Solana (SOL) has climbed to $181.92, marking a 3.48% gain in the past 24 hours and extending its 7-day rise to over 10%.

The move comes amid growing speculation around spot Solana ETFs, fresh real-world adoption milestones, and promising network upgrades — even as some short-term technical signals flash caution.

ETF Momentum Gains Despite BlackRock’s Exit

BlackRock officially denied plans for a Solana ETF on August 9, briefly cooling enthusiasm. However, seven other issuers — including VanEck and Fidelity — have amended their filings this week, with analysts like James Seyffart stressing that early applicants may receive priority. The SEC’s request for updated paperwork signals procedural progress, with initial comments due by August 12 and VanEck’s final deadline set for September 5.

Recent court rulings classifying Solana as a commodity rather than a security may improve approval odds. Analysts estimate a 90% chance of a green light by October 2025, pointing to potential institutional inflows comparable to Bitcoin and Ethereum’s combined $19B post-ETF approvals.

Real-World Adoption Strengthens Bullish Case

Institutional credibility got another boost on August 8 when Exodus Movement, a NYSE-listed company, partnered with Superstate to tokenize its Class A shares on Solana. This follows PayPal’s June expansion of its PYUSD stablecoin to the network. Solana now hosts $10.9 billion in stablecoins, trailing only Ethereum, underscoring its growing role as a settlement layer for compliant financial instruments.

Such developments could attract conservative capital from traditional finance, especially as tokenization gains traction in regulated markets.

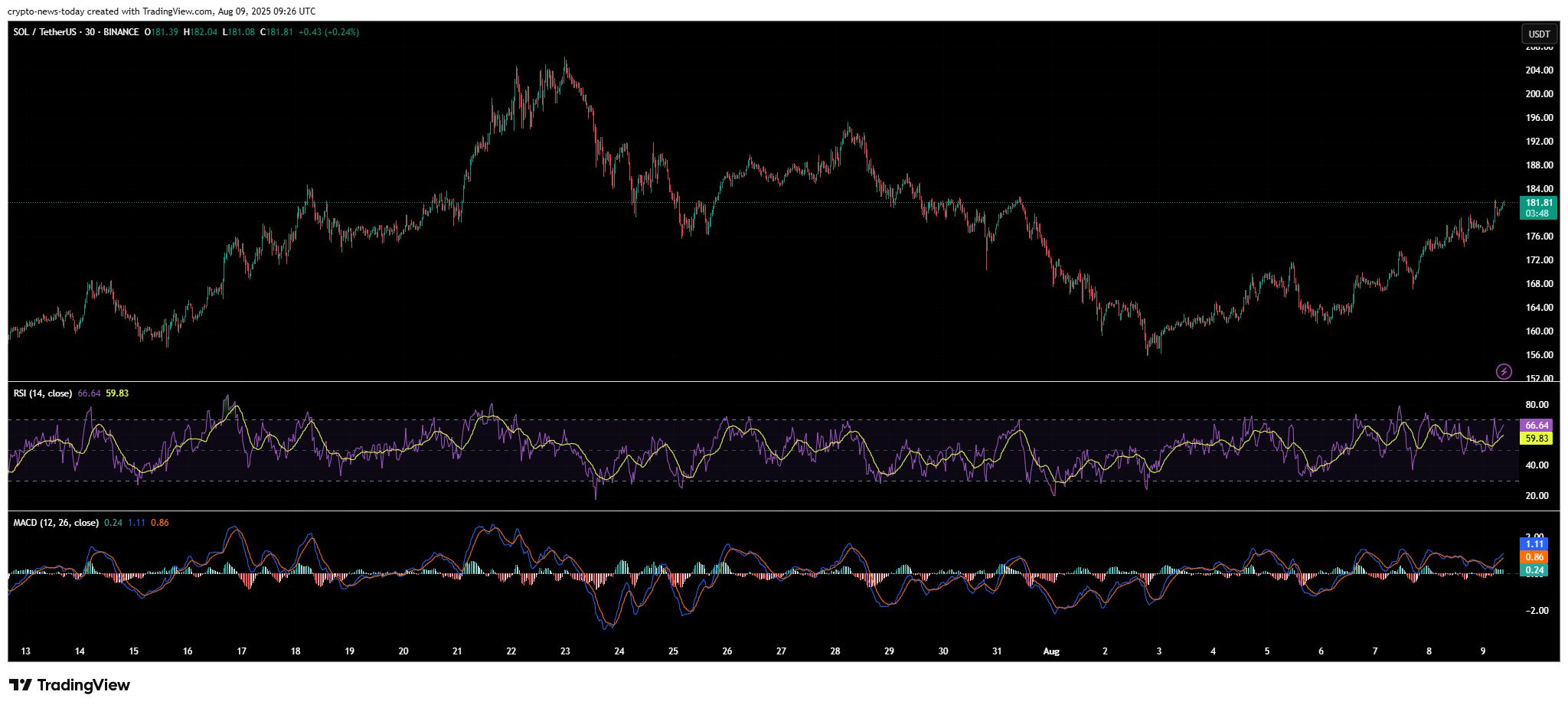

Technical Picture: Bulls Eye $194–$205

From a chart perspective, SOL has broken above the 50% Fibonacci retracement level at $180.96 and is trading above its 30-day SMA at $174.87. The RSI is approaching overbought territory at 66.64, suggesting momentum remains on the bulls’ side, while the MACD is showing a modest bullish crossover.

If SOL closes above $186.84 (38.2% Fib), analysts see upside targets between $194 and $205. A failure to hold above $180 could shift focus back to $171 support.

Network Upgrades and Performance Gains

July’s SIMD-0256 upgrade increased block capacity by 20% to 60 million compute units. Looking ahead, the Q4 Alpenglow update aims to slash transaction finality from 12 seconds to just 150 milliseconds, while the Firedancer client is targeting over 1 million transactions per second by 2026. These improvements aim to prevent congestion issues like the January meme coin frenzy and could cement Solana’s lead in DeFi and NFT performance.

Whale Activity Adds Short-Term Uncertainty

Large holder behavior remains a mixed factor. On August 2, a whale moved 108,000 SOL (worth $17.7M) to exchanges, contributing to a 2.86% price dip. However, July saw a net withdrawal of 123,000 SOL ($23M) for long-term staking . With 63% of circulating supply staked, sell pressure is limited, but heavy exchange deposits could trigger liquidations if key support levels break.

Next Week’s Outlook

Solana’s immediate trajectory will hinge on ETF-related news and its ability to maintain momentum above $180. If bullish sentiment holds, the $194–$205 zone is within reach. However, weakening MACD signals and whale movements warrant caution.

Investors will be watching closely for SEC updates on August 12 and September 5, alongside price action near $186. A decisive break above that level could set the stage for a strong August finish.