Multinational Healthcare Firm Secures up to $300,000,000 To Roll Out New Ethereum (ETH) Treasury Strategy

The global healthcare group Cosmos Health (COSM) just announced that it has secured funding to launch its Ethereum ( ETH ) digital asset treasury reserve strategy.

In a statement, the Chicago-based company says that it has entered into a securities purchase agreement with a US-based institutional investor.

The deal involves the issuance of up to $300 million in senior secured convertible promissory notes to support the company’s strategic accumulation of the second-largest cryptocurrency by market cap.

The terms of the facility require Cosmos Health to allocate at least 72.5% of the net proceeds from each tranche for building its crypto treasury reserve. The rest will be used for working capital and growth initiatives.

The firm says it is stocking up ETH to bring more value to its long-term shareholders. The digital asset trust company BitGo will provide the institutional infrastructure to custody and stake the crypto assets.

Says Cosmos Health CEO Greg Siokas,

“This financing marks a strategic milestone for Cosmos Health, offering shareholders direct exposure to ETH, currently one of the most widely adopted digital assets in the world.

We are confident that the size and flexibility of this facility should position us to deliver long-term, sustainable value for our shareholders.”

The company’s share closed at $1.05, down by 8.7% from the previous closing price of $1.15.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Popeyes operator managing more than 130 restaurants files for bankruptcy protection

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

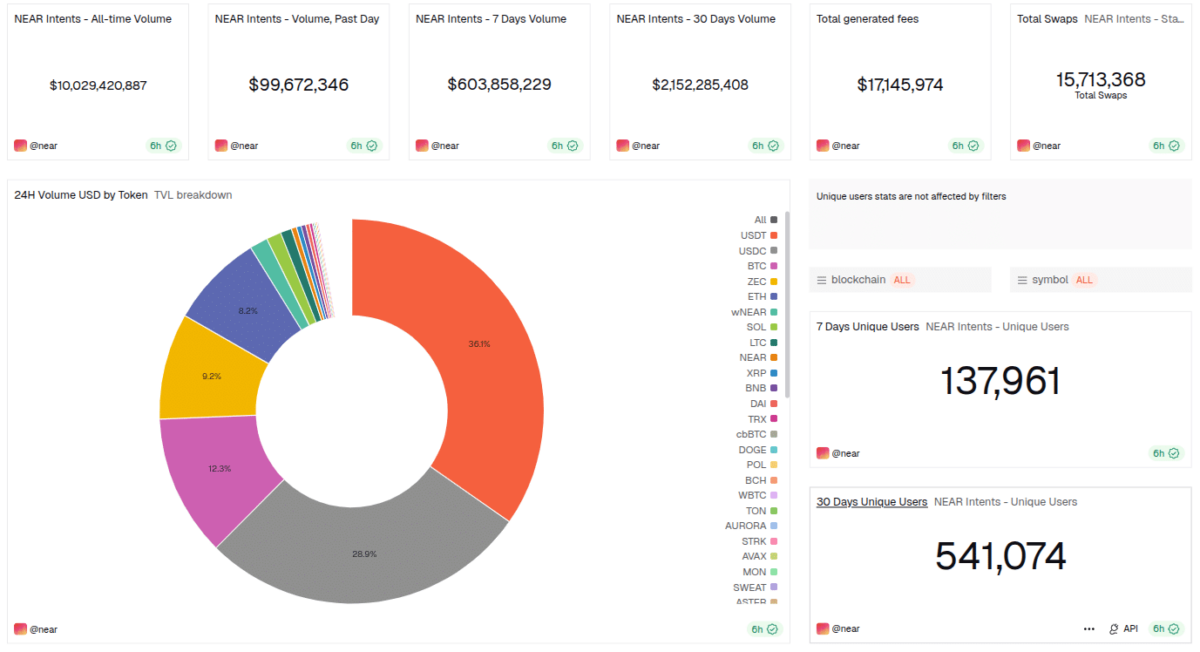

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow