Today’s Outlook

1、Hong Kong to Tighten Restrictions on Misleading Financial Titles: The scope may expand to cover terms like “virtual assets.” Public consultation ends today.

2、Malaysia Securities Commission Proposes Crypto Exchange Rule Updates: Public feedback also due today.

3、Solayer ($LAYER) Unlock: Around 27.02 million tokens unlocked, accounting for 9.51% of circulating supply.

4、BounceBit ($BB) Unlock: Around 42.9 million tokens unlocked, about 6.36% of circulating supply.

Macro & Hot Topics

1、Fed’s Bowman: Supports starting rate cuts in September and three cuts this year. Cites sharply revised down job growth and softening labor market, suggesting it’s appropriate to shift from “moderately restrictive” to neutral policy as economic momentum slows.

2、El Salvador Passes New Law, Paves Way for Bitcoin Investment Banks: The “Investment Banking Law” provides regulated investment banks the framework to hold BTC and offer crypto services to institutions, further cementing El Salvador’s bid to be a global digital asset hub. Banks can operate in fiat and foreign currencies, and, with a digital asset service provider license, run as Bitcoin-only banks.

3、US Debt Tops $37 Trillion for First Time: The Kobeissi Letter notes US national debt hit a historic $37T, up $780B since July 4th—an average increase of $2.2B/day. Last week alone, the US government issued $724B in Treasuries over 10 sales events. The US debt crisis appears more dire than ever.

4、US Average Tariff Rate Surges to Highest Since 1933: Per WTO and IMF, US trade-weighted average tariffs reached 20.11%, up from 2.44% at the start of the year. Simple average tariffs jumped from 2.08% to 17.39%, affecting $2.747T in global trade. Yale’s Budget Lab notes current effective rates are now at 18.6%—a 91-year high.

Market Overview

1、

$$BTC and $$ETH Surge: Mixed action across the market; $290M in liquidations (mostly longs) in last 24 hours.

2、Geopolitical Easing Fuels Risk-On Sentiment: Nasdaq hit new highs last Friday; Apple surged, notching its best week since 2020.

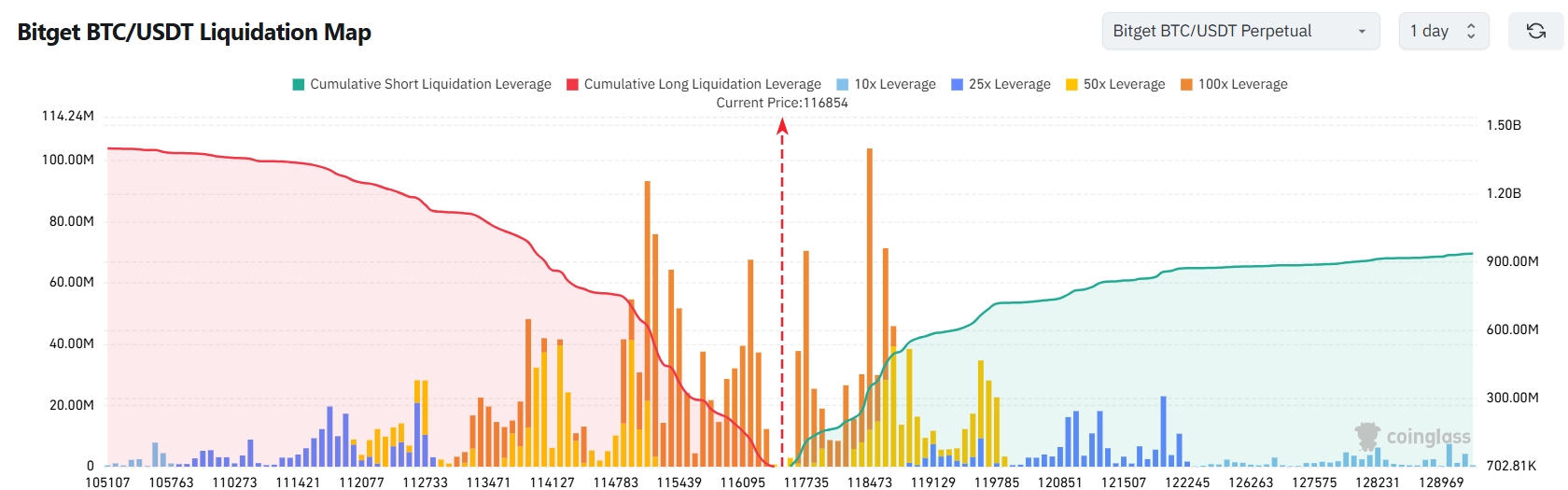

3、Bitget BTC/USDT Liquidation Map: With BTC at $119,053 USDT, a 2,000-point drop to around $117,053 would see over $776M in long liquidations; a 2,000-point rise to around $121,053 would trigger $982M in short liquidations. Long-side liquidation risk notably higher—use leverage with caution.

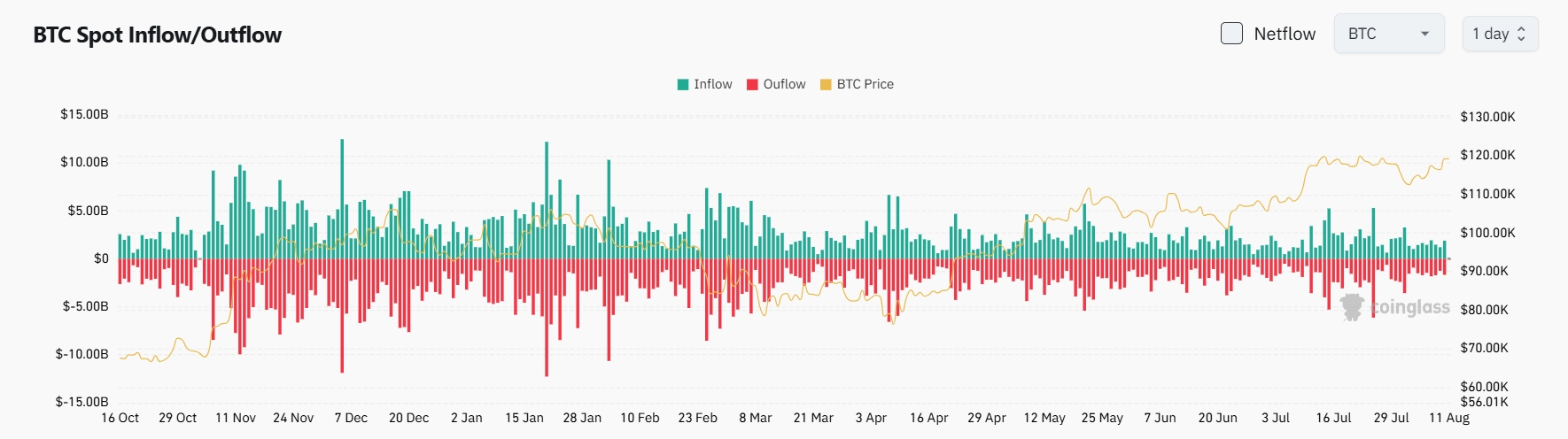

4、BTC Spot Flows: $1.93B in, $1.6B out—net inflow $330M in past 24 hours.

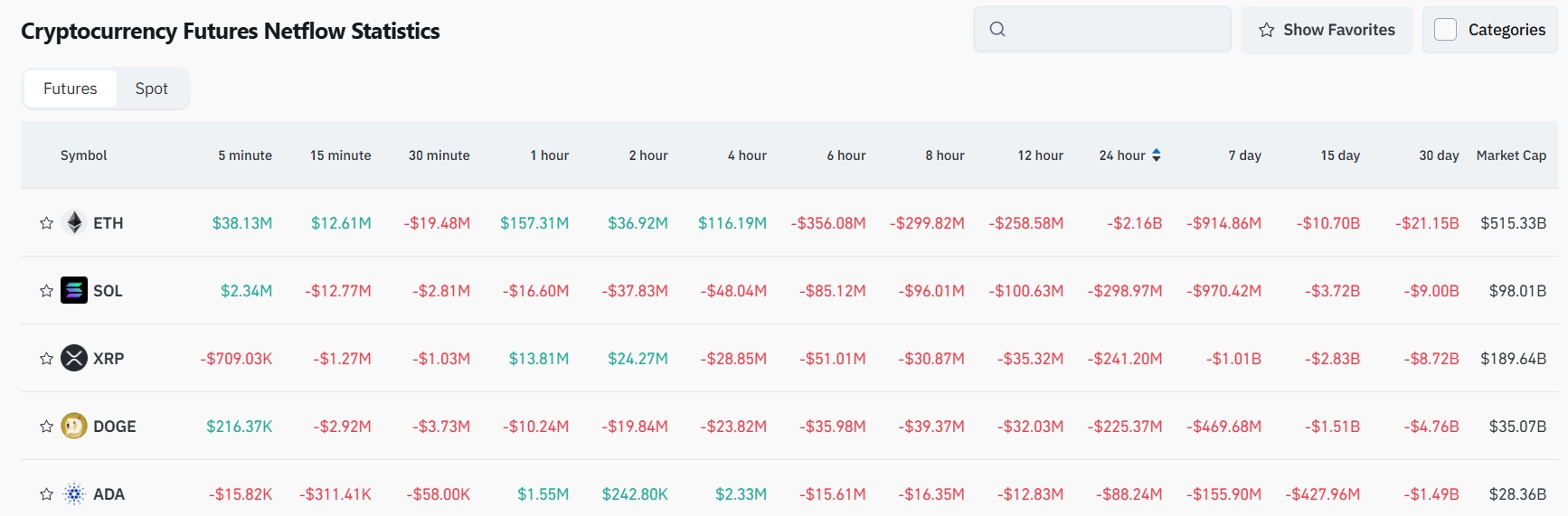

5、Derivatives Outflows in ETH, SOL, XRP, DOGE, ADA: Watch for potential trading opportunities as net outflows lead.

Institutional Views

LD Capital Founder: New $5,000 ETH Target; Quality Altcoin Season Could Follow on Rate Cut Bets

View tweet

Glassnode: Notable Surge in First-Time ETH Buyers and Momentum Traders

View tweet

Greeks.Live: Short-Term BTC Volatility Expectation Low; ETH Implied Vol More Than Double BTC

View tweet

News Highlights

1、Fed’s Bowman supports three rate cuts this year, starting September

2、Montenegro’s ex-justice minister proposes €500M government bonds to buy BTC and ETH

3、Ethereum developer “Fede's Intern” detained in Turkey over alleged ETH misuse

4、CME FedWatch: 88.4% odds of a 25bp rate cut in September

5、US Treasury Secretary Bessent expects trade issues resolved by end of October

Project Updates

1、1inch team's investment fund sold partial ETH & 1INCH, securing $8.36M profit

2、LayerZero Foundation proposes $110M acquisition of Stargate bridge and STG token

3、Michael Saylor posts updated Bitcoin tracker; MicroStrategy may disclose more BTC buys this week

4、NFT sales volume down 11% WoW to $134.9M; buyers and sellers both down about 90%

5、Trump-linked World Liberty initiative launches crypto vault company

6、Synthetix founder: sUSD expected to fully re-peg by month end

7、Jupiter cofounder “meow” addresses unallocated JUP tokens: personal & cofounders’ funds locked till 2030

8、ETF Store president: $19B of ETH purchased by corporates and spot ETFs YTD

9、Linea unveils 9-month product roadmap

10、pump.fun sends $5.6M SOL to new address to buy back PUMP token

X Hot Topic

1、AB Kuai.Dong: Arthur and Eugene Align Bullish on ETH, Confidence Returns

After ETH broke above $4,000 and saw a brief correction, two legendary traders—Arthur and Eugene—reopened long positions in the $4,100-$4,200 range after taking profits earlier at the highs. Both referenced Wall Street analyst Tom Lee’s view that ETH could ultimately hit $16,000. Their synchronized bullish positioning, echoing their previous consensus at $2,500 ETH which fueled the last rally to $4,000, now revives market enthusiasm and long-side confidence.

Original tweet

2、Phyrex: “ETH Hit $4,200—I Didn’t Sell a Single Coin”

Despite many locking in profits as ETH reclaimed $4,200, I’m holding my full stack. My reasoning:

1、No systemic risk in sight; Trump’s policies favor both equities and crypto, and ETH’s current structure reminds me of BTC in March 2024, bolstered by BlackRock and on-chain broker ecosystem;

2、I don’t see better opportunities elsewhere—selling risks missing further upside;

3、Short-term, ETH spot ETF staking is expected; mid-term, maturing RWA apps could drive another leg up; long-term, on-chain brokers may achieve massive valuations. Given these, I’m holding rather than cashing out early.

Original tweet

3、SleepinRain: Portfolio

Thoughts—From

$ZORA to $IKA, Balancing Altcoin Bets & Opportunity Cost

Largest holding remains $ZORA—I'm bullish on Coinbase’s base app and the ZORA flywheel even after a 50% pullback post $0.1. B3 and $RFL supplement my Base ecosystem bets, but B3’s slow pace increases opportunity cost. $IKA mimics $DEEP, so I’m staking low size on SuiLend for 140% APY. $DOLO remains leading WLFI ticker—trend and narrative both strong, so holding at ATH. Key learnings: opportunity cost is real in any market—pick the wrong bet and lose out. For high-conviction setups, go big when your research is strong—it amplifies profits and forces sharp retrospection if you’re wrong.

Original tweet

4、XinGPT: Why I Lost Most Profits Even After Longing ETH From $2,600

While I correctly longed ETH at $2,600 and called the July rally, I lost out due to poor contract management—overusing 5x leveraged futures, making mistakes on altcoin contracts, and lacking strict stop losses. Volatility repeatedly washed me out and eroded expected gains. Lessons: If your contract trading skills aren’t solid, don’t go heavy on leverage—stick to spot, pace yourself, build income streams outside the market so you can hold through volatility, and avoid risky leverage when alts are lackluster.

Original tweet