Pantera Capital’s Dan Morehead accurately predicted Bitcoin’s price to reach $117,482 by August 2025, leveraging historical halving cycles.

-

Bitcoin’s price surged over 660% from its 2022 low, highlighting the predictive strength of halving cycles.

-

Institutional adoption is reshaping the Bitcoin narrative, with ETFs holding significant amounts of BTC.

-

Experts like Bob Loukas and Jason Williams provide insights into the evolving Bitcoin market dynamics.

Pantera Capital predicts Bitcoin to hit $117,482 by 2025, driven by historical halving cycles and increasing institutional adoption.

| 2025 | $117,482 | $119,000 |

What is Pantera Capital’s Bitcoin Price Prediction?

Pantera Capital, led by Dan Morehead, predicts that Bitcoin will reach $117,482 by August 11, 2025. This forecast is based on historical data from Bitcoin’s halving cycles, which have historically influenced price movements.

How Accurate Are Bitcoin Price Predictions?

Bitcoin’s price predictions often rely on historical trends. Pantera’s analysis shows a consistent pattern of price increases following halving events. As of now, Bitcoin is trading near $120,000, reflecting a significant recovery from its 2022 lows.

Frequently Asked Questions

What is the significance of Bitcoin’s halving cycle?

The halving cycle reduces the reward for mining Bitcoin, which historically leads to increased scarcity and price appreciation over time.

How does institutional adoption affect Bitcoin’s price?

Institutional adoption introduces significant capital into the market, potentially stabilizing prices and increasing demand, which can lead to price surges.

Key Takeaways

- Bitcoin’s price prediction by Pantera Capital is based on historical halving cycles.: This method has proven effective in the past.

- Institutional adoption is reshaping market dynamics.: ETFs and corporate holdings are significant factors in current price movements.

- Expert insights can provide valuable context.: Analysts like Bob Loukas offer perspectives that enhance understanding of market trends.

Conclusion

In summary, Pantera Capital’s prediction of Bitcoin reaching $117,482 by 2025 is grounded in historical analysis of halving cycles and current market trends. As institutional adoption grows, the dynamics of Bitcoin’s price may evolve, making it essential for investors to stay informed.

Pantera’s Dan Morehead nailed his prediction for Bitcoin’s Aug. 11, 2025 price, made in November 2022 as BTC was nearing its bottom.

Pantera Capital’s adherence to the Bitcoin halving cycle enabled it to predict Bitcoin’s price with striking accuracy in 2022, underscoring how the asset’s supply schedule can influence valuations, even as skepticism about the cycles grows.

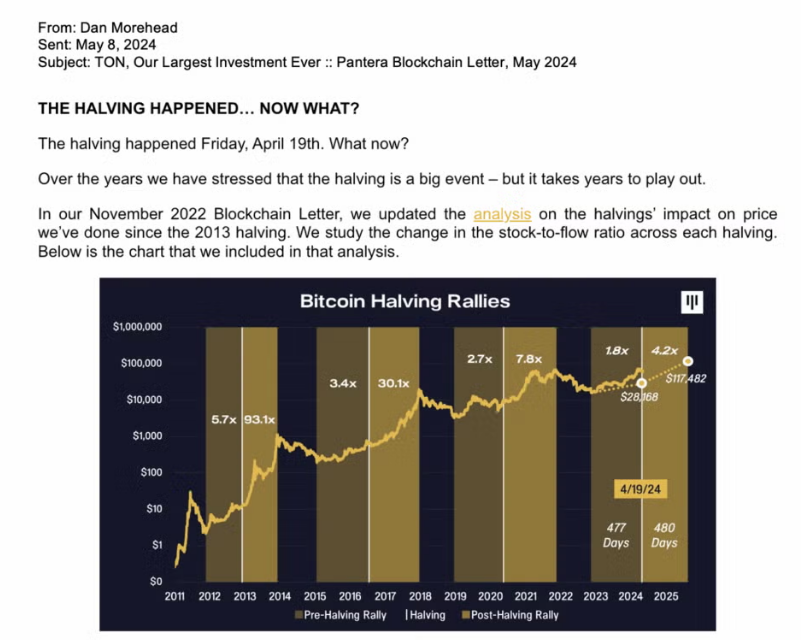

In November of that year, Pantera published a price chart mapping Bitcoin’s (BTC) halving rallies and showing diminishing returns after each four-year epoch. Factoring in the typical timing between market bottoms and post-halving rallies, the firm projected Bitcoin would hit $117,482 by Aug. 11, 2025.

On Aug. 11, Bitcoin closed above $119,000, according to Coin Metrics data cited by CNBC.

An excerpt from Dan Morehead’s May 2024 Blockchain Letter, where he references the firm’s Bitcoin price forecast from 2022. Source: Pantera Capital

An excerpt from Dan Morehead’s May 2024 Blockchain Letter, where he references the firm’s Bitcoin price forecast from 2022. Source: Pantera Capital

Amid a flood of Bitcoin price predictions, Pantera’s stood out for its remarkable accuracy. At the time of its original forecast, Bitcoin was headed toward a cycle low below $16,000 — a level it reached on Nov. 21, 2022, according to Bitbo.

Bitcoin is now trading near $120,000, up more than 660% from its 2022 low.

The rally underscores the predictive strength of Bitcoin’s four-year price cycles, which align closely with its halving events and generally follow a pattern of post-halving rally, cycle peak, correction and accumulation.

Analysts such as Bob Loukas also apply cycle theory to map Bitcoin’s highs and lows. Loukas correctly identified the start of a new four-year cycle in January 2023, less than two months after Bitcoin hit its bottom.

Source: Bob Loukas

Source: Bob Loukas

Related: Bitcoin ‘demand generation’ phase mirrors 2022 market bottom — Are new highs incoming?

Will institutional adoption change the Bitcoin cycle narrative?

Each Bitcoin halving cycle brings fresh narratives about why “this time is different” and why the four-year cycle pattern is destined to fade.

To their credit, those predicting the erosion of these dynamics have a strong point this time: Bitcoin has never been this institutionalized, with exchange-traded funds (ETFs) and corporations holding millions of BTC.

Beginning in January 2024, the US spot Bitcoin ETFs have become the most successful ETF debut in history. ETFs now hold 7.1% of Bitcoin’s supply — about 1.491 million BTC, according to Bitbo. Public and private companies together account for another 1.36 million BTC.

Author and investor Jason Williams has pointed to the rise of Bitcoin treasury-holding companies as a reason he believes “the Bitcoin 4 year cycle is over.”

Source: Jason Williams

Source: Jason Williams

Bitcoin advocate Pierre Rochard agreed, noting: “Halvings are immaterial to trading float, 95% of BTC have been mined, supply comes from buying out OGs, demand is the sum of spot retail, ETPs getting added to wealth platforms, and treasury companies.”

Magazine: Scottie Pippen says Michael Saylor warned him about Satoshi chatter