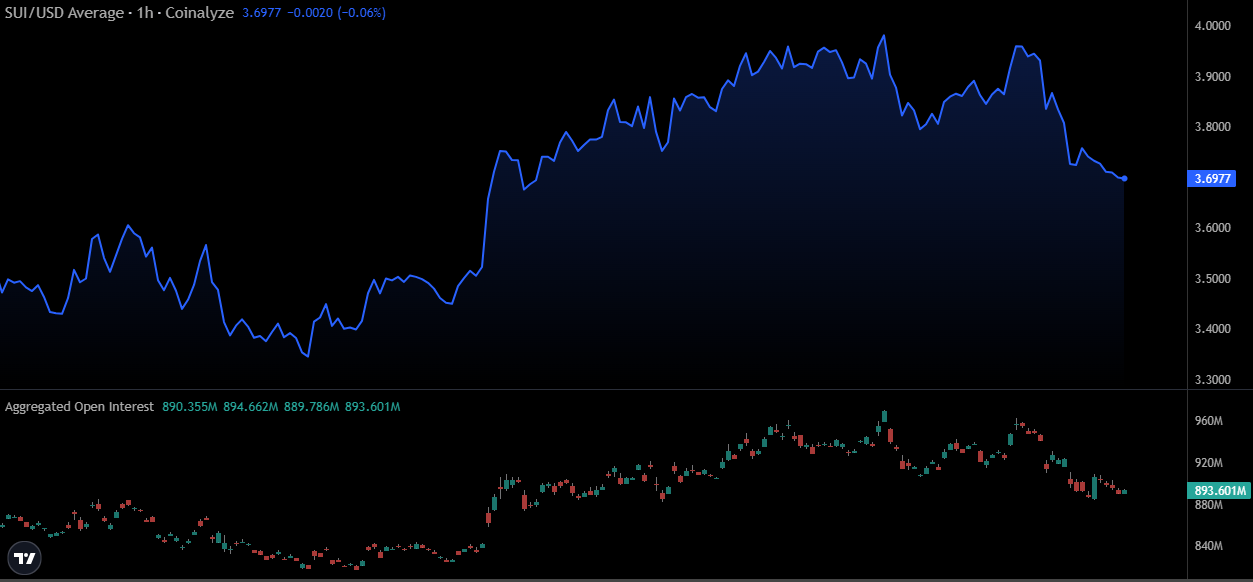

- SUI’s Pullback Signals Caution—Price retreat and easing open interest show traders trimming positions after a strong rally near $4.00.

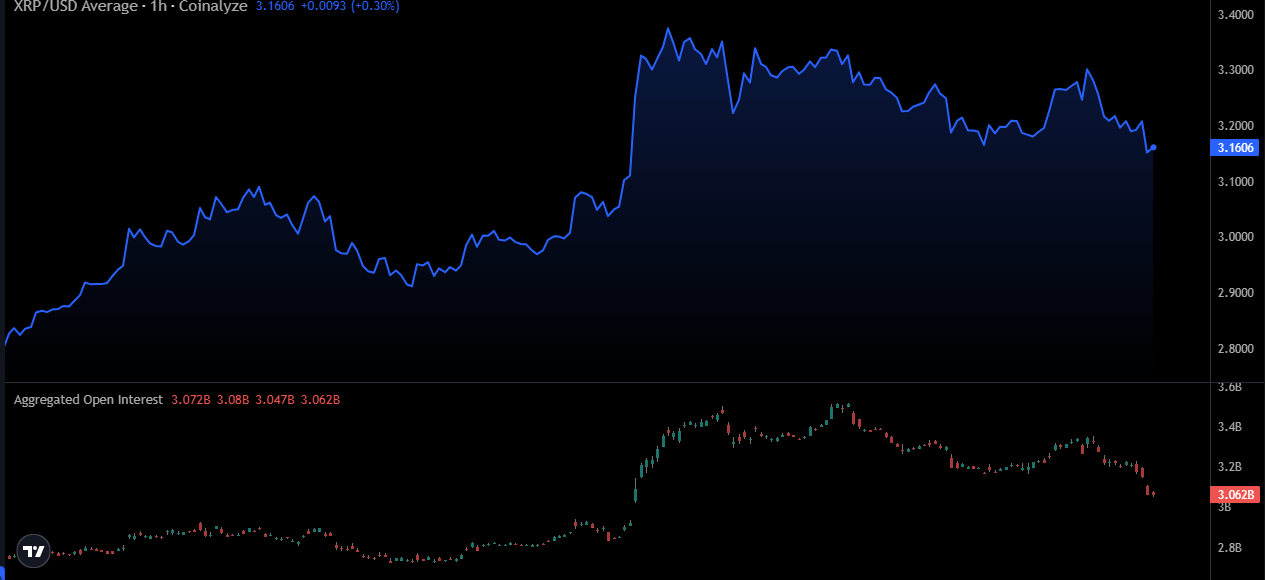

- XRP Leverage Unwinds – Falling price and reduced open interest suggest cooling sentiment, with fresh buying needed to regain bullish momentum.

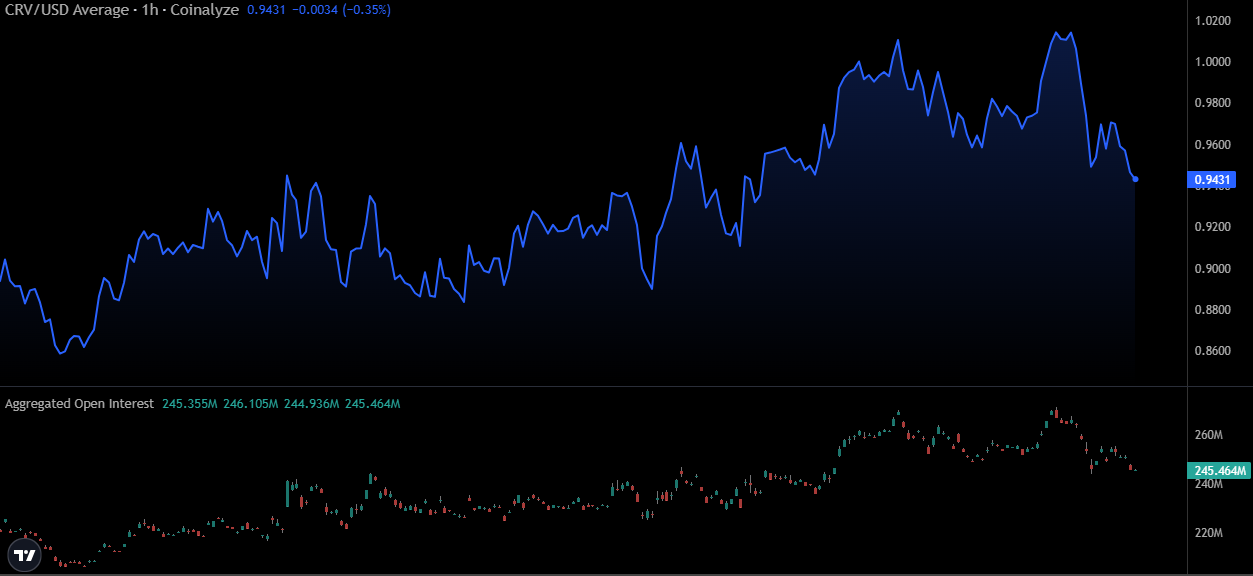

- CRV Momentum Slows—Modest price drop and lower open interest highlight profit-taking, leaving upside dependent on renewed derivatives activity.

Altcoins have active trade scenarios of SUI, XRP, and CRV undergoing price correction and halving of the open interest rate. The progress shows profit-taking and contracting speculative exposure, and that may change momentum in the subsequent sessions. The present market behavior predicts a significant tendency of oscillation, as open interest patterns provide important clues in the positioning strength.

SUI Faces Pressure After Recent Rally

SUI has moved lower after peaking near $4.00, with the current price at $3.6977 signaling a short-term downtrend. The open interest is at $245.46M, which is lower compared to the level of $260M, which shows less leverage. This is indicative that traders are taking profits after the recent rally.

A deranged drop in price and open interest indicates waning bullish actions. Although the retracement is not very significant, it reveals the sensitivity of the market to the change in position. Continued selling may have the price under pressure in the short run.

The profitability of CRV greatly relates to the derivatives activity, where their subsequent upside will depend on the re-entry of the market. A sustained shift in derivatives positioning will likely guide the next directional move.

XRP Pulls Back as Leverage Lightens

XRP is trading at $3.1606, easing from recent highs above $3.30 after a period of steady gains. Current open interest is $3.062B, down from levels near $3.6B, showing reduced speculative engagement. This alignment between falling prices and shrinking open interest suggests a moderation in market sentiment.

The decline likely represents profit-taking after the recent advance, with traders scaling back leveraged exposure. This dynamic could slow price momentum in the short term unless new entrants drive volume higher. Both spot and derivative trends point to a cooling phase.

However, XRP’s ability to sustain support near current levels will determine whether it can reattempt a push toward its recent highs. Renewed open interest growth would be a key signal for any breakout attempts.

CRV Loses Momentum After Testing $1.02

CRV is trading at $0.9431 after failing to hold above $1.02, marking a pullback from recent strength. The open interest is at $245.46M, which is lower compared to the levels of $260M which shows less leverage. This is indicative that traders are taking profits after the recent rally.

Deranged drop in price and Open interest indicates waning bullish actions. Although the retracement is not very significant, it reveals the sensitivity of the market to the change in position. Continued selling may have the price under pressure in the short-run.

The profitability of CRV greatly relates to the derivatives activity, where their subsequent upside will depend on the re-entry of the market. A shift back toward higher open interest could reestablish bullish momentum if broader sentiment improves.