Trader Says Ethereum-Based Altcoin on a ‘Clear Path’ to a 138% Rally, Outlines Path Forward for Bitcoin and XRP

Cryptocurrency trader Ali Martinez is highlighting a top-20 altcoin built on the Ethereum ( ETH ) blockchain that is primed to skyrocket.

Martinez tells his 146,400 followers on the social media platform X that blockchain oracle Chainlink ( LINK ) could appreciate by around 138% from the current level.

“Chainlink still has a clear path to $46 as long as the $13 support level holds strong.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Chainlink is trading at $19.37 at time of writing, up by nearly 40% over the past 30 days.

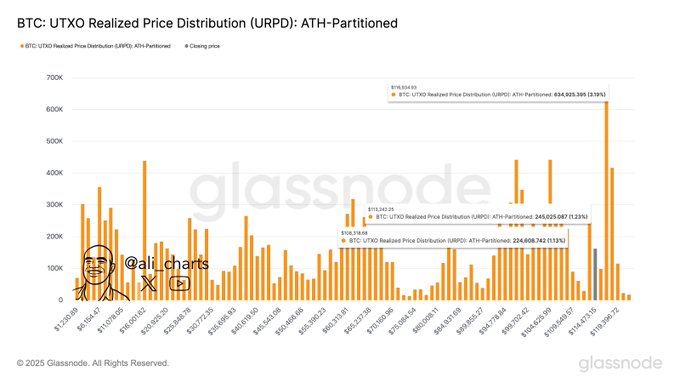

Turning to Bitcoin ( BTC ), the widely followed trader says the flagship crypto asset is in a “tough spot” as it is sitting on weak support while facing strong resistance.

“There’s a massive resistance wall at $117,000, while an air gap looms below, with little support between $113,000 and $108,000.”

Source: Ali Martinez/X

Source: Ali Martinez/X

Bitcoin is trading at $116,694 at time of writing.

Next up is the payments altcoins XRP ( XRP ).

According to Martinez, XRP “may be headed for a deeper correction” based on various metrics and indicators. Martinez says the Tom DeMark (TD) Sequential indicator, which is used to determine potential trend exhaustion and price reversal points, has flashed a sell signal for XRP on the three-day chart. Per the widely followed analyst, XRP could fall by over 25% from the current level to the next support zone.

“While the $3 zone has acted as support for XRP, on-chain data points to $2.80 as a temporary buffer, but real support begins below $2.48.”

Source: Ali Martinez/X

Source: Ali Martinez/X

XRP is trading at $3.33 at time of writing.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x FOGO: Trade futures to share 1,000,000 FOGO!

Bitget Spot Cross Margin adds HYPE/USDT

Instant BGB airdrop: Complete fiat tasks to earn incentives

CandyBomb x SOL: Trade futures to share 160 SOL!