Will Ethereum Price Hit $5,000 This Cycle? A Technical Breakdown

Ethereum’s recent rally past the $4,000 mark has crushed short sellers and attracted renewed institutional interest, driving futures open interest higher. Holding strong support near $3,909, ETH could push toward $4,430 resistance and possibly retest its all-time high, provided buying momentum continues.

Ethereum’s rally above the $4,000 mark has triggered a significant wave of short liquidations, reflecting the strengthening demand for the leading altcoin.

On-chain data reveals a resurgence in interest and accumulation, suggesting that short sellers could face continued losses if Ethereum’s price momentum holds.

ETH Surges Past $4,000 on Renewed Buying Momentum

The surge in new demand for ETH has driven its price up by 18% over the past week. This strong buying momentum and improving market sentiment culminated in a move above the $4,000 price mark yesterday, sparking liquidations among short sellers.

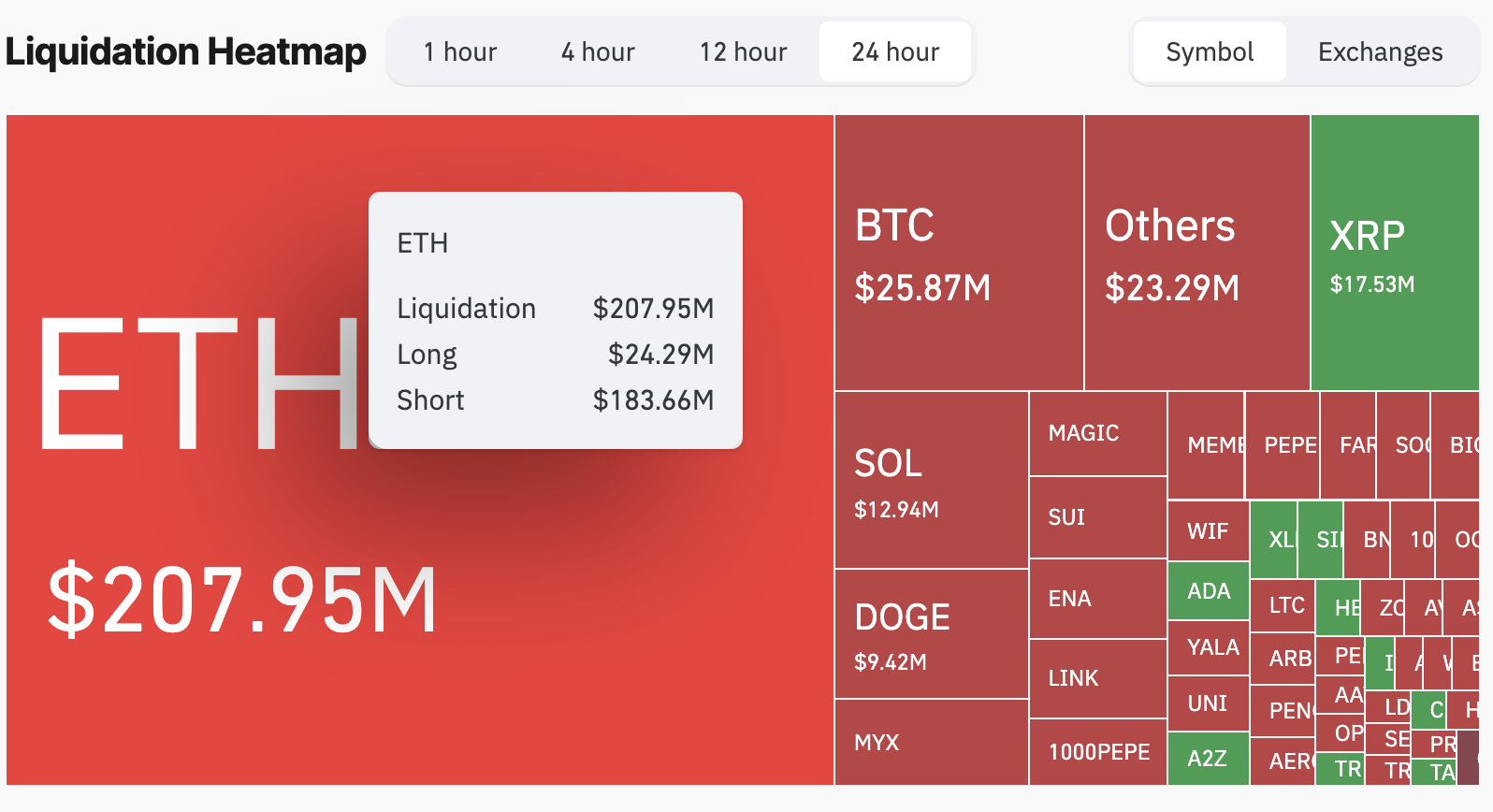

Data from Coinglass reveals that short liquidations have totaled $184 million in the past 24 hours, while long liquidations remain comparatively modest at around $24 million.

This highlights the intensity of the short squeeze as traders scramble to cover their positions amid the rally.

Crypto Liquidation Heatmap. Source:

Coinglass

Crypto Liquidation Heatmap. Source:

Coinglass

However, on-chain data signals that this investor cohort might experience more losses ahead, with ETH poised to keep climbing.

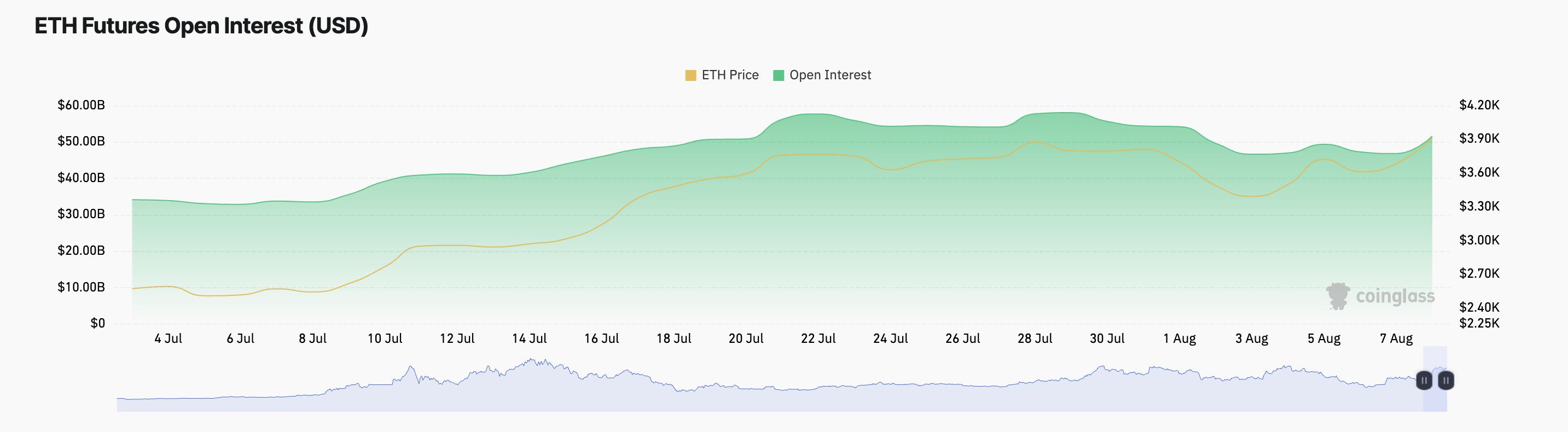

For example, ETH’s futures open interest has climbed with its price, signalling heavy market participation. At press time, this sits at $51.61 billion, up 10% in the past 24 hours.

ETH Open Interest. Source:

Coinglass

ETH Open Interest. Source:

Coinglass

An asset’s open interest measures the total number of outstanding futures or options contracts in the market. When both an asset’s price and its open interest rise simultaneously, it signals strong conviction among traders that the current trend will continue.

For ETH, this suggests that more investors are actively taking new positions and are confident in the ongoing price momentum.

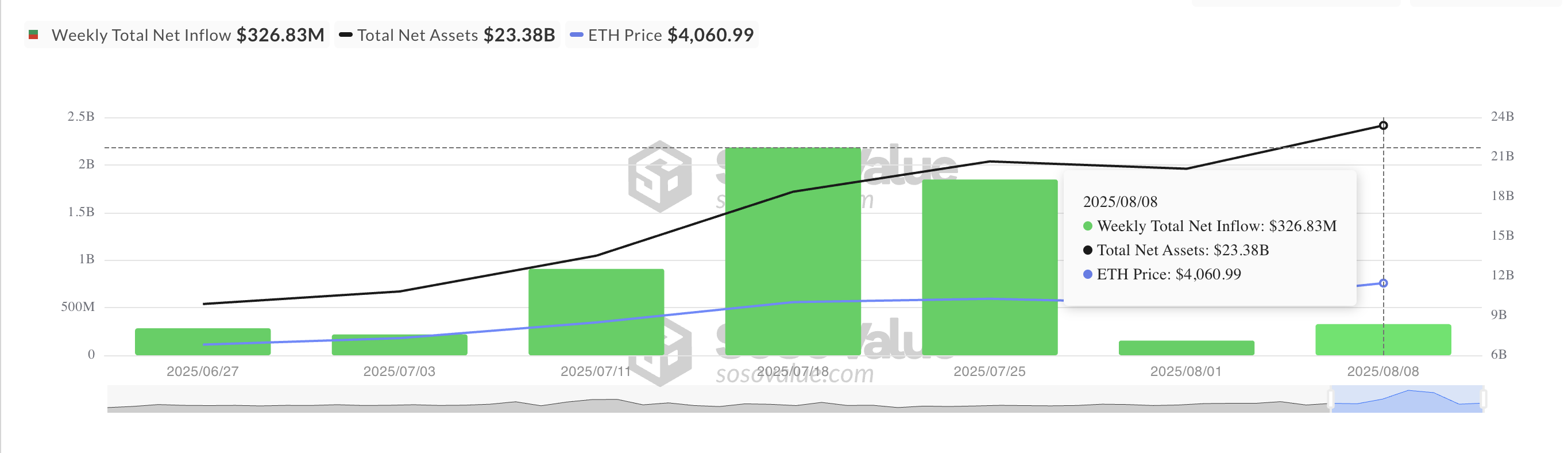

Moreover, the resurgence of institutional interest adds credence to this bullish outlook. Per SosoValue, this week has seen renewed inflows into ETH-backed exchange-traded funds (ETFs) as market sentiment improves.

Between August 4 and 8, these funds recorded inflows totaling $326.83 million.

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

Total Ethereum Spot ETF Net Inflow. Source:

SosoValue

The fresh wave of institutional capital shows the renewed confidence from larger investors, providing an important support layer that could sustain ETH’s upward trajectory in the near term.

Ethereum Holds $3,909 Support — Next Target $4,430 and Beyond

ETH trades at $4,160 at press time, maintaining a newly established support level near $3,909. Should this support strengthen and buying momentum increase, ETH’s price could rally toward $4,430, potentially testing and breaking through that resistance.

A successful breakout could set the stage for ETH to revisit its all-time high of $4,827.

ETH Price Analysis. Source:

TradingView

ETH Price Analysis. Source:

TradingView

On the other hand, if buying pressure weakens, ETH may lose steam and reverse its current upward trend. Failure to hold the $3,909 support could cause the price to fall to $3,340.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

AbbVie Plans to Expand in the Obesity Treatment Market

Mira Murati’s company, Thinking Machines Lab, is seeing two of its co-founders depart to join OpenAI

Amazon Criticizes Saks Investment Agreement, Claims Its Shares Have ‘No Value’