The crypto market in 2025 is shaping up to be one of the most dynamic in years, with meme-fueled assets like Dogecoin (DOGE) competing against fundamentally driven projects such as Cardano (ADA) for investor attention.

Over the past week, DOGE has surged 14.72% to $0.2314, while ADA has climbed 10.69% to $0.7918. Despite their very different origins, both tokens are benefiting from strong narratives and potential catalysts — but which offers more upside in the months ahead?

Cardano: Roadmap Execution and ETF Potential

On August 3, ADA holders approved a $71 million treasury withdrawal to support Input Output’s 2025 roadmap. The upgrades include Ouroboros Leios for faster consensus, Hydra for low-cost transactions, and Project Acropolis for modular node architecture. These improvements aim to solve Cardano’s scalability bottlenecks, opening the door to larger DeFi ecosystems and institutional adoption.

Milestone-based funding via Intersect ensures that each phase of development must be delivered before more funds are unlocked. Historically, network upgrades like Alonzo in 2021 — which brought smart contracts to ADA — triggered rallies of 50–80%.

Regulatory momentum is also on Cardano’s side. The U.S. CLARITY Act classified it as a “mature blockchain ” alongside Bitcoin and Ethereum, while Bloomberg analysts assign a 75% approval probability to Grayscale’s spot ADA ETF application. In the UK, the FCA has also greenlit crypto ETNs, potentially broadening access for institutional investors.

- Bullish Price Prediction (2025): If ETF approval aligns with successful Hydra deployment, ADA could push beyond $1.01 and test $1.25 by year-end.

- Bearish Price Prediction (2025): A failure to deliver upgrades on time, coupled with ETF rejection, could see ADA fall back toward $0.68.

- Base Case (2025): Gradual gains into the $0.95–$1.05 range if development stays on track but catalysts take longer to materialize.

Dogecoin: Whale Activity and ETF Hype

Dogecoin’s 2025 story blends high-stakes debates with market-moving hype. In April, a proposal surfaced to slash DOGE’s block reward from 10,000 to 1,000, cutting annual inflation from about 3.3% to 0.33%. Supporters believe this would strengthen DOGE’s store-of-value narrative, while critics warn that miner participation could drop if prices don’t compensate for the reduced rewards.

ETF optimism is also driving the market. Bloomberg analysts estimate an 80% chance of approval by Q4 2025, with recent policy changes — including Trump’s July executive order allowing crypto in 401(k) retirement accounts — fueling further demand.

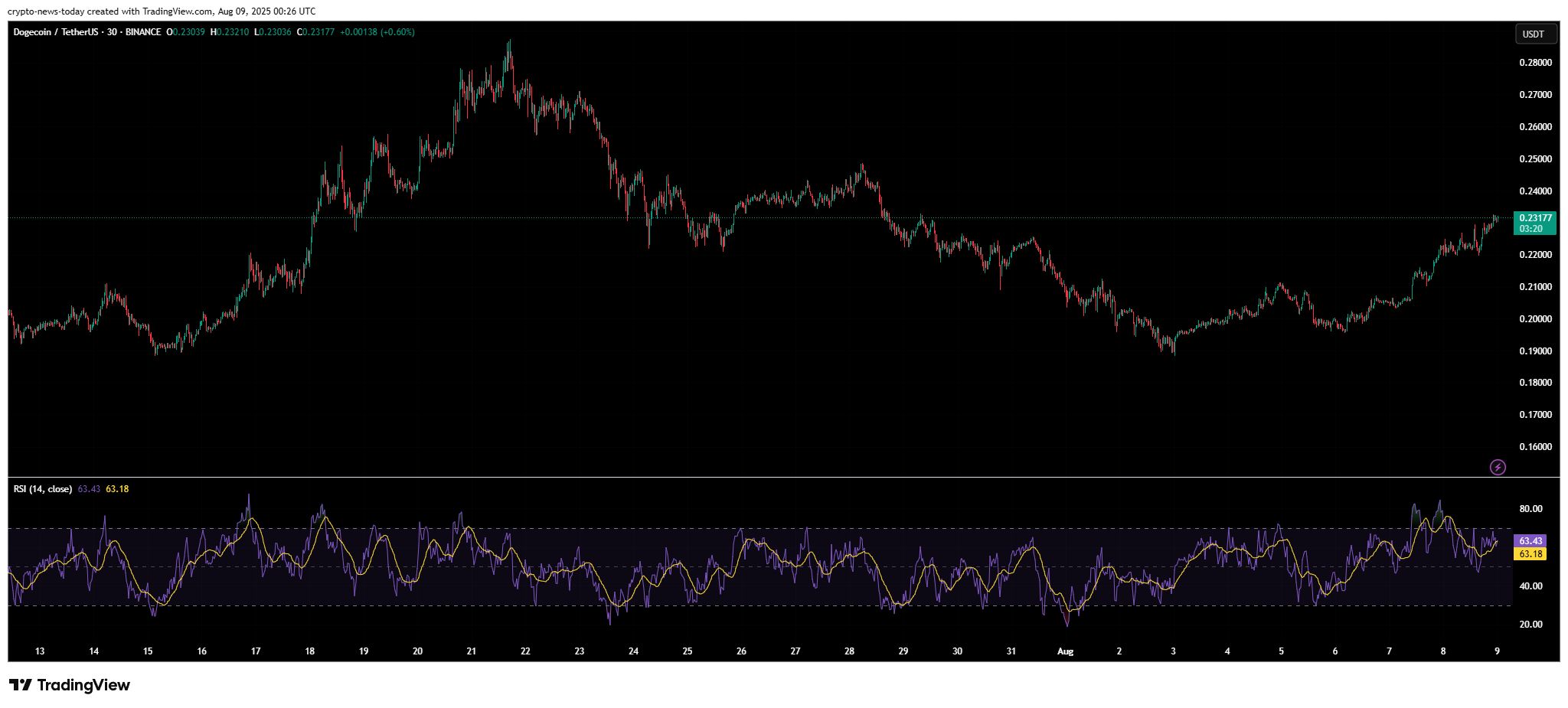

Adding to the bullish picture, whales have been aggressively accumulating DOGE, scooping up 1.23 billion tokens ($284 million) between August 5–8. The coin has reclaimed its 200-day EMA and is now eyeing the $0.247 resistance level.

Whale accumulation in Dogecoin has often been a precursor to significant rallies, with past buying waves sparking gains of 30–40%. An approved Dogecoin ETF could provide an additional catalyst, potentially delivering an immediate 8–12% price boost. Furthermore, the proposed supply cut has the potential to enhance DOGE’s long-term scarcity appeal, adding another layer to its investment narrative.

- Bullish Price Prediction (2025): Breaking above $0.26 could unleash a rally toward $0.35, with extended momentum possibly pushing to $0.48.

- Bearish Price Prediction (2025): If the supply cut proposal causes miner unrest and ETF approval is delayed, DOGE could retreat to $0.18–$0.20.

- Base Case (2025): Sideways trading between $0.22–$0.30 until a clear regulatory or structural catalyst emerges.

Technical Outlook

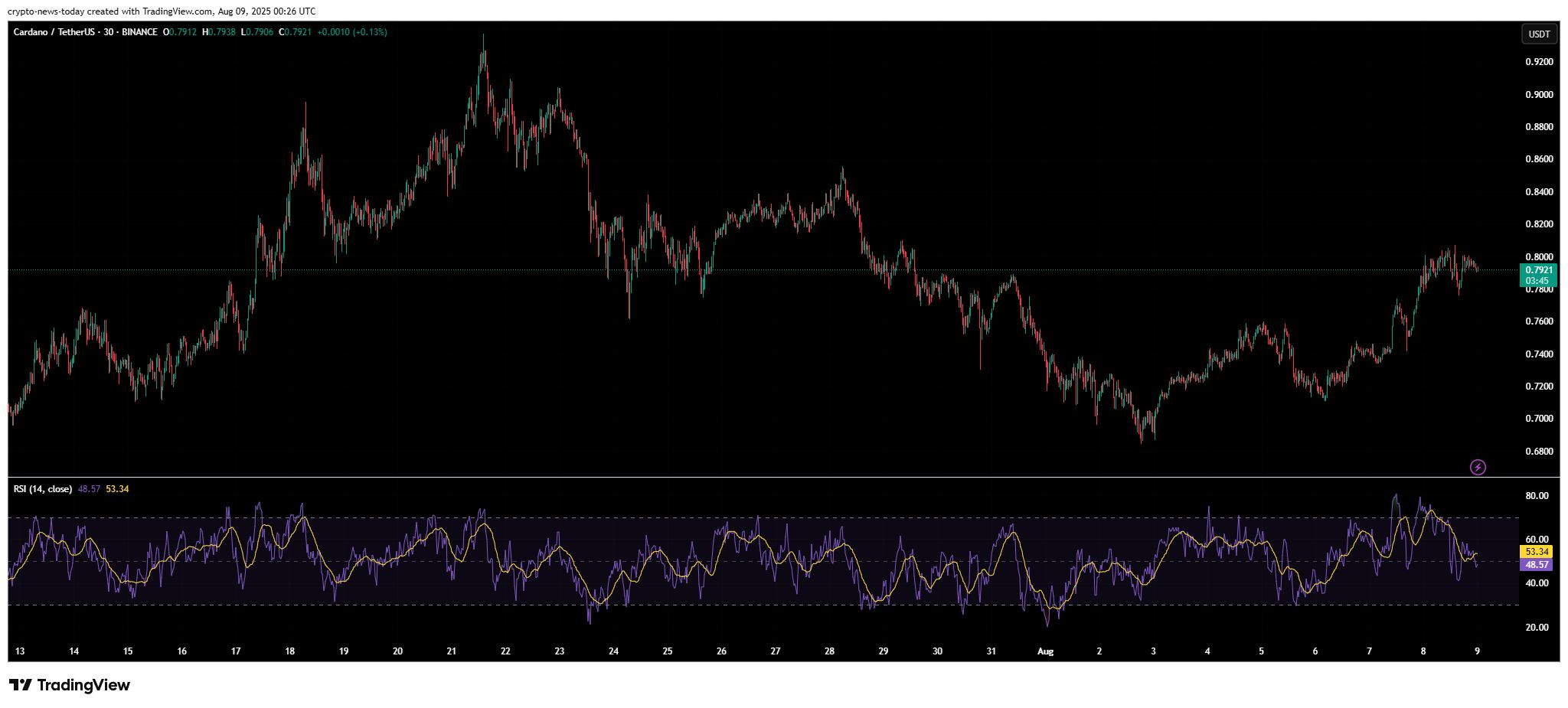

From a technical perspective, both tokens are in an upward trend but face near-term resistance. ADA’s RSI near 60 suggests there’s room for more upside, with a key breakout level at $0.856. DOGE’s RSI at 62.75 is approaching overbought, but sustained whale buying could keep momentum alive until $0.26 is tested.

Final Verdict: Growth vs. Hype

While Cardano offers a fundamentally driven growth story backed by a clear technical roadmap, Dogecoin remains a high- volatility play with explosive short-term potential. ADA’s appeal lies in its ability to attract institutional capital through ETF approval and network upgrades, while DOGE thrives on community-driven surges and speculative catalysts.

For 2025, risk-averse investors may lean toward ADA for its development-backed momentum, while traders seeking rapid gains may find DOGE more appealing. The “better” choice ultimately depends on whether you value long-term stability or short-term excitement.