Key Notes

- BitMEX co-founder Arthur Hayes joins Upexi's Solana-focused advisory committee as first member to guide strategic expansion.

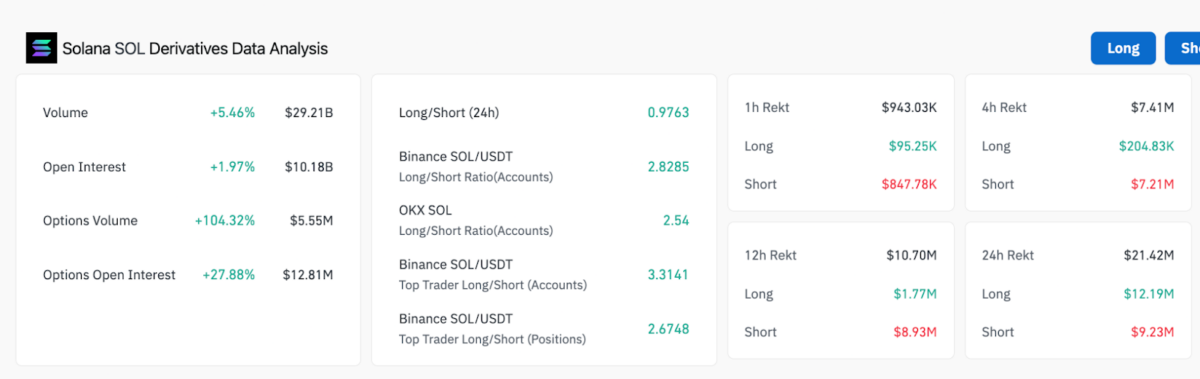

- Solana futures open interest climbed 1.97% to $10.18B while derivatives volume rose 5.46% amid fresh capital inflows.

- Technical analysis shows SOL testing $189 resistance with potential breakout toward $200 representing 7.18% upside gain.

After an underwhelming performance on Monday, Solana BTC $119 667 24h volatility: 0.7% Market cap: $2.38 T Vol. 24h: $46.88 B price rose 7% on Tuesday, Aug. 12, to hit $185, its highest single-day gain since July 12. Solana’s renewed bullish traction was supported by a major announcement from Upexi, a leading Solana treasury investor .

On Aug. 12, Upexi announced the appointment of BitMEX co-founder and key opinion leader Arthur Hayes to its crypto strategy advisory committee. Hayes joins as the first member of Upexi’s Solana-focused advisory group. Upexi, which currently holds 1.9 million SOL tokens, says the move will help solidify its leadership in Solana treasury management.

“The Advisory Committee will be a catalyst for Upexi’s next stage of growth – driving performance, amplifying our brand and unlocking transformative opportunities. It will expand our footprint in the Solana ecosystem through strategic partnerships and targeted investments and help us champion Solana among institutions and corporates” Allan Marshall, Upexi’s Chief Executive Officer, stated.

BitMEX co-founder Arthur Hayes is expected to bring strategic guidance and industry connections to the company’s expansion plans. The committee will work to grow Upexi’s presence in the Solana ecosystem through targeted investments and partnerships.

The market response was immediate. Solana futures open interest rose 1.97% to $10.18B intraday, crossing the $10 billion mark for the first time this month, a clear indicator of fresh capital inflows as SOL price rebounded from the local bottom at $175 on Tuesday.

Solana Derivatives Market Analysis | Source: Coinglass

Moreover, Solana derivatives volume also climbed 5.46% to $29.2 billion, while options open interest rose 27.88% to $12.81M.

The large jump in options volume, coupled with the increase in open interest, indicates traders are building positions for potential breakout moves.

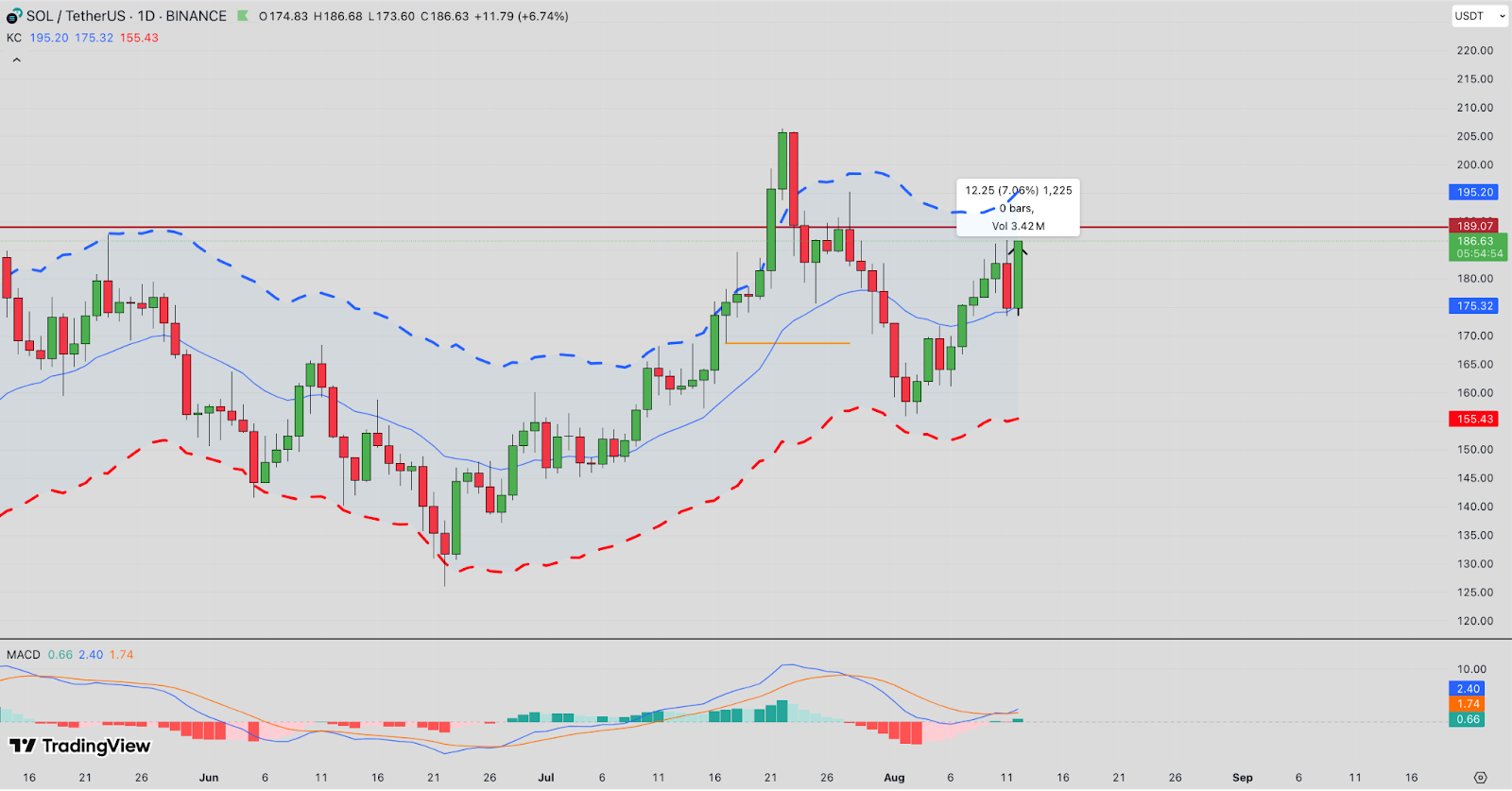

SOL Price Forecast: Can Bulls Flip $189 Resistance to Retake $200?

Solana price is testing a critical resistance level at $189 after reclaiming its short-term moving average near $175. The daily chart shows SOL trading just below the upper Keltner Channel band at $195.20, with momentum indicators improving. The MACD histogram has flipped toward green, signaling early bullish momentum, while price action shows higher lows since the August 5 reversal.

Solana price forecast

From current levels near $186.60, a move to $200 represents a 7.18% gain. A daily close above $189 on rising volume and sustained open interest would confirm a breakout. Clearing the upper channel near $195 would add technical confirmation and likely trigger momentum-driven buying towards July peaks near $210.

Conversely, failure to close above $189 followed by a drop below the 20-day moving average at $175.32 would invalidate the bullish Solana price forecast. A further break under $170 would expose the lower channel support near $155.43, representing a potential 16.7% decline from current prices.

As Solana’s ecosystem regains momentum with positive treasury investor news, Bitcoin’s Layer 2 sector is also drawing significant interest.

BTC Hyper