Bo Hines Moves From Public Office To Private Sector

In Washington, crypto policy loses one of its most prominent faces. Bo Hines, propelled at the end of 2024 to the head of the Presidential Council of Advisers for Digital Assets, leaves his position after only a few months. A key figure in the system wanted by the Trump administration to make the United States a global blockchain hub, he moves to the private sector. His departure raises a central question : will the White House be able to maintain the momentum given to its crypto strategy ?

In brief

- Bo Hines, director of the White House crypto council, announces his departure less than a year after his appointment.

- Appointed in December 2024 by Donald Trump, he worked closely with David Sacks to position the United States as a global crypto leader.

- His departure, motivated by a return to the private sector, comes shortly after the publication of a strategic report on digital assets.

- Patrick Witt, current deputy director, is expected to succeed him, without official confirmation.

A departure announced at the top of the White House crypto council

While a strategic report on crypto was published a few weeks ago , Bo Hines formalized his withdrawal. He stated this Saturday, August 9 : “Serving in President Trump’s administration and working alongside our brilliant AI & Crypto Czar, David Sacks, as Executive Director of the White House Crypto Council has been the honor of a lifetime.”

Appointed in December 2024, he led several notable initiatives to try to position the United States as a global crypto leader. In his message, he also thanked the community for its unwavering support and assured that he would continue to defend the industry from the private sector.

Here are the key facts :

- His appointment in December 2024 by Donald Trump as head of this council, an advisory body on American crypto policy ;

- A close collaboration with David Sacks, a central figure in the White House crypto and AI strategy ;

- The announcement of his departure this Saturday, August 9, justified by a return to the private sector, while remaining active in supporting the ecosystem ;

- A tense political context : the departure comes a few weeks after the publication of the council’s flagship regulatory report in July ;

- An uncertain succession : journalist Eleanor Terrett indicates that Patrick Witt, deputy director, is expected to replace him.

A mixed record and unfinished strategies

Among the most emblematic dossiers followed by Bo Hines is the strategic bitcoin reserve initiative. In January, Donald Trump had signed an order creating a national BTC reserve and a crypto stockpile, prohibiting any resale by the State and requiring that new acquisitions be financed by budget-neutral methods.

This constraint limited the executive’s room for maneuver, allowing increases in holdings only through asset seizures or other means without direct tax impact.

Hines had proposed a bold path : re-evaluate American gold reserves, recorded at 42.22 dollars per ounce while the spot price was around 3,400 dollars, and convert part of this updated value into bitcoin.

An approach likely to significantly increase BTC reserves without creating a deficit, but which remains a recommendation. The lack of concrete implementation and criticism of the BTC accumulation pace reflect difficulties in turning the strategic vision into tangible results.

By leaving his position, Bo Hines thus leaves a mixed legacy: strong political momentum, especially with the vote on the Genius Act , but partial achievements. The question remains open about his successor’s ability, whether Patrick Witt or another profile, to overcome regulatory and budget constraints to realize the American vision of global crypto leadership.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Moldova moves towards clearer Bitcoin and crypto regulation in 2026

TotalEnergies Plans to Sell Its 10% Share in Nigeria’s Renaissance Joint Venture

TSMC: The True Giant of AI, Who Would Say No?

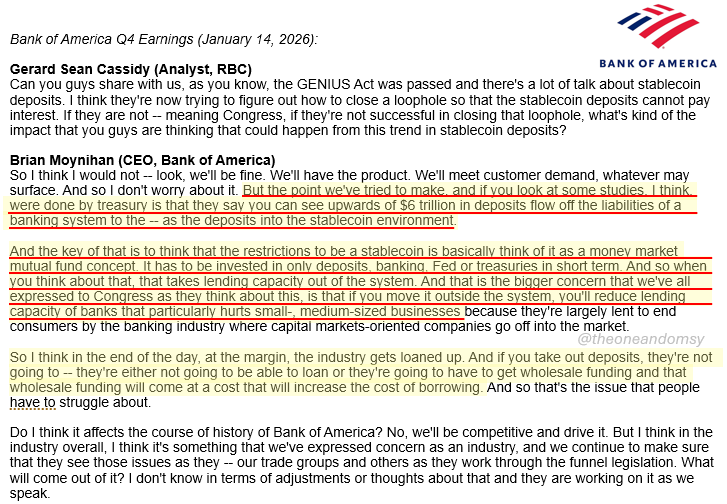

Stablecoins shouldn’t pay interest, Bank of America CEO says