Investment Firm Loses $190,000,000 After Trying to Short Bitcoin, Ethereum and Altcoins: Lookonchain

One investment firm is down hundreds of millions of dollars after attempting to short Bitcoin ( BTC ), Ethereum ( ETH ) and other altcoins, according to on-chain analysis.

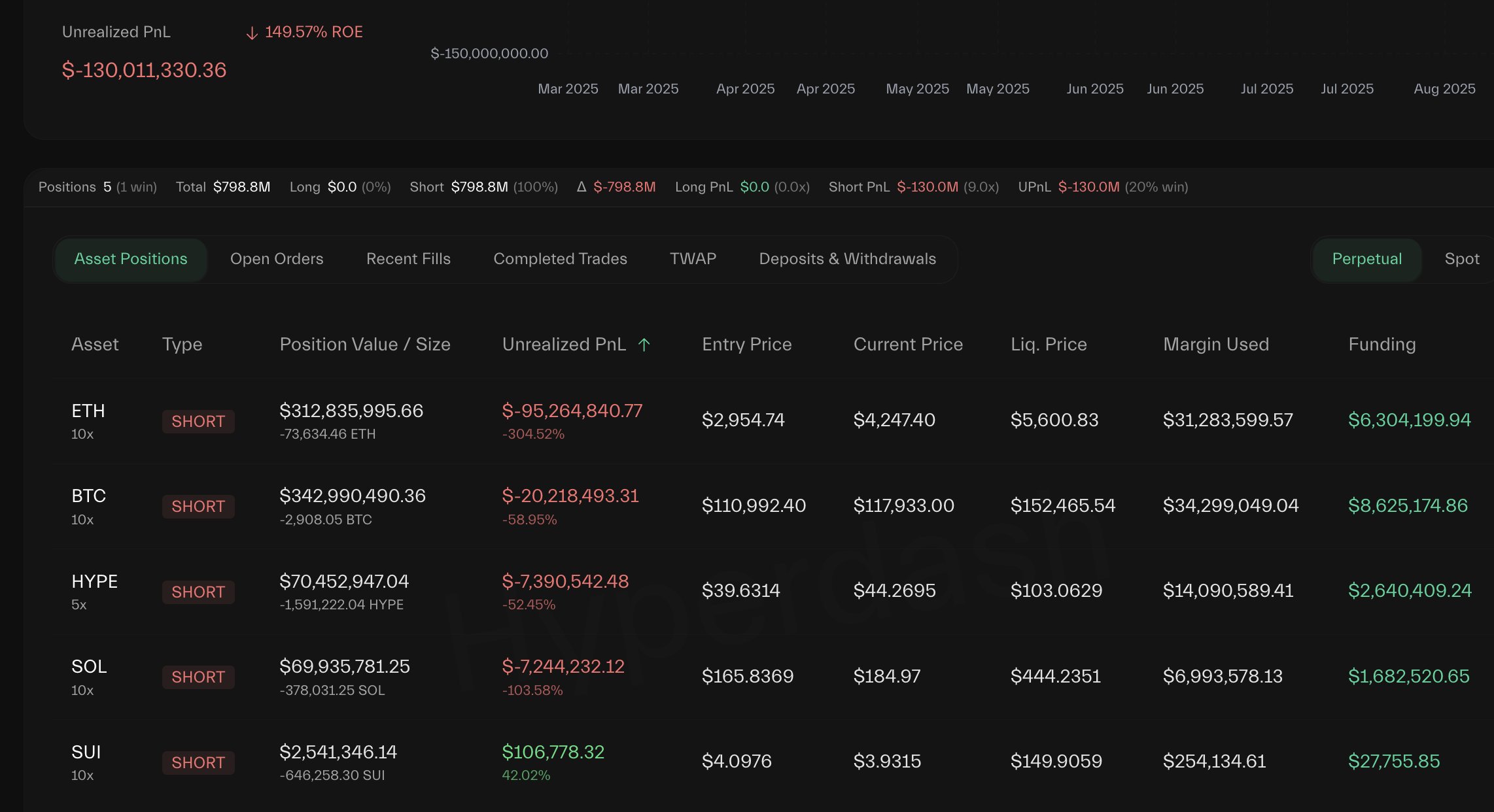

In a post on the social media platform X, Lookonchain says that crypto asset manager Abraxas Capital – a firm with around $3 billion in assets under its management – tried to short BTC, ETH, Solana ( SOL ), SUI Network ( SUI ), and Hyperliquid ( HYPE ) as a hedge on its other positions

However, the positions may have been too large and have resulted in nearly $200 million worth of unrealized losses.

“Abraxas Capital’s two accounts are shorting ETH, BTC, SOL, HYPE, and SUI as a hedge against spot holdings, with total unrealized losses exceeding $190 million! They’re holding 113,819 ETH ($483 million) in shorts – down more than $144 million.”

Source: Lookonchain/X

Source: Lookonchain/X

Shorting is the practice of borrowing a stock or crypto asset and selling it right away, with the expectation of buying it back later at a lower price for a profit.

The market analytics firm goes on to highlight another failed attempt to short Ethereum by an unknown whale, resulting in $20 million worth of losses.

“To avoid liquidation, whale 0x8c58 deposited another 8.6 million USDC into Hyperliquid over the past 24 hours. He shorted ETH at ~$2,969 on July 12, but as ETH kept climbing, he kept adding margin to avoid liquidation…

New liquidation price: $4,885.3.”

Looking at Solana, Lookonchain says that crypto asset management giant Galaxy Digital appears to be selling its stash of SOL as it has been moving the token into prominent crypto exchanges.

“Is Galaxy Digital dumping SOL? Galaxy Digital deposited another 224,000 SOL ($41.12 million) into Binance and Coinbase.”

Source: Lookonchain/X

Source: Lookonchain/X

Solana is trading for $184 at time of writing, a marginal decrease on the day, while BTC and ETH are worth $122,187 and $4,302, respectively.

Featured Image: Shutterstock/Tithi Luadthong

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

CandyBomb x FOGO: Trade futures to share 1,000,000 FOGO!

Bitget Spot Cross Margin adds HYPE/USDT

Instant BGB airdrop: Complete fiat tasks to earn incentives

CandyBomb x SOL: Trade futures to share 160 SOL!