- Fear & Greed Index hits 63, up from “Neutral” the day before.

- Profit-taking among short-term BTC holders has eased.

- Analysts see potential for BTC breakout toward $125,000.

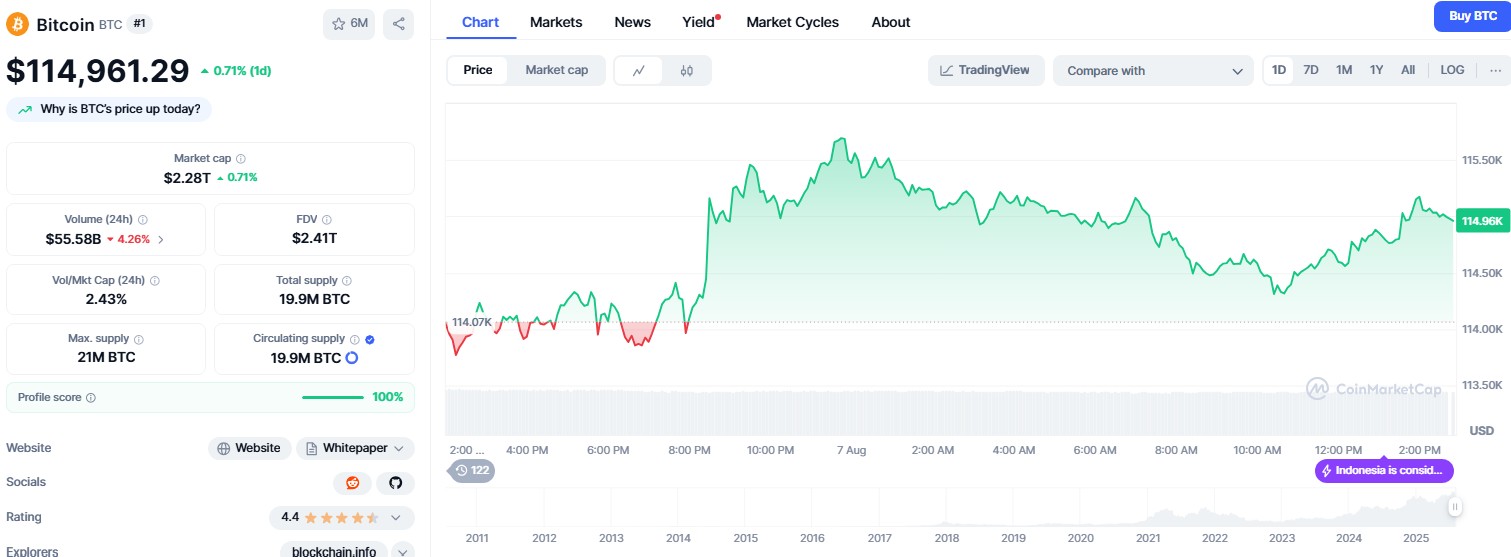

Bitcoin regained ground above $114,000 on Thursday, marking a return in investor confidence after a volatile weekend triggered short-term jitters across the cryptocurrency market.

As sentiment improved, the Crypto Fear & Greed Index climbed to 63 — a level that signals “Greed” — suggesting traders anticipate further upside despite recent turbulence.

The bounce follows Bitcoin’s decline to $112,000 over the weekend, down from its mid-July peak of $123,100.

However, the modest 1% rebound over the past 24 hours to $114,961 has shifted outlooks among both traders and analysts, who now see signs of short-term stability.

Source: CoinMarketCap

Source: CoinMarketCap

Broader market rebounds with ETH up 2.52%, SOL up 3.26%

The wider digital asset market mirrored Bitcoin’s move. Ether (ETH) gained 2.52% in the past 24 hours to trade at $3,724, while XRP (XRP) rose 1.87% to $2.99.

Solana (SOL) posted the strongest performance among major altcoins, climbing 3.24% to $169.56.

The change in market direction coincided with a cooling off in profit-taking by short-term Bitcoin holders.

According to experts, this group—defined as those holding for less than 155 days—has significantly reduced its selling activity since earlier this week.

This reduction in sell pressure is seen as one reason behind Bitcoin’s ability to reclaim price levels lost during the weekend drop.

Market watchers suggest that fewer short-term exits often signal a return to confidence, especially when prices are inching higher after a correction.

Analysts eye potential for Bitcoin breakout above resistance

Crypto analysts have responded to the sentiment shift by highlighting a potential bullish breakout.

Several trading desks tracking Bitcoin’s price action noted that the asset is once again testing a key resistance zone.

This pattern of consolidation near the upper range is often seen ahead of upward breakouts, particularly when supported by improving sentiment indicators like the Fear & Greed Index.

Historical price behaviour also shows that when Bitcoin holds above psychological levels such as $110,000 after a sharp dip, it tends to attract renewed buying interest from both retail and institutional participants, increasing the likelihood of a continuation in upward momentum over the short term.

Crypto market regains momentum amid reduced profit-taking

The shift in sentiment, now back in the “Greed” zone, is closely watched as an early indicator of investor mood and market trajectory.

Thursday’s reading of 63 represents a notable recovery from the previous day’s “Neutral” rating, underlining how quickly outlooks can change in the crypto sector.

Bitcoin’s gradual rebound and ETH and SOL’s stronger rallies suggest that investors may see the latest uptick as the start of a broader recovery, rather than a brief relief rally.

Much will now depend on whether Bitcoin can break above its current resistance level and establish a new short-term trend.