BCH Price Holds Steady During Market Slide — What Next for Bitcoin Cash?

Bitcoin Cash holds firm amid market sell-off, with a key liquidity zone at $603 potentially triggering more upside.

Bitcoin Cash has defied the broader crypto market downturn of the past 24 hours to record a modest 3% gain.

The move marks a continuation of BCH’s recent rally, which began on August 3. Trading at $590.30 at press time, the altcoin’s price has since soared 14% and is poised to keep increasing.

BCH Defies Bears; Key Liquidity Zone Could Unlock Fresh Upside

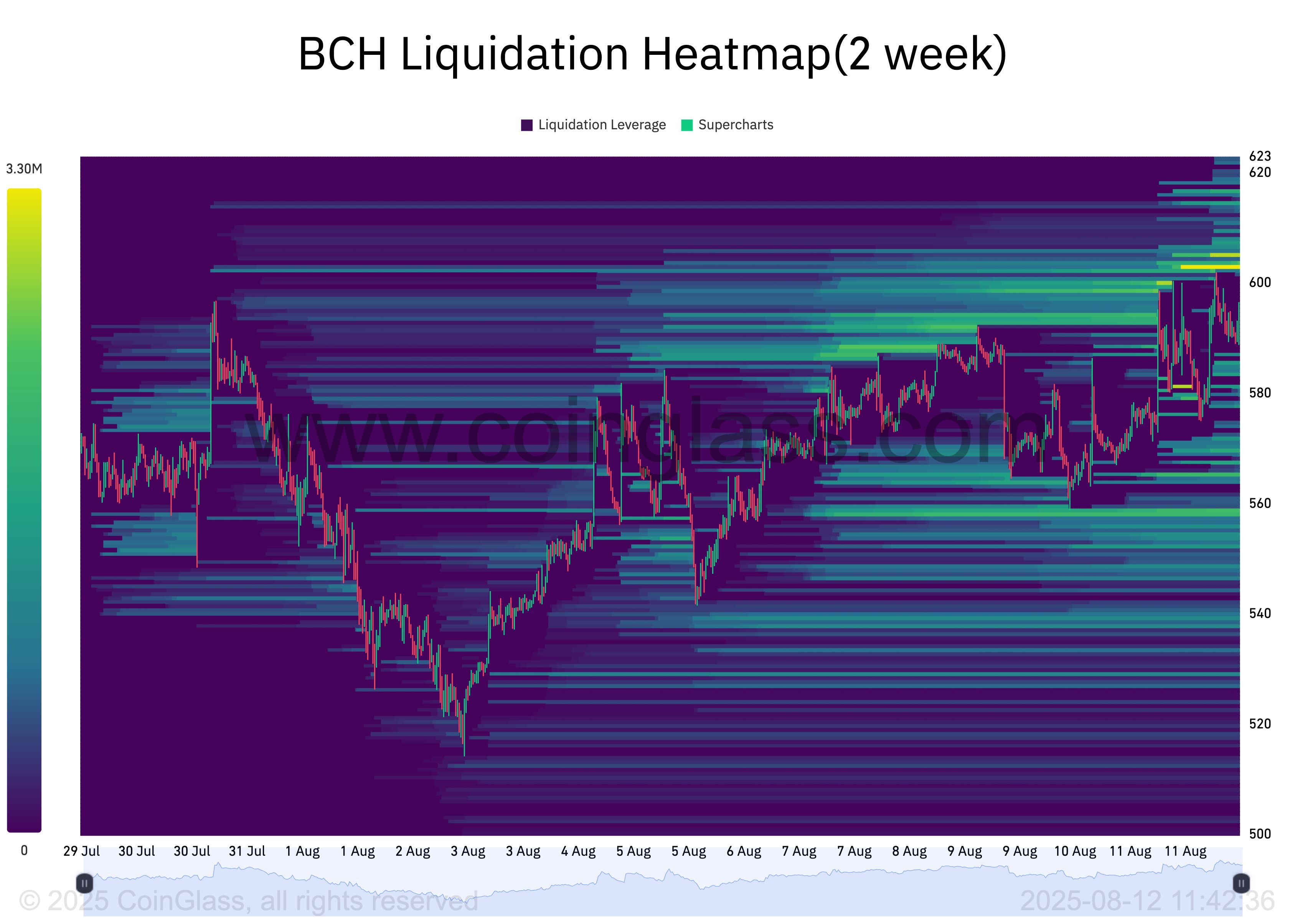

An assessment of BCH’s liquidation heatmap has revealed a concentration of liquidity at the $603 price zone.

BCH Liquidation Heatmap. Source:

BCH Liquidation Heatmap. Source:

A liquidation heatmap tracks clusters of leveraged positions in the market and highlights where large amounts of open interest could be triggered into buying or selling if the price reaches those levels. These areas of high liquidity are often color-coded to show intensity, with brighter zones representing larger liquidation potential.

When liquidity is concentrated above an asset’s current price, it indicates a potential “magnet” effect, where traders push the price upward to trigger liquidations and unlock that liquidity.

For BCH, the $603 zone could act as such a target, fueling further upside if bullish momentum persists.

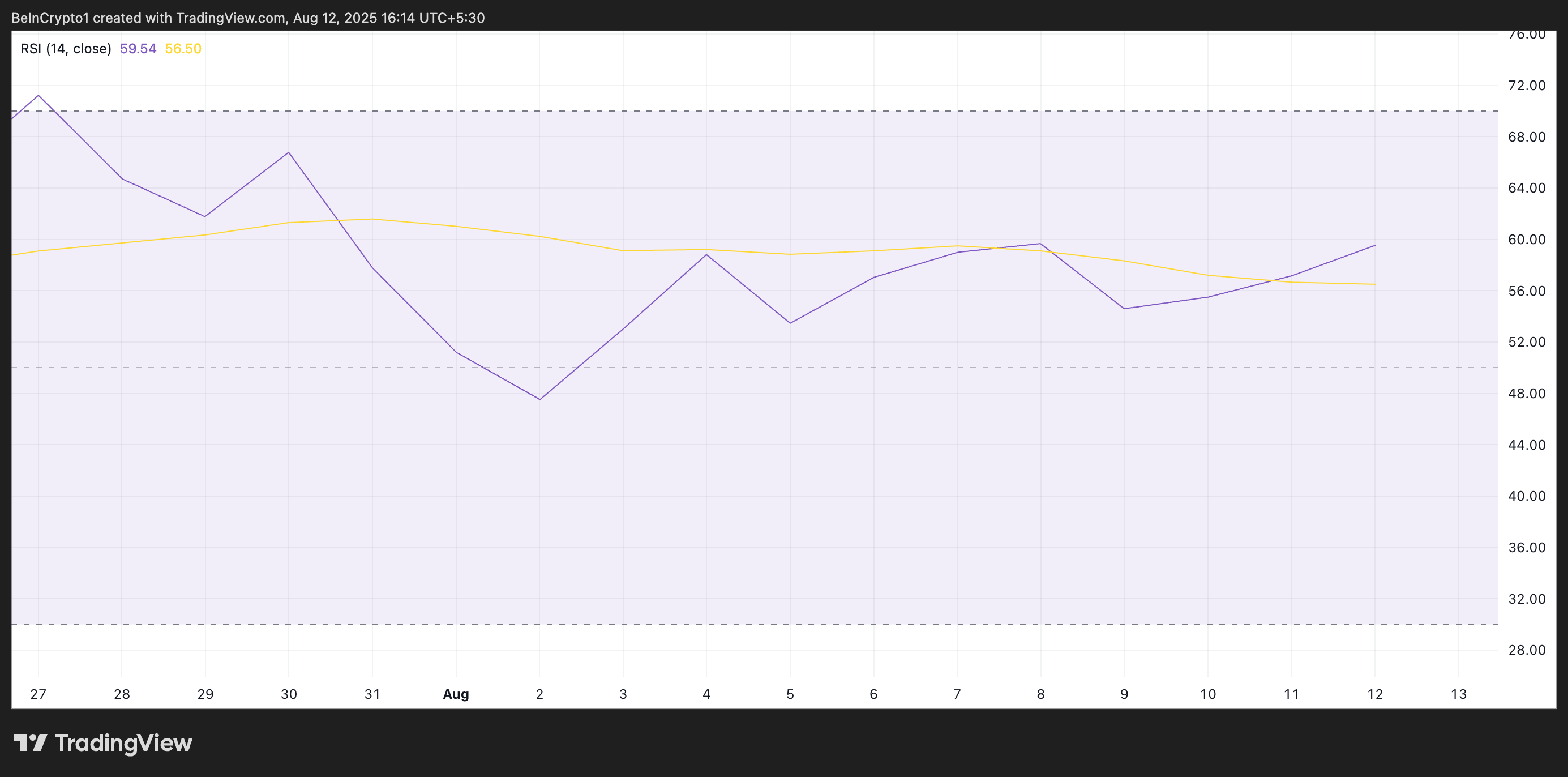

Further, BCH’s climbing Relative Strength Index (RSI), which stands at 59.54 at press time, confirms this bullish outlook.

BCH RSI. Source:

BCH RSI. Source:

The RSI measures an asset’s overbought and oversold market conditions. It ranges between 0 and 100. Values above 70 suggest that the asset is overbought and could be due for a price correction, while values under 30 indicate that the asset is oversold and may be primed for a rebound.

At 59.54 and rising, BCH’s RSI reflects strengthening bullish momentum. If it remains below the overbought threshold of 70, a sustained RSI uptrend with improving market sentiment would allow BCH’s price to see further upside.

Bitcoin Cash Poised for Breakout

Sustained buy-side pressure could push BCH’s price above the psychological $600 mark. If the altcoin establishes strong support near this price level, it could extend its rally toward $602.20.

BCH Price Analysis. Source:

BCH Price Analysis. Source:

However, if profit-taking resumes, BCH eyes a decline to $556.40.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

On the night of the Federal Reserve rate cut, the real game is Trump’s “monetary power grab”

The article discusses the upcoming Federal Reserve interest rate cut decision and its impact on the market, with a focus on the Fed’s potential relaunch of liquidity injection programs. It also analyzes the Trump administration’s restructuring of the Federal Reserve’s powers and how these changes affect the crypto market, ETF capital flows, and institutional investor behavior. Summary generated by Mars AI. This summary was produced by the Mars AI model, and the accuracy and completeness of the generated content are still being iteratively updated.

When the Federal Reserve is politically hijacked, is the next bitcoin bull market coming?

The Federal Reserve announced a 25 basis point rate cut and the purchase of $40 billion in Treasury securities, resulting in an unusual market reaction as long-term Treasury yields rose. Investors are concerned about the loss of the Federal Reserve's independence, believing the rate cut is a result of political intervention. This situation has triggered doubts about the credit foundation of the US dollar, and crypto assets such as bitcoin and ethereum are being viewed as tools to hedge against sovereign credit risk. Summary generated by Mars AI. The accuracy and completeness of this summary are still in the process of iterative updates.

x402 V2 Released: As AI Agents Begin to Have "Credit Cards", Which Projects Will Be Revalued?

Still waters run deep, subtly reviving the narrative thread of 402.

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

You’d better honestly ask yourself: which side are you on? Do you like cryptocurrency?