Lido’s (LDO) 67% Rally Faces Reality Check as Euphoria Nears Peak

LDO’s 67% rally faces a reality check as euphoria peaks, risking a pullback if buyer fatigue sets in.

LDO, the native token of Ethereum’s largest decentralized staking platform, Lido, has surged 67% over the past week, earning the top spot among crypto gainers in the last seven days.

However, both on-chain and technical data suggest this rally may be running out of steam as signs of buy-side exhaustion begin to surface.

Warning Signs Flash for LDO

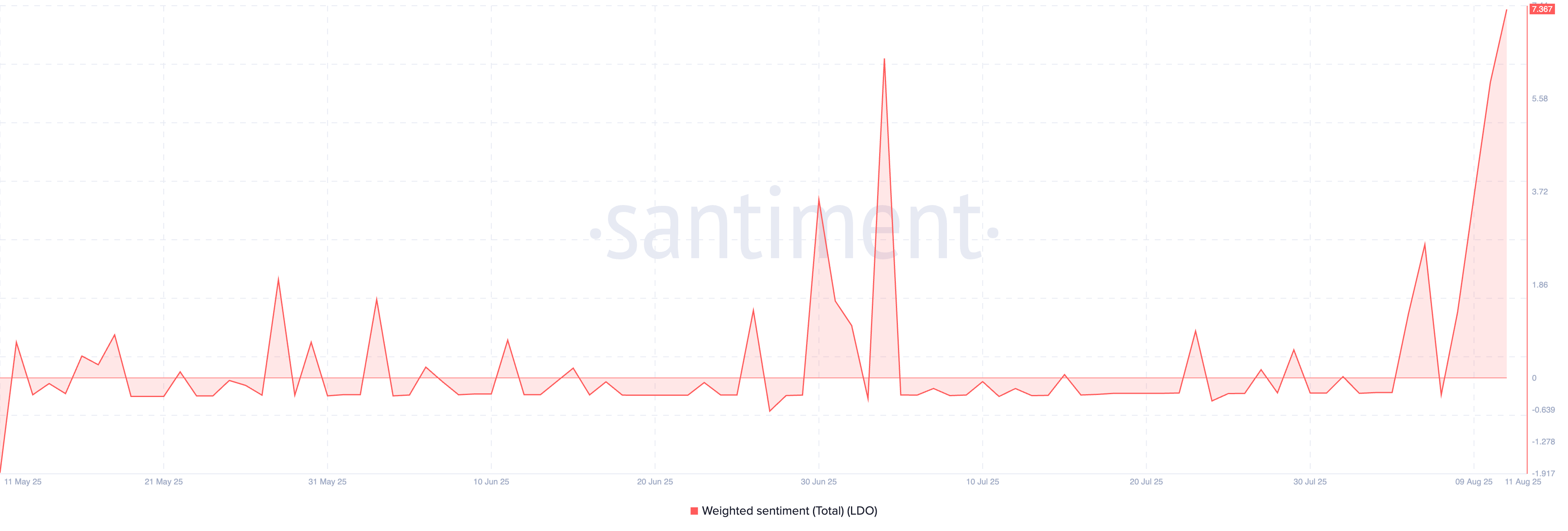

Per Santiment data, LDO’s weighted sentiment has rocketed to a nine-month high of 7.32. This places the metric in euphoric territory, a zone that historically has often preceded price pullbacks. This puts LDO at risk of shedding some of its recent gains.

LDO Weighted Sentiment. Source:

Santiment

LDO Weighted Sentiment. Source:

Santiment

An asset’s weighted sentiment measures its overall positive or negative bias, considering both the volume of social media mentions and the sentiment expressed in those mentions. When it is negative, it is a bearish signal, as investors are increasingly skeptical about the token’s near-term outlook. This prompts them to trade less, exacerbating the price decline.

On the other hand, when its value is positive, traders are discussing the asset more with an overall bullish tone.

When it continues to climb, as with LDO, while this can reflect strong confidence, such extreme optimism often signals that buyers may be overextended. Historically, spikes in weighted sentiment have marked the end of uptrends, as heightened optimism like this indicates that buyers may soon become exhausted, raising the risk of a reversal.

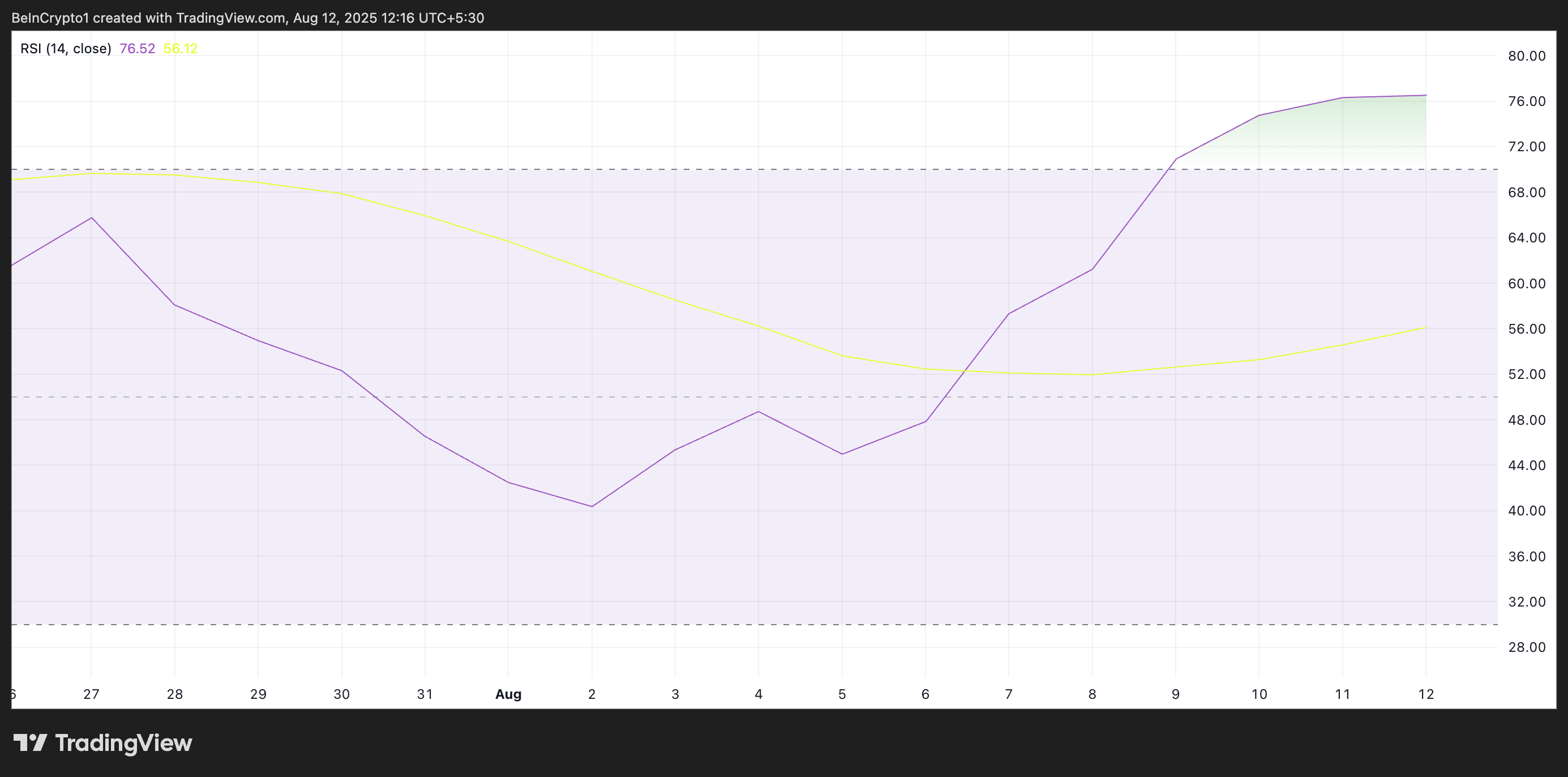

Furthermore, readings from LDO’s Relative Strength Index (RSI) on the daily chart support this bearish outlook. As of this writing, it sits at 76.52, an overbought territory.

LDO RSI. Source:

TradingView

LDO RSI. Source:

TradingView

The RSI indicator measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and due for a price decline, while values under 30 indicate that the asset is oversold and may witness a rebound.

LDO’s RSI readings indicate that the altcoin is now firmly in overbought territory, suggesting buying momentum may be unsustainably high. This raises the possibility of a price consolidation or a pullback as sellers look to lock in profits.

Buyer Fatigue Looms Over LDO

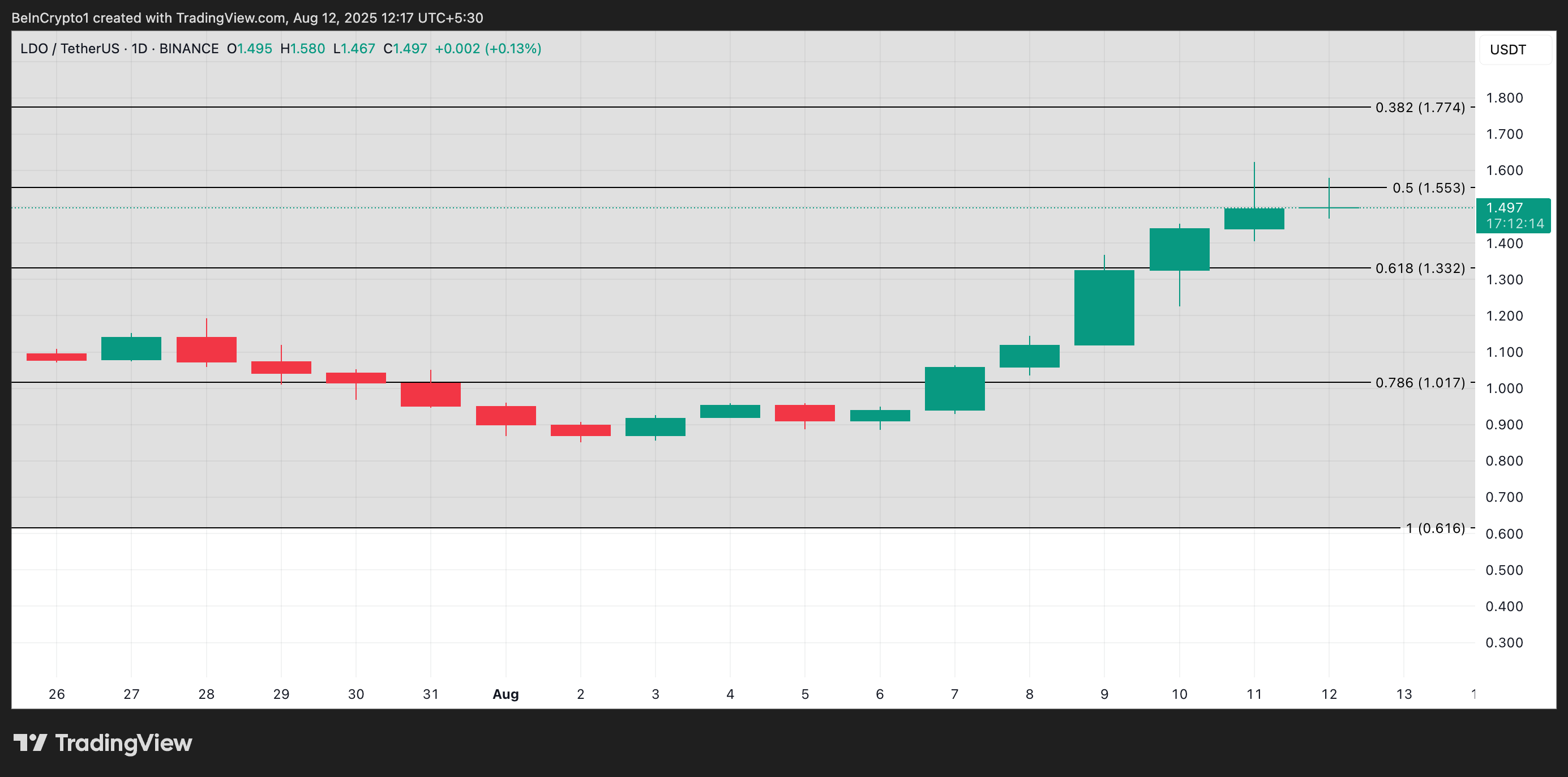

Once buyer exhaustion grows, LDO risks falling to $1.33. If the support floor fails to hold, the token could plummet further to $1.017.

LDO Price Analysis. Source:

TradingView

LDO Price Analysis. Source:

TradingView

However, LDO’s price could extend its rally and climb above $1.55 if buying pressure remains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

The largest IPO in history! SpaceX reportedly seeks to go public next year, aiming to raise over 30 billion and targeting a valuation of 1.5 trillion.

SpaceX is advancing its IPO plan, aiming to raise significantly more than $30 billion, which could make it the largest public offering in history.

DiDi has become a digital banking giant in Latin America

Attempting to directly replicate the "perfect model" used domestically will not work; we can only earn respect by demonstrating our ability to solve real problems.

Macroeconomic structural contradictions are deepening, but is it still a good time for risk assets?

In the short term, risk assets are viewed bullishly due to AI capital expenditures and affluent consumer spending supporting earnings. However, in the long term, caution is advised regarding structural risks brought by sovereign debt, demographic crises, and geopolitical restructuring.

a16z predicts four major trends will be announced first in 2026

AI is driving a new round of structural upgrades in infrastructure, enterprise software, health ecosystems, and virtual worlds.