Lido DAO (LDO) has posted an explosive rally, climbing over 54% in the past seven days and 19% in the last 24 hours, after the U.S. Securities and Exchange Commission clarified that liquid staking tokens, including Lido’s stETH, do not qualify as securities.

The decision removes a major regulatory hurdle that has loomed over the sector for years, and analysts now believe liquid staking products could even be integrated into future ETFs.

With $33 billion in total value locked, Lido remains the largest liquid staking protocol, making it a prime beneficiary of the ruling. Institutional investors, previously cautious due to regulatory uncertainty, may now see Lido as a safer entry point into the staking market. Futures market sentiment has also shifted rapidly, with open interest in LDO surging 32.2% to $225 million.

Ethereum Rally Lifts Staking Demand

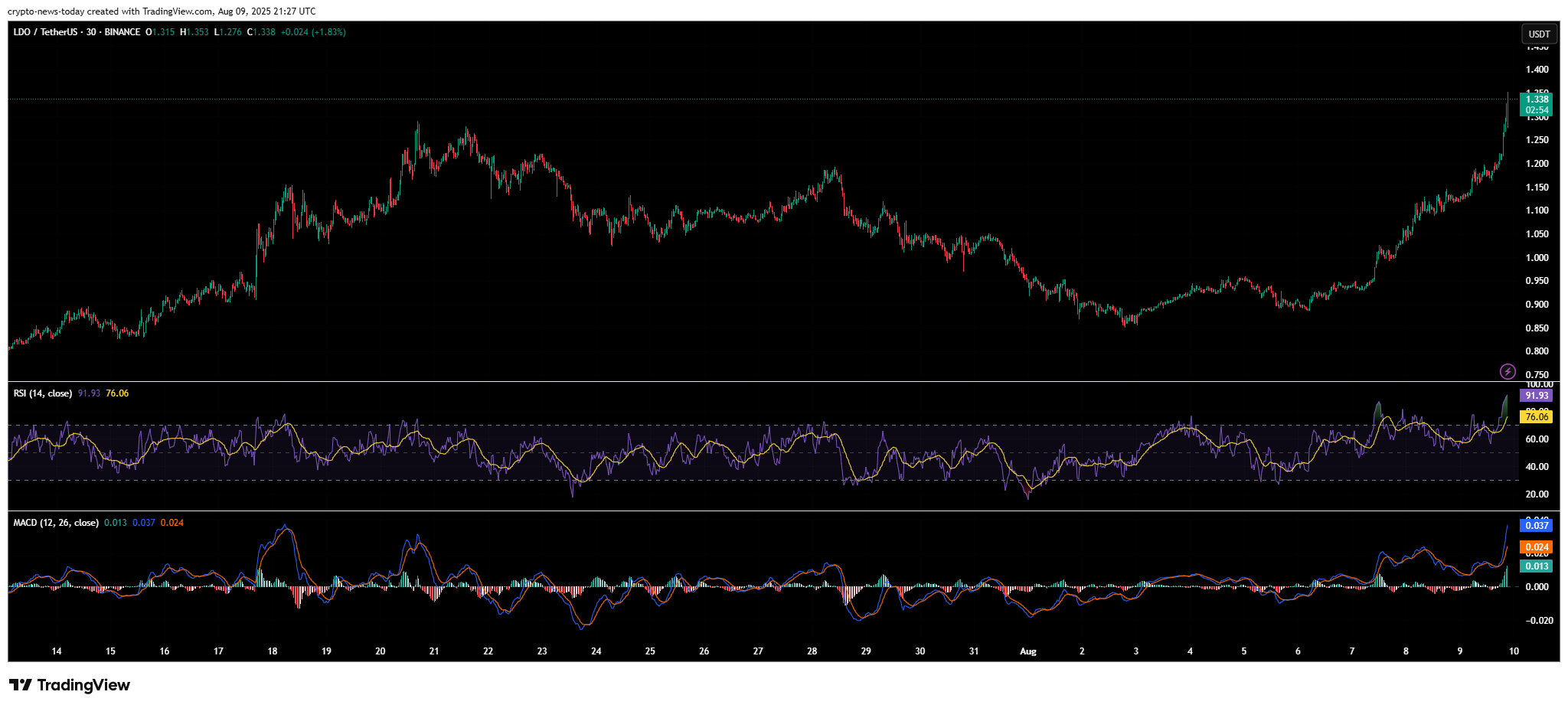

Ethereum’s recent push above $4,100, marking its highest level since December 2024, has further amplified interest in staking derivatives. Lido, which controls roughly 27% of all ETH staking, stands to gain directly from this momentum. Rising ETH prices not only boost staking rewards but also drive Lido’s revenue, which is heavily tied to its staking fee model. LDO has mirrored ETH’s rally, rebounding from July’s low of $0.86 to around $1.34, breaking above the $1.20 resistance for the first time since March 2025.

DeFi Yields See a Resurgence

The broader DeFi market has also been heating up, with total value locked reaching $153 billion — a two-year high. Lido and lending giant Aave lead the charge, with Lido alone generating an estimated $90 million in annualized staking revenue. Staking yields between 5% and 7% are pulling capital back into the ecosystem, although competition from rivals like Rocket Pool remains a factor. One cautionary note is that LDO has underperformed Ethereum by 22.45% over the past 90 days, signaling that governance challenges may still weigh on investor confidence.

What’s Next for Lido DAO ?

The combination of regulatory clarity, Ethereum’s rally, and a recovering DeFi market has put Lido DAO in a strong position heading into the final quarter of 2025. Market watchers are keeping a close eye on potential developments around ETH staking ETFs and institutional inflows, both of which could serve as major catalysts for LDO’s next leg up.