Bitcoin Nears $117,000 Ahead of Trump’s Plan To Open 401(k)s to Crypto

Bitcoin surged past $116,000 amid reports that Trump plans to open 401(k)s to crypto. Analysts call it “insanely bullish” for digital assets.

Bitcoin (BTC) has reclaimed the $116,000 psychological level, inching closer to its July peak.

The recovery follows reports that US President Donald Trump is preparing to sign a sweeping executive order allowing crypto and other alternative assets into 401(k) retirement accounts.

Trump’s Impending Executive Order Pushes Bitcoin Near $117,000

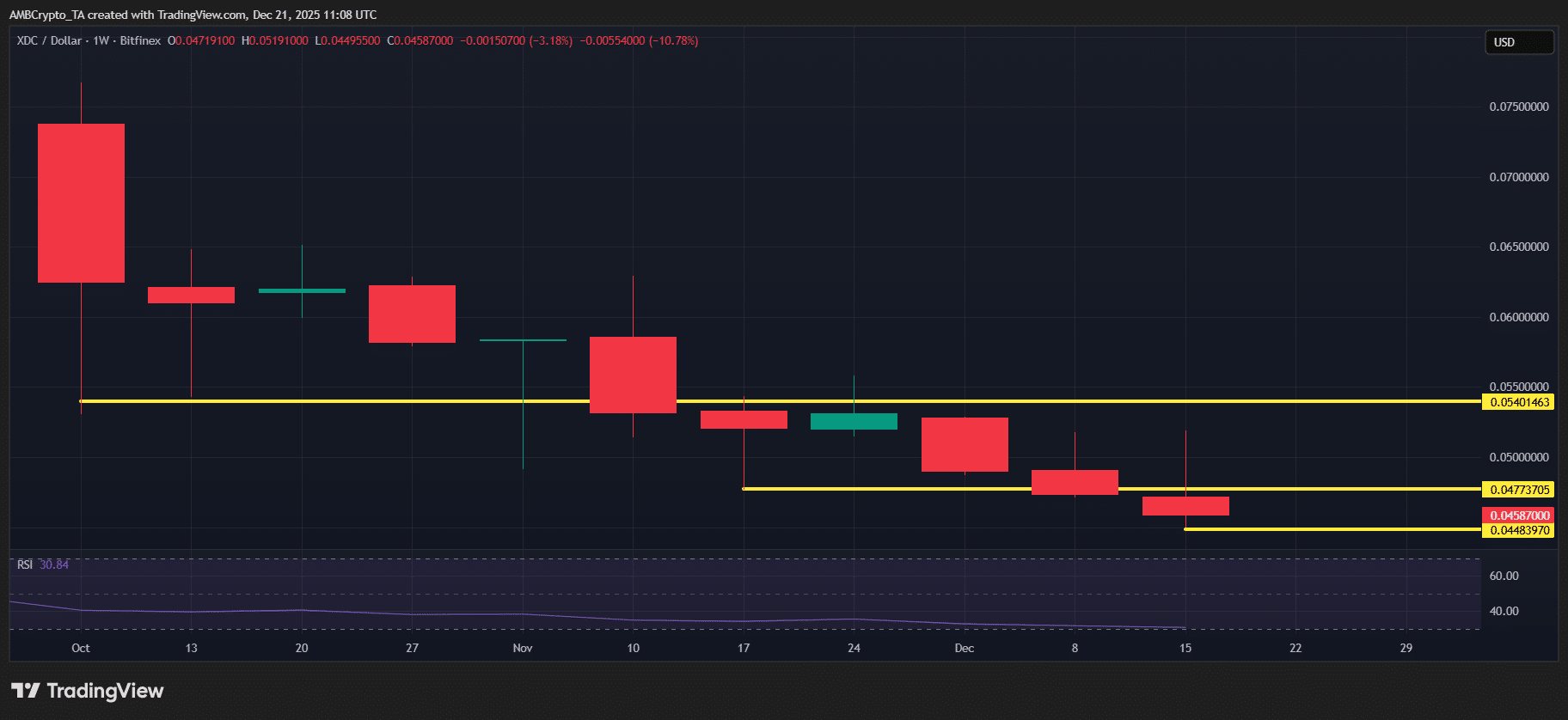

As of this writing, Bitcoin was trading for $116,695, a significant climb after opening the Thursday trading session in the $114,000 range.

Bitcoin Price Performance. Source:

Bitcoin Price Performance. Source:

The surge follows reports of an imminent executive order directing the Department of Labor to reassess guidance under the Employee Retirement Income Security Act of 1974 (ERISA).

TRUMP WILL SIGN AN EXECUTIVE ORDER THURSDAY THAT AIMS TO ALLOW PRIVATE EQUITY, REAL ESTATE, CRYPTOCURRENCY & OTHER ALTERNATIVE ASSETS IN 401(K)S- BLOOMBERG NEWS – RTRS

— Tree News (@TreeNewsFeed) August 7, 2025

Notably, the guidance traditionally excluded alternative assets like crypto, real estate, and private equity from most worker retirement plans.

Bloomberg reports that the order instructs the Labor Secretary to coordinate with the Treasury Department, the US SEC (Securities and Exchange Commission), and other regulators to explore rule changes.

Among other reasons, the goal is to ease legal hurdles for crypto inclusion in defined-contribution accounts.

“Insanely bullish for crypto!”

Davis’ remark highlights the market’s reaction to what may be a landmark shift in US retirement investment policy. With nearly $12.5 trillion held in 401(k) accounts, the potential inflow into Bitcoin and other digital assets could be massive.

Institutional investors like pensions and endowments have long tapped into private equity and alternative markets. However, the average American saver has remained excluded until now.

This move mirrors Trump’s broader pro-crypto agenda in 2025. The prospective order is expected to repeal the Biden-era crypto warning for 401(k)s.

Notwithstanding, allowing crypto into retirement accounts will not be without challenges. Legal experts caution that 401(k) plan administrators could face lawsuits tied to volatility and high crypto or other illiquid asset fees.

Valuation difficulties, custody risks, participants’ limited understanding, and continuous changes in regulatory oversight also remain a concern. Based on this, fiduciary responsibilities remain a core issue.

“At this early stage in the history of cryptocurrencies, the Department has serious concerns about the prudence of a fiduciary’s decision to expose a 401(k) plan’s participants to direct investments in cryptocurrencies, or other products whose value is tied to cryptocurrencies,” the department noted.

Bitcoin’s Role Expands in American Finance

Still, proponents argue that the modern financial system has evolved. Public markets have shrunk considerably since the 1990s, while private equity has more than doubled in the decade ending 2023.

As financial innovation accelerates, Trump’s order may unlock new diversification options for everyday investors. For crypto, the move could inject fresh liquidity into the market, with this optimism already fueling Bitcoin’s recovery.

Beyond 401(k) access, Bitcoin is making quiet but significant progress in another cornerstone of American finance, the housing market.

BeInCrypto reported a pilot initiative to offer Bitcoin-backed mortgages through a new American Housing Credit facility.

This approach allows crypto holders to use BTC as collateral to access home loans, potentially bridging decentralized finance (DeFi) with traditional credit markets.

However, it is not a clean sweep. Mortgage recognition of Bitcoin comes with regulatory strings attached, including strict loan-to-value ratios, collateral liquidity checks, and heightened risk disclosures.

US regulators are also wary of volatility and counterparty risk in crypto-collateralized home lending, even as they cautiously greenlight innovation.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ripple CTO to XRP Holders: We Are Going to Take Over the World

Why Bitcoin Billionaire Arthur Hayes Expects BTC to Hit $200K by March

Ark of Panda Collaborates with Duck Chain to Boost Network Scalability, Connect RWAs To Cross-Chain Ecosystems

Crypto market’s weekly winners and losers – CC, UNI, HYPE, M