BIG Ripple NEWS: XRP Skyrockets After Ripple Ends SEC Battle

One of the most closely watched legal battles in cryptocurrency has come to a close. The U.S. Securities and Exchange Commission and Ripple Labs have jointly agreed to drop their appeals in the Second Circuit, ending years of litigation. This move cements Judge Analisa Torres’s July 2023 ruling as the final word on the matter.

Under the agreement, each side will bear its own legal costs and fees. Ripple CEO Brad Garlinghouse had already hinted in June that the company would close this chapter and focus on building the Internet of Value. With no further appeals, the industry now has clarity on how U.S. courts view certain XRP transactions.

Ripple vs SEC: The Legal Outcome in Detail

Judge Torres’s ruling was a mixed result for both sides. She concluded that Ripple’s institutional sales of XRP , worth hundreds of millions of dollars, were unlawful securities offerings. However, she sided with Ripple on secondary market transactions, determining that “blind bid” sales to retail investors through exchanges were not securities transactions.

This decision provides a degree of legal comfort to retail XRP traders in the U.S., while keeping institutional sales under regulatory scrutiny.

Market Reaction and Price Movement after Ripple News

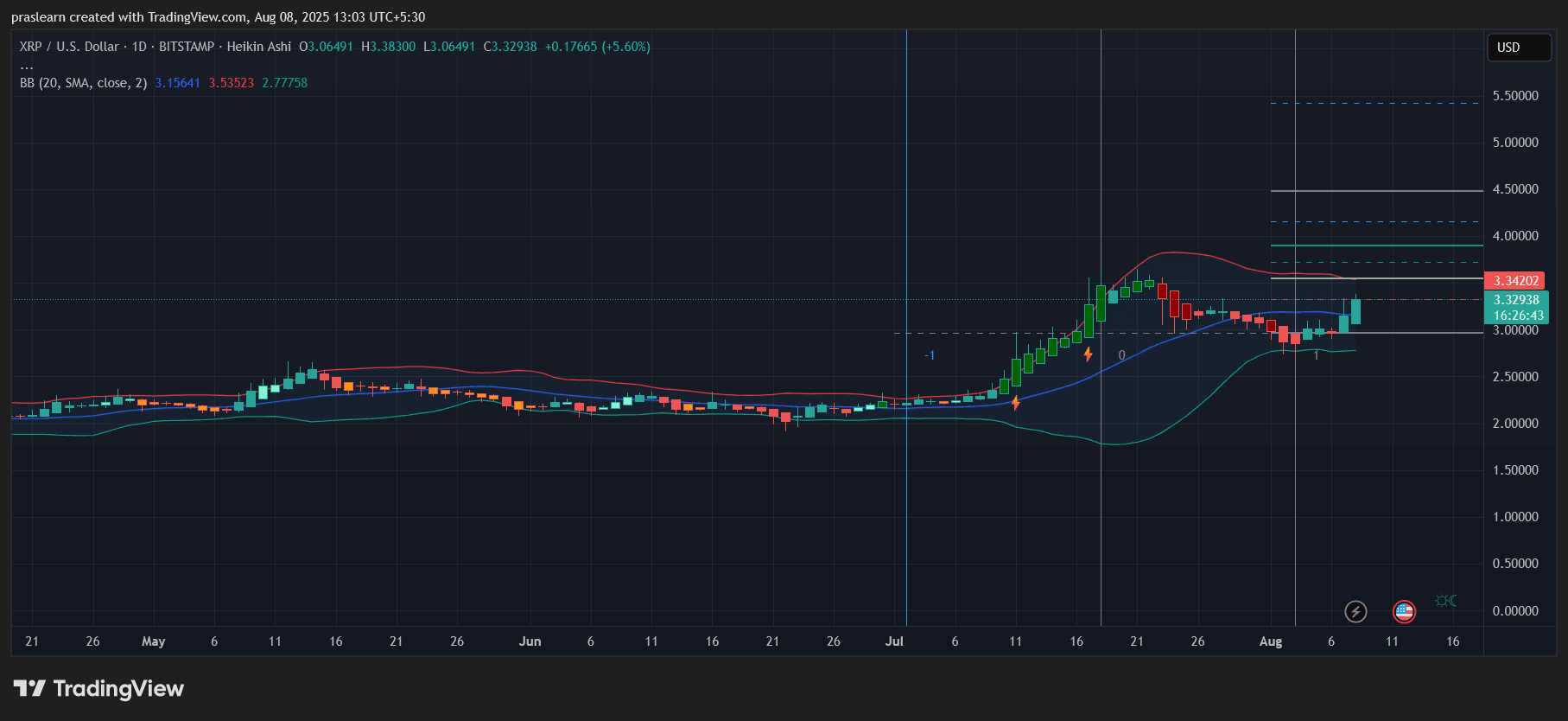

XRP/USD Daily Chart- TradingView

XRP/USD Daily Chart- TradingView

Following the announcement, XRP price rose about 7 percent as traders reacted to the removal of a major legal overhang. On the daily chart, XRP is trading near 3.33 dollars after bouncing from the 3.06 dollar support zone. The news-triggered rally pushed price action closer to the middle Bollinger Band, signaling a shift in short-term momentum.

Technical Analysis – Key Levels to Watch

The daily Heikin Ashi chart shows that XRP recently broke out from a short consolidation phase after a multi-day decline. The lower Bollinger Band around 2.77 dollars acted as strong support, preventing further downside. The current resistance zone sits near 3.53 dollars, which aligns with the upper Bollinger Band.

If buying momentum continues, the next Fibonacci extension targets are 3.85 dollars, 4.20 dollars, and potentially 4.50 dollars. A breakout above 4.50 dollars could open the path toward the psychological 5.00 dollar level.

On the downside, if sellers regain control, support lies first at 3.15 dollars, followed by the 3.00 dollar zone. A sustained close below 3.00 dollars would reintroduce bearish pressure, potentially dragging the price back toward 2.77 dollars.

Short-Term Outlook

In the immediate term, the combination of bullish legal news and a technical bounce increases the likelihood of further upside. However, traders should watch for possible profit-taking near resistance zones. Volume confirmation will be key to sustaining momentum.

Long-Term Outlook

The conclusion of the SEC case removes a significant barrier to XRP adoption, especially for partnerships with U.S.-based financial institutions. The XRP price now has a clearer regulatory path for retail usage, which could drive investor confidence. Still, institutional sales remain subject to securities law, meaning Ripple’s corporate dealings must remain carefully structured.

If broader market sentiment stays positive and Ripple executes its growth strategy, XRP could re-test multi-year highs within the next 12 to 18 months.

Ripple vs SEC: Final Take after Ripple News

With the courtroom chapter closed, XRP has regained a degree of legal certainty that few cryptocurrencies enjoy in the U.S. This clarity, combined with the current bullish chart setup, creates conditions for potential sustained growth — provided the market can maintain momentum.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years

DeFi: Chainlink paves the way for full adoption by 2030