Crypto Twitter doesn't want to hear "get rich in ten years" stories. But that might actually be the only truly viable way.

The central bank sets a major tone on stablecoins for the first time—where will the market go from here?

This statement will not directly affect the Hong Kong stablecoin market, but it will have an indirect impact, as mainland institutions will enter the Hong Kong stablecoin market more cautiously and low-key.

Charlie Munger's Final Years: Bold Investments at 99, Supporting Young Neighbors to Build a Real Estate Empire

A few days before his death, Munger asked his family to leave the hospital room so he could make one last call to Buffett. The two legendary partners then bid their final farewell.

Stacks Nakamoto Upgrade

STX has never missed out on market speculation surrounding the BTC ecosystem, but previous hype was more like "castles in the air" without a solid foundation. After the Nakamoto upgrade, Stacks will provide the market with higher expectations through improved performance and sBTC.