Bitget Daily Digest(8.13)|US Treasury Secretary Besant Recommends 50 Basis Point Rate Cut in September; ETH Breaks Through $4,600, Foundation-Linked Address Sells ETH at Average Price of $4,602.1

远山洞见2025/08/13 02:42

By:远山洞见

Today’s outlook

1、US EIA crude oil inventory (10,000 barrels) for the week ending Aug 8 will be released today, previous: -3.029 million barrels;

2、Pixel Heroes Adventure to launch on CROSS on August 13, supporting CROSS wallet login for PHA DApp;

3、Block may release a new Bitcoin mining chip today;

Macro & Hot Topics

1、US Treasury Secretary Besant: The Fed should consider a 50 basis point rate cut in September. The US Treasury Secretary commented that the Fed should consider a 50bps rate cut and expressed hope to confirm the Fed board seat at the Senate before the September meeting. They are recruiting for the vacant Fed positions with Trump’s open attitude. “We hope to find someone who can restructure the Fed. If data permits, the Fed could have cut rates in June. There are fundamental issues within the Fed.”

2、pump.fun sold SOL for the first time after launching their token: 86,000 SOL for $16.28 million USDC. Transaction details show SOL transferred from a fee and buyback wallet to Kraken, then sold on-chain at an average price of $189, USDC returned to Kraken. pump also published a summary after selling: in the past week, $8.42 million worth of PUMP was bought back, with total buyback at 7.29 billion PUMP (0.729% of total supply).

3、Kazakhstan’s Fonte Capital launches Central Asia’s first spot Bitcoin ETF. Fonte Capital announced BETF, the region’s first spot BTC ETF, listed at the Astana International Exchange (AIX). Custodied by BitGo, BETF supports physical BTC holdings, up to $250 million insurance, USD-denominated, allows physical settlement, and aims to reduce tracking error and fees. The product is regulated by the Astana International Financial Center (AIFC) and open to both Central Asian and international investors. Investors don’t need to manage private keys or use crypto exchanges to participate.

4、Do Kwon intends to plead guilty to conspiracy and wire fraud charges. At a US court hearing, the judge indicated Do Kwon will plead to two charges related to the $40B+ crypto collapse. Kwon was previously accused of misleading investors about TerraUSD’s peg and covertly instructing an HFT firm to support the price, pushing UST and Luna to $50B market cap in spring 2022. Kwon previously settled with the SEC, agreeing to an $80M fine and a ban from crypto trading. He has been detained since extradition from Montenegro in 2024.

Market Overview

1、

$$BTC and $$ETH both surged, while other markets were mixed; $482M in liquidations in the past 24H, mostly short positions;

2、US inflation data reinforced rate cut expectations, Nasdaq and S&P 500 hit new highs;

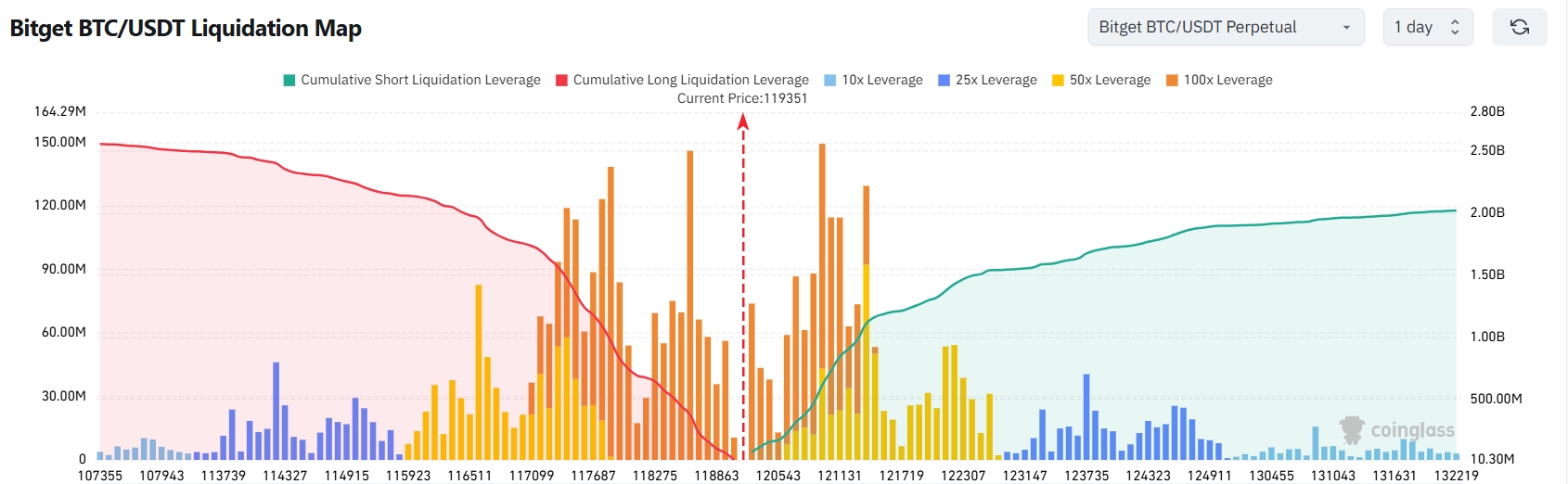

3、On Bitget BTC/USDT liquidation map, with BTC at 119,351 USDT, a drop of 2,000 points to ~117,351 would trigger >$1.47B long liquidations; a rise to ~121,351 would liquidate >$1.16B in shorts. Long liquidation totals far outpace shorts. Advice: Manage leverage carefully to avoid mass liquidations during volatility.

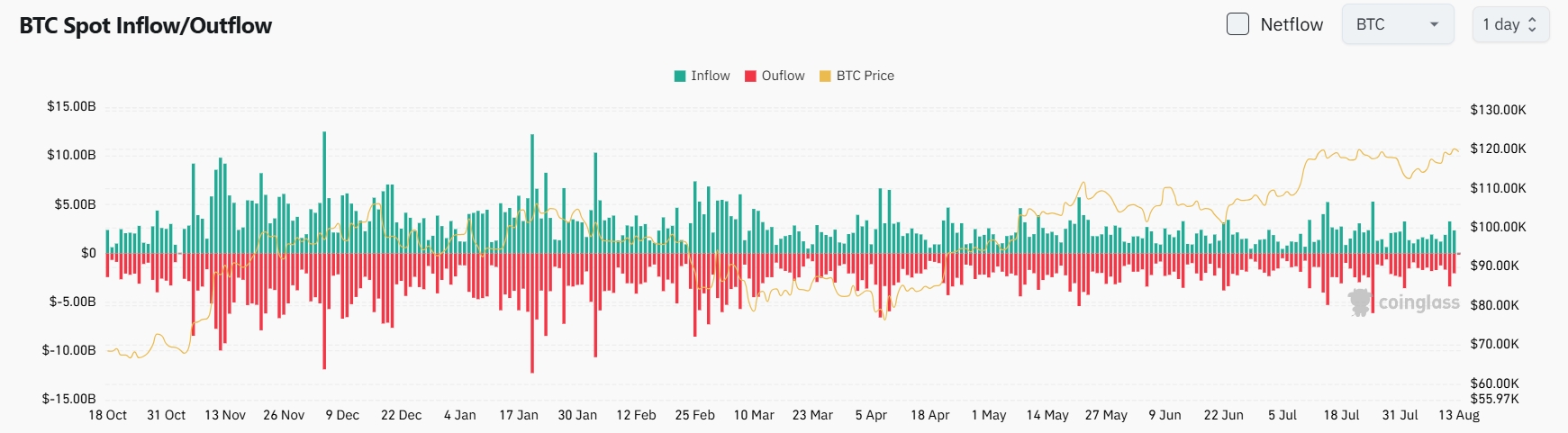

4、In the past 24H, BTC spot inflows were $1.93B, outflows $1.6B, net inflow $330M.

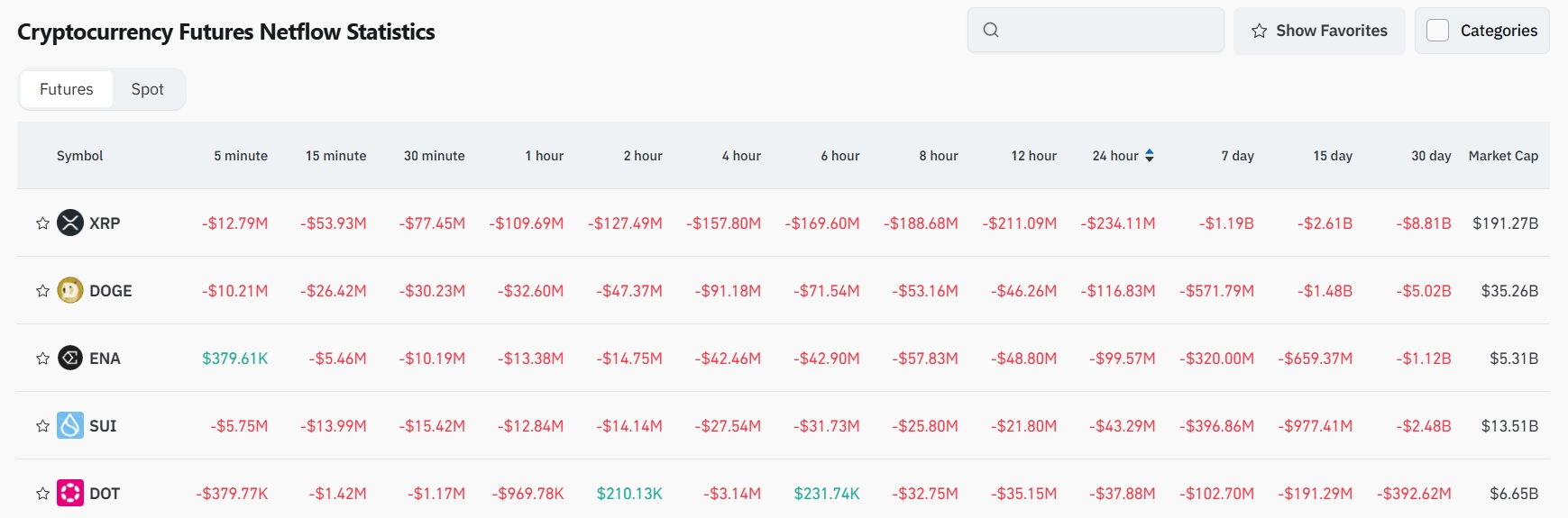

5、In past 24H, $XRP, $DOGE, $ENA, $SUI, $DOT contract trading had leading net outflows, possibly signaling opportunities.

Institutional Views

Matrixport: Bitcoin price may rise slowly, not parabolically

Original link

News Flash

1、SEC Commissioner: The market will decide the final form of asset tokenization

2、Politico: Trump officials consider Fed Vice Chair Jefferson for Fed Chair

3、Do Kwon to plead guilty in $40B crypto collapse case

4、Trump: Tariffs did not cause inflation

5、Vietnam announces a pilot crypto trading platform at its international financial center

Project Developments

1、Ethereum Foundation-linked address sells another 1,100 ETH at average $4,602.1

2、Kazakhstan launches Central Asia’s first spot BTC ETF

3、Grayscale registers Cardano and Hedera Trust ETFs in Delaware

4、Sanctum community proposes early unlock option for CLOUD investors

5、Qubic responds to Monero's 51% attack: Monero experiment proceeding as planned, details to be revealed when appropriate

6、Circle to launch stablecoin-focused L1 blockchain ARC

7、WLFI token valuation set at $0.2 in the ALT5 Sigma Corporation acquisition

8、Monad hints at mainnet launch later this year

9、CoinGecko co-founder: Moonbirds' next target price is 10 ETH

10、Uniswap Foundation proposes adopting DUNA DAO framework, paving the way for turning on protocol fee switch

X Highlights

1、Haotian: ETH steadily absorbs capital, SOL poised for action, institutional preference marks the divide with on-chain activity

Compared to ETH’s steady rise ($4,300), SOL’s ($175) story is more about institutional pathways and liquidity. With an ETF approved, ETH has attracted over $10B in compliant funds, $137B in stablecoins (dominated by USDC, USDT, DAI), serving as Wall Street’s mainline. SOL, despite US VC backing, lacks an ETF and has $11B in stablecoins—even with PYUSD, accumulation takes time. Institutions favor ETH’s layered L2 model (risk isolation, liquidity depth, security history), while SOL’s integrated high-performance architecture appears riskier to them; lingering FTX effects and only 4 years of ecosystem history also make institutions cautious. However, SOL’s on-chain activity, innovations like PumpFun, rapid stablecoin growth, and resilience mean its catch-up and breakout potential could be big during the next retail FOMO cycle.

Original link

2、rick awsb: Subprime + Luna’s hybrid bomb? The leverage truth behind the BMNR model

In just over a month, Bitmine (BMNR) soared from a fringe company to an ETH giant with $4.9B, led by Tom Lee. Rather than using its own funds, it started with $250M in private placement + $20.7M public offering, then used an "ATM" share issuance tool to raise limits from $2B to $4.5B, steadily selling stock while the price surged 3,000% to get cash for ETH purchases. Similar to MicroStrategy, but the devil's in the details—early holdings exceeded funding, with July 17 filings revealing about 60,000 ETH acquired via in-the-money options, essentially using derivatives leverage to ramp up, then de-leveraging and locking in profits with later ATM funds. It’s a bold move, but sets a precedent for aggressive leverage in listed Digital Asset Treasury (DAT) companies. With competition for lower NAV multiples, mass adoption of the model could be a “subprime + Luna” scenario—fragile funding chains and risk magnifiers. Retail should enjoy the pump but watch leverage ratios—beware systemic collapse from a massive blowup!

Original link

3、jain.sats: “Whale Mapping Tutorial Compilation”—from method to tools, a full workflow

The core of whale tracking is reconstructing decentralized addresses into a controller's "cluster" via fund flows/behavior, then combining entry times, charts, and position ratios to spot whales or insider addresses. Traditional methods involve tech scripts or manual tracking on Solscan/Arkham—high thresholds and inefficiency. But with user-friendly cluster analysis tools like kryptogo, you can directly see cluster numbers, included addresses, and holdings, capturing fund transfers, coin bundle moves, and centralized withdrawals, drastically lowering tracking costs.

Original link

4、AB Kuai.Dong: BMNR’s infinite ammo: from US stock liquidity machine to ETH accumulation logic

BitMine’s ability to keep loading up on ETH comes from the extraordinary liquidity and trading volume of its own stock (BMNR). As per recent disclosures, BMNR ranks 25th by US stock liquidity, with $9.2B traded just yesterday. At this scale, ATM (At-the-Market) share sales can pull in huge cash with minimal price impact, letting them buy more ETH endlessly. Similar examples: MicroStrategy (MSTR, 15th in liquidity) and Coinbase (COIN, 14th), who also raise funds in equity markets to buy coins, expand, and make acquisitions.

Original link

11

0

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

PoolX: Earn new token airdrops

Lock your assets and earn 10%+ APR

Lock now!

You may also like

Gain Insight into Cryptocurrency’s Promising Future for 2026

In Brief The next major crypto bull cycle will start in early 2026. Institutional investors and regulation drive long-term market confidence. Short-term shifts show investors favoring stablecoins amid volatility.

Cointurk•2025/12/14 02:57

Stunning $204 Million USDT Transfer Ignites Market Speculation

BitcoinWorld•2025/12/14 02:54

Trending news

MoreCrypto prices

MoreBitcoin

BTC

$90,216.04

-0.10%

Ethereum

ETH

$3,112.86

+0.79%

Tether USDt

USDT

$1

-0.00%

BNB

BNB

$894.15

+0.96%

XRP

XRP

$2.02

-0.68%

USDC

USDC

$1

+0.01%

Solana

SOL

$132.6

-0.02%

TRON

TRX

$0.2741

-0.04%

Dogecoin

DOGE

$0.1380

+0.54%

Cardano

ADA

$0.4078

-0.58%

How to buy BTC

Bitget lists BTC – Buy or sell BTC quickly on Bitget!

Trade now

Become a trader now?A welcome pack worth 6200 USDT for new users!

Sign up now