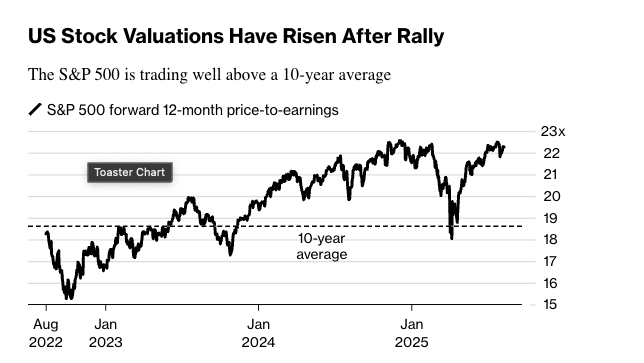

91% of Investors Say US Stock Market is Overvalued, According to New Bank of America Survey: Report

Over 90% of fund share managers, a new record, reportedly think that the US stock market is overvalued, according to a Bank of America (BofA) survey.

Per a new Bloomberg report, 91% of polled fund managers think US stocks are overvalued, the highest rate since 2001.

BofA’s poll also found that investor allocation in foreign markets has climbed to its highest weight since February, signalling a potential sentiment shift on US markets.

BofA strategist Michael Hartnett warns that the recent stock market rally may be at risk of turning into a bubble, especially given that the bank’s survey showed that cash levels as a percentage of total assets were at 3.9% – a level that has historically signalled an incoming sell-off.

Source: Bloomberg

Source: Bloomberg

On the contrary, a net 49% of respondents believe that emerging market (EM) stocks are undervalued, the most since February of 2024. Among the most “crowded trades,” the most popular answers were long the Magnificent 7 stocks, short the dollar, and long gold.

Respondents said that the biggest tail risks for markets include a trade war-induced recession, runaway inflation preventing Fed rate cuts, “disorderly rise” in bond yields, an artificial intelligence (AI) equity bubble and dollar debasement.

Generated Image: Midjourney

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When the Federal Reserve "cuts interest rates alone" while other central banks even start raising rates, the depreciation of the US dollar will become the focus in 2026.

The Federal Reserve has cut interest rates by 25 basis points as expected. The market generally anticipates that the Fed will maintain an accommodative policy next year. Meanwhile, central banks in Europe, Canada, Japan, Australia, and New Zealand mostly continue to maintain a tightening stance.

From MEV-Boost to BuilderNet: Can True MEV Fair Distribution Be Achieved?

In MEV-Boost auctions, the key to winning the competition lies not in having the most powerful algorithms, but in controlling the most valuable order flow. BuilderNet enables different participants to share order flow, reshaping the MEV ecosystem.

JPMorgan Chase issues Galaxy short-term bonds on Solana network

The three giants collectively bet on Abu Dhabi, making it the "crypto capital"

As stablecoin giants and the world's largest exchange simultaneously secure ADGM licenses, Abu Dhabi is rapidly emerging from a Middle Eastern financial hub into a new global center for institutional-grade crypto settlement and regulation.