Crypto Market Outlook After US Inflation Data: Bitcoin Eyes $125K as CPI Hits 2.7%

US CPI Data Comes in Slightly Below Expectations

Today’s US inflation report landed at 2.7% year-over-year, just under the forecasted 2.8%. According to the pre-announcement framework from Ash Crypto (@Ashcryptoreal), this reading leans bullish for risk assets like crypto. Core CPI, however, remained elevated at 3.1%, slightly above estimates.

Markets reacted positively — US stock index futures climbed, and rate cut bets for September strengthened. The crypto sector followed suit, with Bitcoin holding near $119K and Ethereum edging higher.

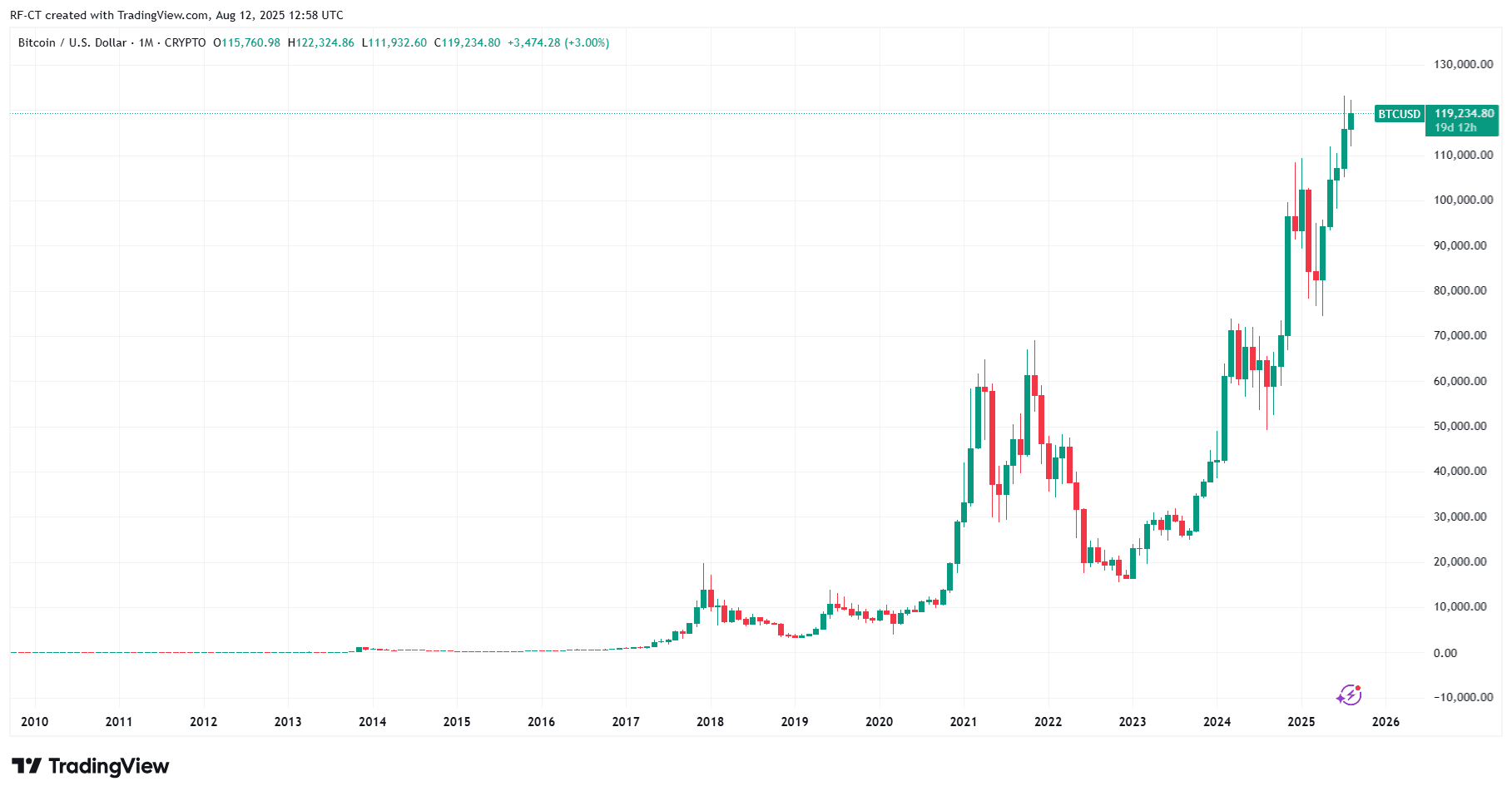

Bitcoin Price Prediction: Path to $125K?

Bitcoin ($BTC) briefly spiked above $119K after the CPI release before consolidating. The lower-than-expected inflation reading has reinforced the possibility of a 75 basis points Fed rate cut by year-end, starting as early as September.

By TradingView - BTCUSD_2025-08-12 (All)

By TradingView - BTCUSD_2025-08-12 (All)

- Bullish Scenario: If the Fed confirms a September cut, Bitcoin could break the $120K resistance and aim for $125K by Q4 2025.

- Neutral Scenario: A pause in Fed action could keep BTC range-bound between $116K–$120K.

- Bearish Scenario: Any uptick in inflation or hawkish Fed stance could push BTC back toward $112K support.

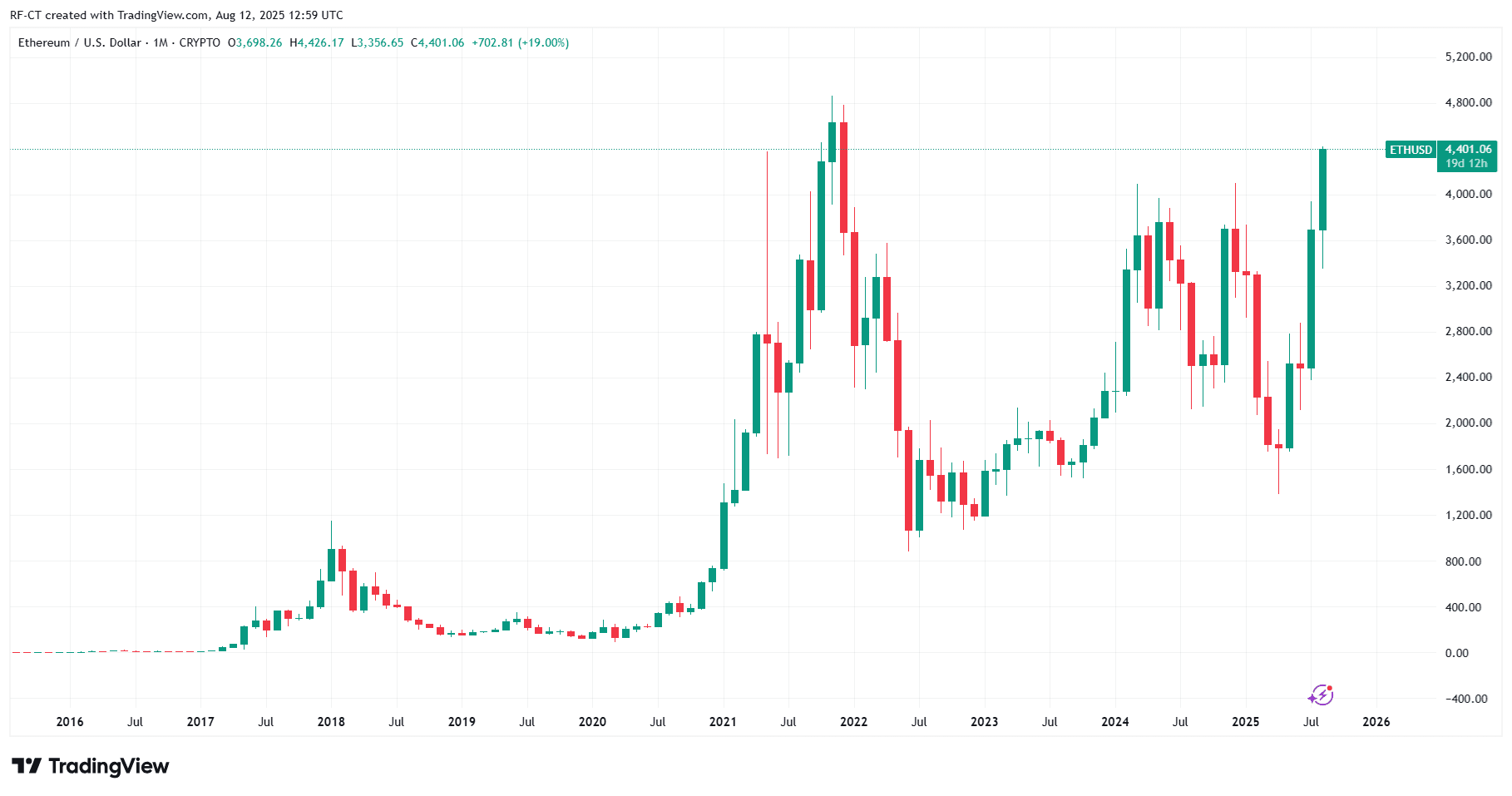

Ethereum and Altcoins: Rally Potential

Ethereum ($ETH) has shown resilience, trading near key support levels above $4,000. If the rate cut narrative gains momentum, ETH could target $4,500 in the coming weeks.

By TradingView - ETHUSD_2025-08-12 (All)

By TradingView - ETHUSD_2025-08-12 (All)

Altcoins like Cardano ($ADA) and Solana ($SOL) stand to benefit from increased liquidity and renewed investor appetite. Short-term volatility is still expected, but a dovish Fed would generally favour higher beta assets.

Macro Takeaway for Crypto Investors

The CPI outcome provides a cautiously bullish backdrop. The headline number supports rate cut hopes, but sticky core inflation means the Fed may move slower than markets want. This sets the stage for short bursts of volatility, especially around Fed communications.

For traders, the next major catalyst will be the FOMC meeting in mid-September. Until then, Bitcoin and altcoins may trade within a tighter range, with potential breakouts if macro sentiment shifts further toward easing.

$BTC, $ETH, $ADA, $SOL

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Google Plans to Challenge US Court Decision Declaring Its Search Practices as an Illegal Monopoly

Dollar Bounces Back Amid Speculation About Fed Chair

Why a Recent Trump Proposal Caused Major Surges in Energy Stocks This Friday