- Ethereum is approaching a key breakout from a 4-year range.

- Previous breakout led to a 20x surge within a year.

- Analysts speculate a move to $10,000 could be on the horizon.

After years of sideways trading, Ethereum ($ ETH ) is showing strong signs of breaking out of its 4-year consolidation range. Many crypto analysts are drawing comparisons to the last time this happened—when ETH surged nearly 20x in just 12 months. With momentum building, some are even calling for a $10,000 ETH target in the near future.

Why This Breakout Matters

In technical analysis, long periods of consolidation often lead to explosive price movements once the asset breaks out of its range. Ethereum has spent the last four years fluctuating mostly between $1,000 and $4,000. But recent price action suggests that ETH may finally be preparing to break through this resistance.

If history repeats itself, the implications could be massive. The last major breakout from a range led ETH from around $300 to over $4,000—a 20x increase. While no two cycles are exactly alike, many believe that Ethereum’s fundamentals and increasing adoption provide the fuel for another major rally.

What Could Push ETH to $10K?

Several factors could drive Ethereum higher:

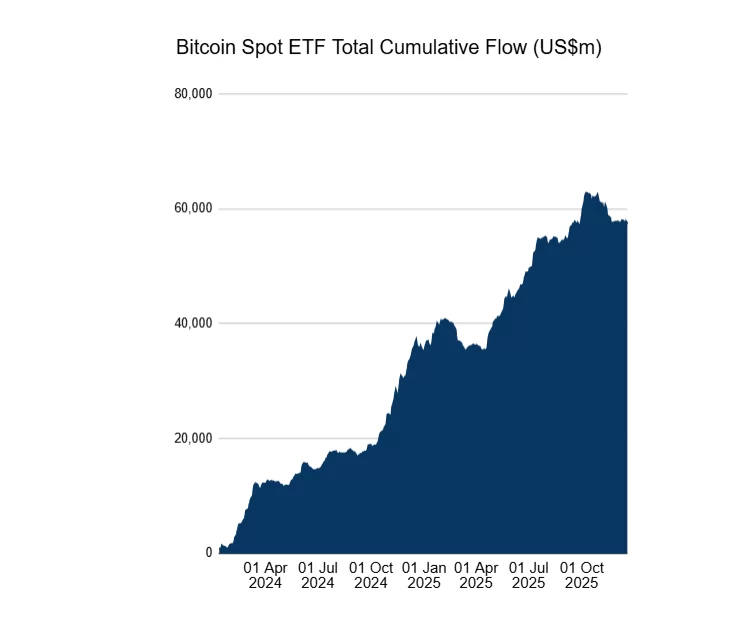

- Institutional interest: With more funds allocating capital to crypto, ETH remains a top pick after Bitcoin .

- Ethereum 2.0: The network’s upgrade to proof-of-stake has improved scalability and energy efficiency.

- DeFi and NFTs: Many decentralized applications and NFT platforms continue to run on Ethereum, increasing its demand.

Though the market is still volatile, the current setup looks promising. If Ethereum can maintain its upward momentum and break out with volume, $10,000 ETH may no longer be just a dream—it could become a reality.

Read also:

- Machi Big Brother Bags $33.8M, Now Shorts ETH & HYPE

- Chainlink Price Prediction: $29 and $46 Targets

- BlockDAG at $5 Could Turn Pennies Into a Fortune, Here’s the Roadmap!