Date: Mon, Aug 11, 2025 | 01:15 PM GMT

The cryptocurrency market is experiencing a mild cooldown as Ethereum (ETH) touched $4,349 before easing back to the $4,185 range. This modest pullback has filtered into several major altcoins — including Near Protocol (NEAR).

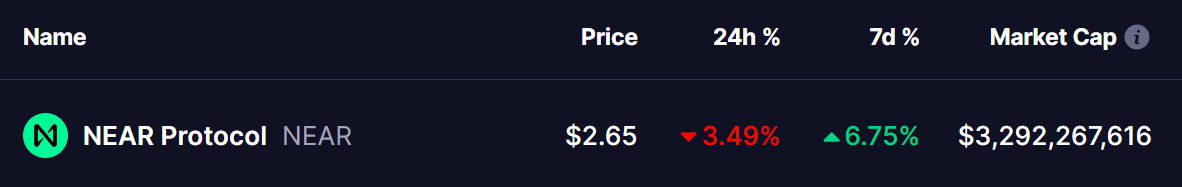

NEAR has notched an 6% weekly gain before slipping into the red today. More importantly, its latest price action is mirroring a familiar chart pattern that could offer clues to its next major move.

Source: Coinmarketcap

Source: Coinmarketcap

Familiar Pattern Hints at Potential Pullback

On the daily timeframe, NEAR is moving within a symmetrical triangle formation, but short-term momentum is showing signs of fatigue. Inside this broader pattern, a bearish ABCD fractal has taken shape — an almost exact replica of a setup seen earlier this year.

In mid-June, NEAR’s rally stalled at the “C” point and was swiftly rejected, leading to a breakdown below both the 25-day and 100-day moving averages (MAs). This triggered a 33% sell-off toward the Potential Reversal Zone (PRZ) and lower trendline support near $1.81.

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

Near Protocol (NEAR) Daily Chart/Coinsprobe (Source: Tradingview)

Today’s chart looks eerily similar. NEAR is once again backing off from the C point at around $2.85 and now trades just under its 25-day MA, hovering precariously above the 100-day MA at $2.54 — a make-or-break level that could decide the next directional swing.

What’s Next for NEAR?

If the fractal plays out again, a clean break below the 100-day MA could spark another leg down toward the PRZ and lower channel support around $1.94 — roughly a 26% decline from current levels.

Bulls still have a lifeline: reclaiming the 25-day MA and closing above $2.85 would invalidate the bearish setup, potentially inviting renewed buying pressure and a push toward the triangle’s upper boundary.