Shiba Inu’s Data Signals Big Move as Volume and Price Spikes

- SHIB bounces from key support and trades near $0.00001262 with rising volume strength.

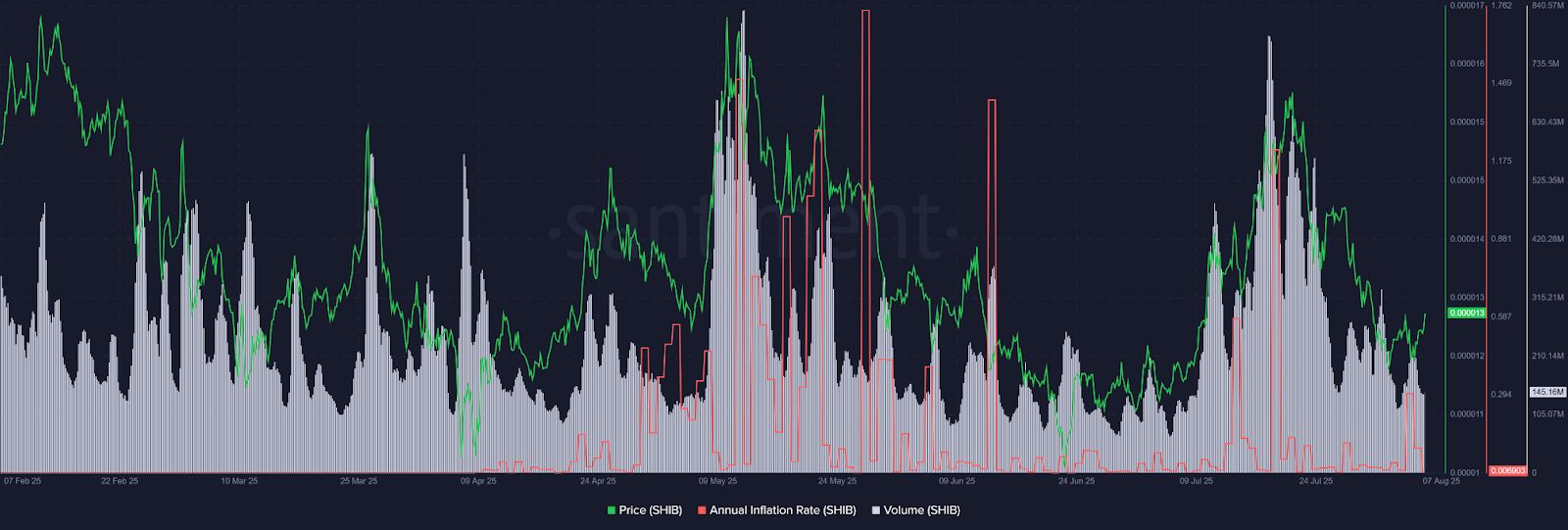

- The inflation rate hits a low of 0.006903 while price and volume grow steadily.

- Analysts watch $0.00001580 as a breakout with targets near $0.00001940 and $0.00002400.

Shiba Inu (SHIB/USDT) is nearing a key technical moment, testing long-term support while shaping a classic cup-and-handle pattern. The price has rebounded from the $0.00001160 region, aligning with the 0 Fibonacci level, and trades at $0.00001262 at press time, marking a daily gain of 2.27%. Simultaneously, on-chain indicators reveal a drop in annual inflation to 0.006903 while volume recovers to 145.16 million SHIB, adding further strength to the ongoing recovery.

SHIB’s Data Highlights a Cup-and-Handle Pattern and Key Fibonacci Levels

According to TradingView data, SHIB has completed a textbook cup-and-handle formation stretching from May to late July, peaking at $0.00001597. The handle formed a descending channel, bottoming out at $0.00001160 before reversing upward. The price activity places SHIB just below the 0.236 Fibonacci of $0.00001263, with the 9-day EMA trailing closely at $0.00001255, providing near-term support.

Source:

TradingView

Source:

TradingView

Market Participants anticipate that a strong break above $0.00001379 (the 0.5 Fib) and $0.00001504 (0.786 Fib) could lead to a breakout above $0.00001597. If bulls succeed, price may target the 1.414 Fibonacci extension at $0.00001778.

The MACD line at -0.00000028 is below the signal line at -0.00000012, indicating a bearish momentum. But the narrowing gap between the lines and the weakening of the histogram suggest potential for a bullish crossover. If the price holds above $0.00001260, the structure remains bullish; if it slips, $0.00001160 remains the key downside floor.

On-Chain Metrics Show Strong Volume and Deflation as Support Builds

Santiment’s on-chain data confirms that SHIB’s rebound from $0.000011 coincides with a strong uptick in trading volume, rising from July lows of 105 million to 145.16 million. Historical volume spikes in March through May saw SHIB prices rally toward $0.000017, backed by volumes exceeding 735 million SHIB. However, those rallies were followed by high inflationary spikes above 1.76%, often preceding price declines.

Source:

Santiment

Source:

Santiment

The current setup is notably different. Inflation has now dropped to a multi-month low of 0.006903 while volume increases. This combination suggests that the recovery is not driven by speculative minting but instead by stronger organic demand. The divergence between low inflation and rising prices could signal a more sustainable trend forming for SHIB.

Related: Shiba Inu Price Forecast: Is SHIB Ready for $0.000045?

Long-Term Support Zone Holds as Analysts Watch $0.00001580 Breakout

In a separate update, an analyst notes that SHIB is once again retesting its multi-year accumulation range between $0.00001090 and $0.00001190. This support has held firm since early 2022.

Source:

TradingView

Source:

TradingView

The analyst predicts that an early reversal trend may be verified as the altcoin breaks out above $0.00001580. Mid-term targets consist of $0.00001940 and $0.00002400. Assuming the momentum continues, the price can reach $0.00003338, with distant resistance at $0.00007870 and $0.00008836. The market arrangement looks like a Wyckoff-style spring, implying a re-accumulation phase.

If SHIB fails to hold $0.00001090, the analyst cautions that it may drop toward $0.00000900, $0.00000700, or even $0.00000550, levels that could indicate trend exhaustion and possible distribution.

In summary, SHIB is currently at a critical crossroads, with increasing volume, decreasing inflation, and bullish chart signs, all indicating the possibility of an upcoming upward trend. A bullish recapture of the $0.00001580 level increases the subsequent goals towards the levels of $0.00002400 and further. Nevertheless, the loss of support on the token at the $0.00001090 level can also result in sudden declines, which could reverse the path of SHIB.

The post Shiba Inu’s Data Signals Big Move as Volume and Price Spikes appeared first on Cryptotale.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Do Kwon Wants Lighter Sentence After Admitting Guilt

Bitwise Expert Sees Best Risk-Reward Since COVID

Stellar (XLM) Price Prediction: Can Bulls Push Toward $0.30 in December?

21Shares XRP ETF Set to Launch on 1 December as ETF Demand Surges