Greenidge Sells Mississippi Bitcoin Mining Facility for $3.9 Million

- Main event involves a facility sale and financial strategy shift.

- The sale excludes operational mining rigs and warehouses.

- Transaction completion slated for September 2025, enhancing liquidity.

Greenidge Generation Holdings Inc. has sold its Columbus, Mississippi Bitcoin mining facility for $3.9 million to LM Funding America’s affiliate. The transaction aims to improve Greenidge’s liquidity after financial pressures, excluding operational mining rigs and a large warehouse.

Greenidge Generation Holdings Inc. has finalized a $3.9 million sale of its Columbus, Mississippi Bitcoin mining facility to an affiliate of LM Funding America. The transaction aims to boost liquidity amid financial strains.

Greenidge’s Sale and Financial Realignment

Greenidge Generation Holdings Inc. sold its Mississippi Bitcoin mining site to US Digital Mining Mississippi LLC to address financial pressures. The deal involves a refundable $195,000 deposit, with the balance payable at closing.The purchaser paid a refundable $195,000 deposit; the remaining balance of $3.705 million is due at closing, expected no later than September 16, 2025. A due diligence period lasting until five business days before closing permits the purchaser to terminate the transaction and recover the deposit.The Mississippi facility’s transaction excludes all active Bitcoin miners and a 73,000 sq ft warehouse. Greenidge aims to enhance liquidity as part of its strategic financial realignment. The sale does not directly affect Bitcoin markets or on-chain activities, as it concerns physical infrastructure divestment. Information about the sale can be further explored in the Greenidge sells Mississippi Bitcoin facility for $3.9 million to improve liquidity filing.

Industry Trends and Impacts

Historically, mining firms like Core Scientific have engaged in similar asset sales. Greenidge’s action hints at internal restructuring, more prevalent in volatile markets, allowing capital retention. The impact on Bitcoin dynamics is contained to operational capacity alterations.The asset sale reveals industry trends under financial duress, with possible liquidity improvements and capacity realignment. Historical patterns show these decisions impact firms’ operational scopes, with technological and financial implications marked under specific regulatory environments.Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

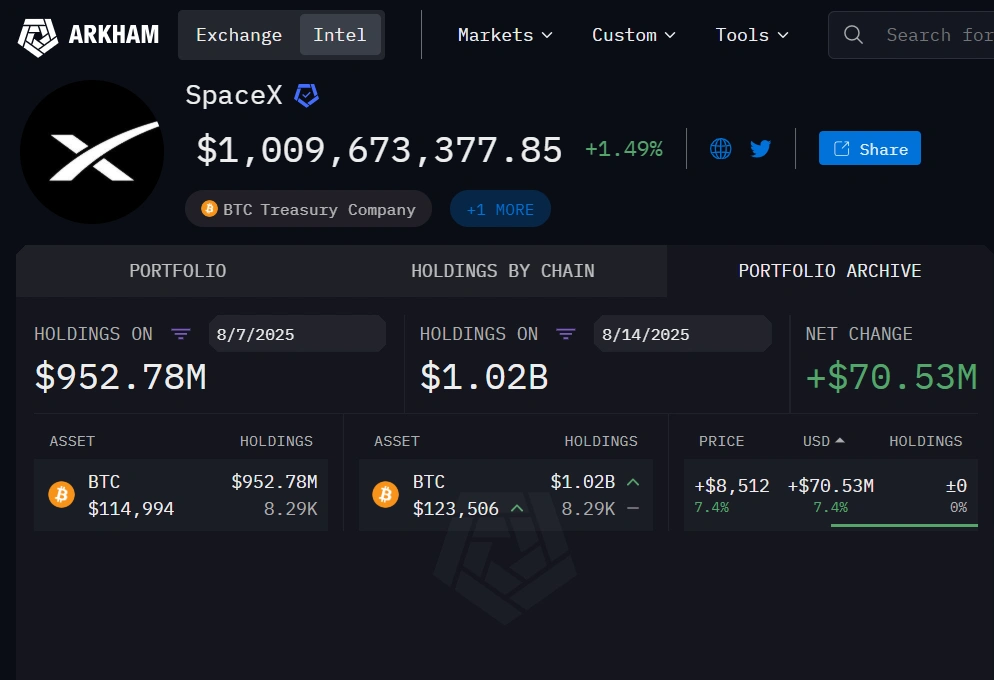

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.