Greeks.Live: Short-term volatility expectations for BTC remain low, while ETH implied volatility is more than double that of BTC

According to ChainCatcher, Greeks.Live analyst Adam posted on social media, "There is a relatively large amount of macro data this week. The most important macro data is Tuesday's CPI, and a notable event to watch is the Trump-Putin meeting on Friday. The Russia-Ukraine conflict has recently shown frequent signs of easing. If the meeting yields substantial results, it could impact the global economy."

BTC's short- and medium-term implied volatility has generally fallen above 30%, indicating low short-term volatility expectations. For ETH, major maturities are mainly hovering between 65% and 70%, more than double that of BTC, especially since ETH surged to $4,300 over the weekend, with short-term IV exceeding 70%."

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Nasdaq-listed Lion Group spends $8 million to purchase 88.49 bitcoins

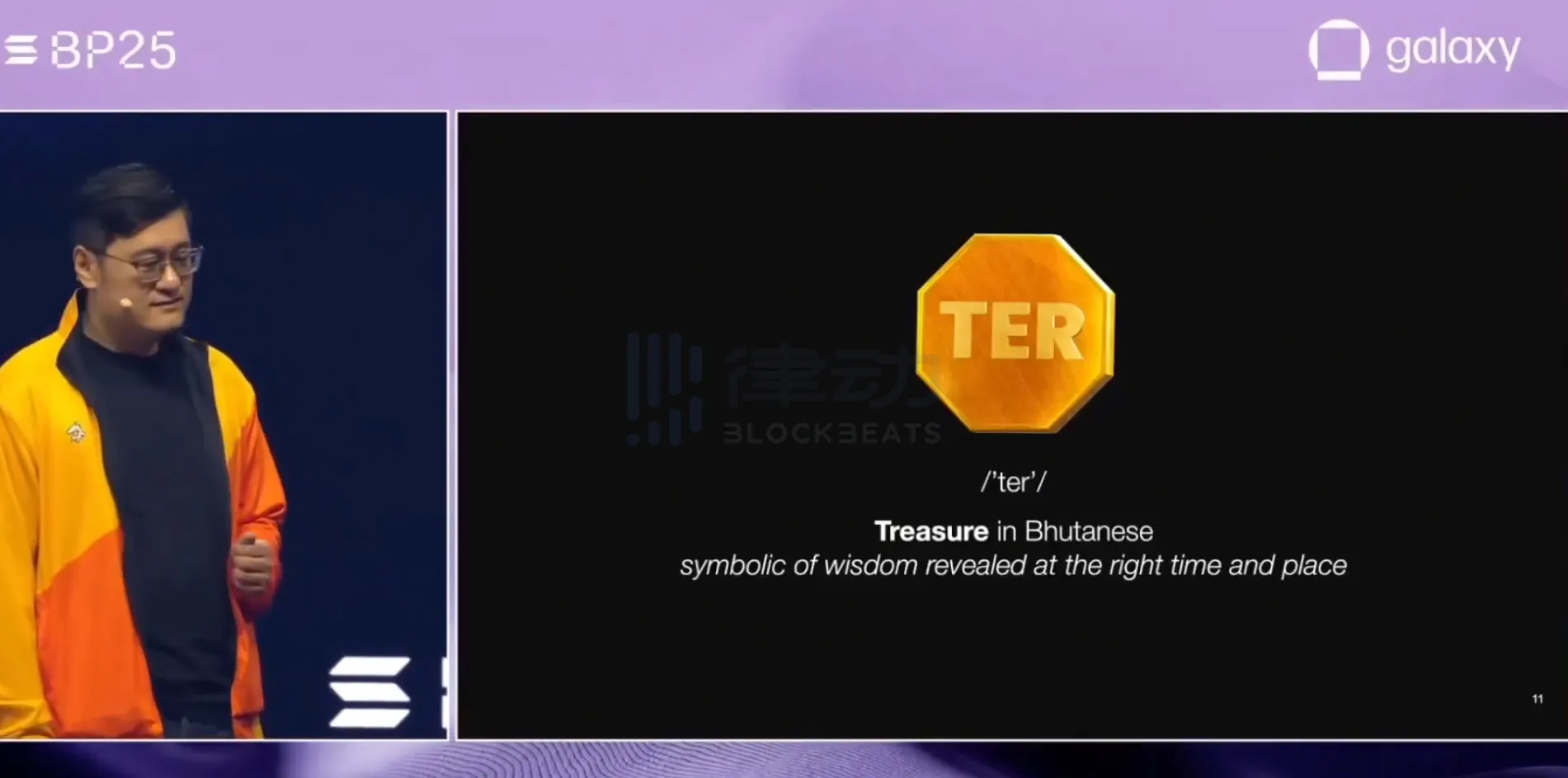

Bhutan announces the launch of the world's first sovereign-backed gold token TER on Solana

dYdX launches spot trading on Solana and opens access to US users

JPMorgan issues Galaxy short-term bonds on the Solana network