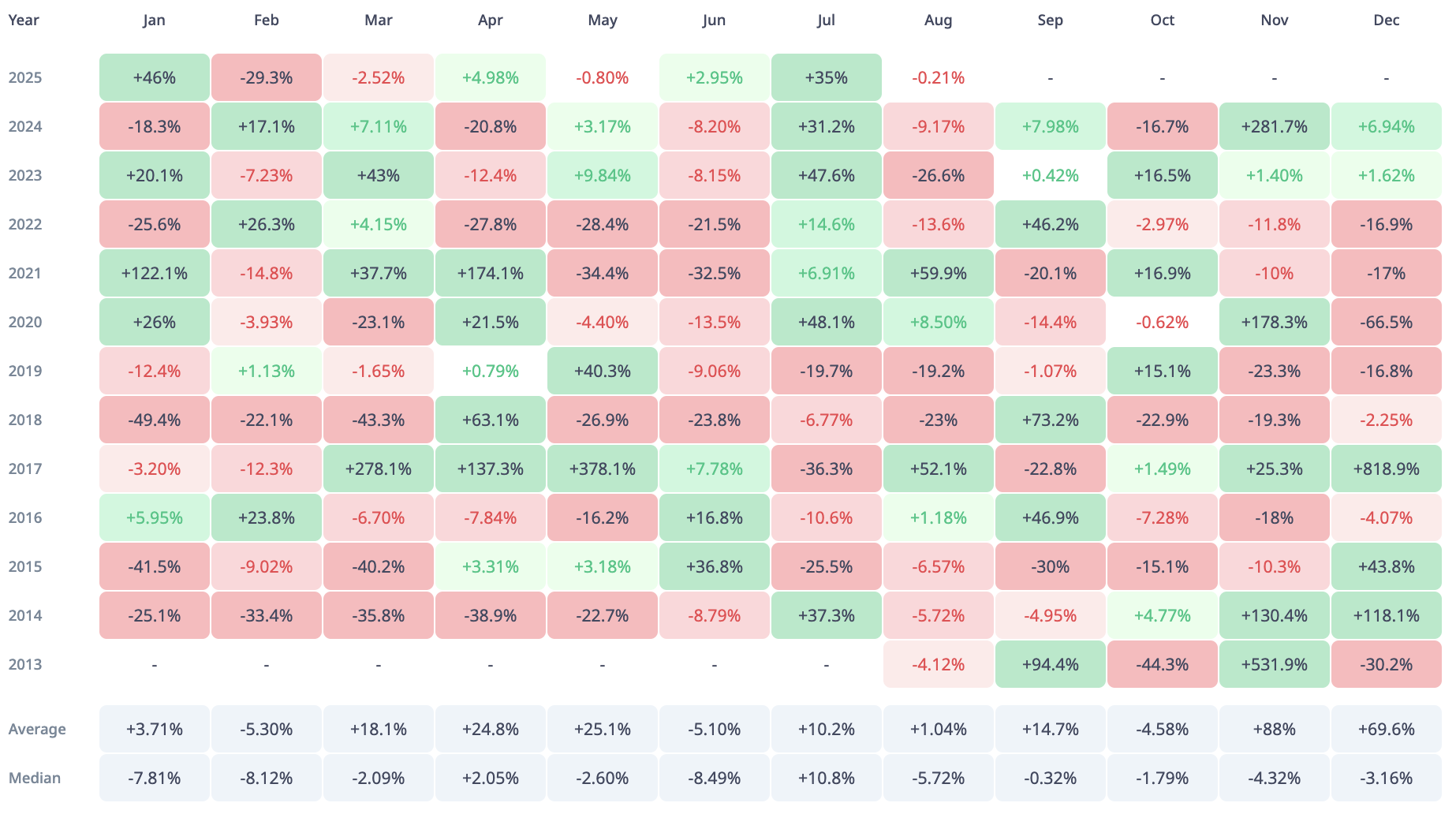

Ethereum Whales Control 23% of Circulating Supply

- Ethereum whales control 23% of circulating supply.

- Exchange reserves approach low levels.

- Staking dynamics reduce liquid supply significantly.

Ethereum’s big investors, often referred to as whales, now control over 23% of its circulating supply, as reported by leading on-chain analytics platforms.

The trend indicates a shift towards self-custody and staking, impacting liquidity and market dynamics significantly.

Ethereum whales now control over 23%

of the asset’s supply, according to on-chain data. Recent trends show increasing holdings among large ETH wallets, which impacts liquidity and market structure significantly. Data from sources like Glassnode details that whale cohorts continue to accumulate, leading to reduced exchange balances system-wide. Both CryptoQuant and Santiment confirm these trends. The actions taken have significantly shifted market dynamics.

Immediate effects are felt

as exchange reserves dwindle, impacting market liquidity negatively. The reduced supply of Ethereum on centralized exchanges has implications for spot liquidity and market pricing. The financial impact is pronounced with decreased liquidity, influencing pricing structures and market behavior in the short term. Stakeholders might see changes due to these shifts.

Technological innovations like L2 scaling are being watched closely as potential solutions to liquidity concerns arise. Trend analysis from previous staking and exchange balance cycles provide insights into future market developments. Potential outcomes include heightened regulatory scrutiny on large wallets and innovation in staking protocols. Historical data shows that liquidity changes align with cycles of increased market activity and adoption.

Reduced exchange balances and structural staking demand compress the available float; that’s rocket fuel when spot demand returns.” – Arthur Hayes, former CEO, BitMEX. Source

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin won’t go below $100K ‘this cycle’ as $145K target remains: Analyst

Will Bitcoin price fall to $110K? Short-term holders sell 22K BTC at a loss

XRP Price Analysis: August’s Challenges and Potential for Recovery Above $3.14

Dogecoin (DOGE) Consolidation May Signal Potential 40% Price Move Amid Ongoing Market Developments