Ethereum Price Today Surpasses $4,5, and Futures Interest Hits Record High

- ETH Surpasses $4,5 Driven by Risk Appetite

- Open interest in futures grows, but without high leverage

- Layer 1 competition puts pressure on Ethereum's on-chain activity

Ether (ETH) saw a strong rise on Tuesday (12), reaching US$4.600 after US consumer inflation data indicated an increase of just 0,1%. This movement reflected a greater appetite for risk in the market, although derivatives indicators suggest that the strength of this rise may be more limited than it appears.

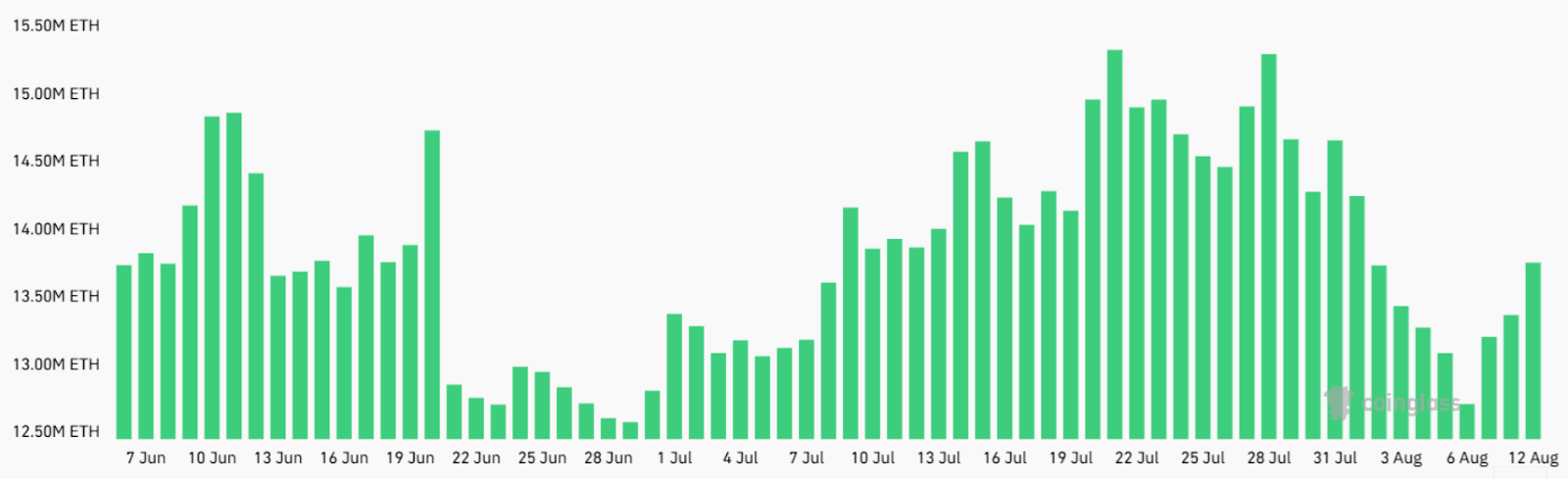

Total open interest in ETH futures contracts rose to $60,8 billion, up from $47 billion the previous week. However, this growth is primarily attributed to price appreciation, as volume in Ether terms is still 11% below the peak of 15,5 million ETH recorded on July 27.

In derivatives, the annualized premium for ETH perpetual contracts is 11%, considered a neutral level. Readings above 13% would indicate high demand for leveraged long positions, something that was only seen last Saturday. Even with a 32% price jump in the last 10 days, the demand for leverage has not returned to the levels seen in previous cycles.

Analyzing monthly futures contracts, which typically trade at an annualized premium of 5% to 10%, the market is also showing caution. After reaching 11% on Monday, the indicator fell back to 8% on Tuesday. This suggests that, despite the significant increase, investors are still closely evaluating Ethereum's fundamentals and on-chain activity.

On-chain data is less optimistic. Total value locked (TVL) on Ethereum fell 7% over the past 30 days, from 25,4 million to 23,3 million ETH. Weekly base layer fees fell to $7,5 million, lower than Solana ($9,6 million) and Tron ($14,3 million).

This combination of increasing competition in layer 1, falling TVL, and low demand for leveraged positions raises questions about the sustainability of ETH's current appreciation, even with the 51% rise in the last month.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Why Molson Coors (TAP) Stock Is Dropping Today

Why Shares of Sirius XM (SIRI) Are Falling Today

Why Shares of PNC Financial Services Group (PNC) Are Rising Today

Why Trimble (TRMB) Stock Is Dropping Sharply Today