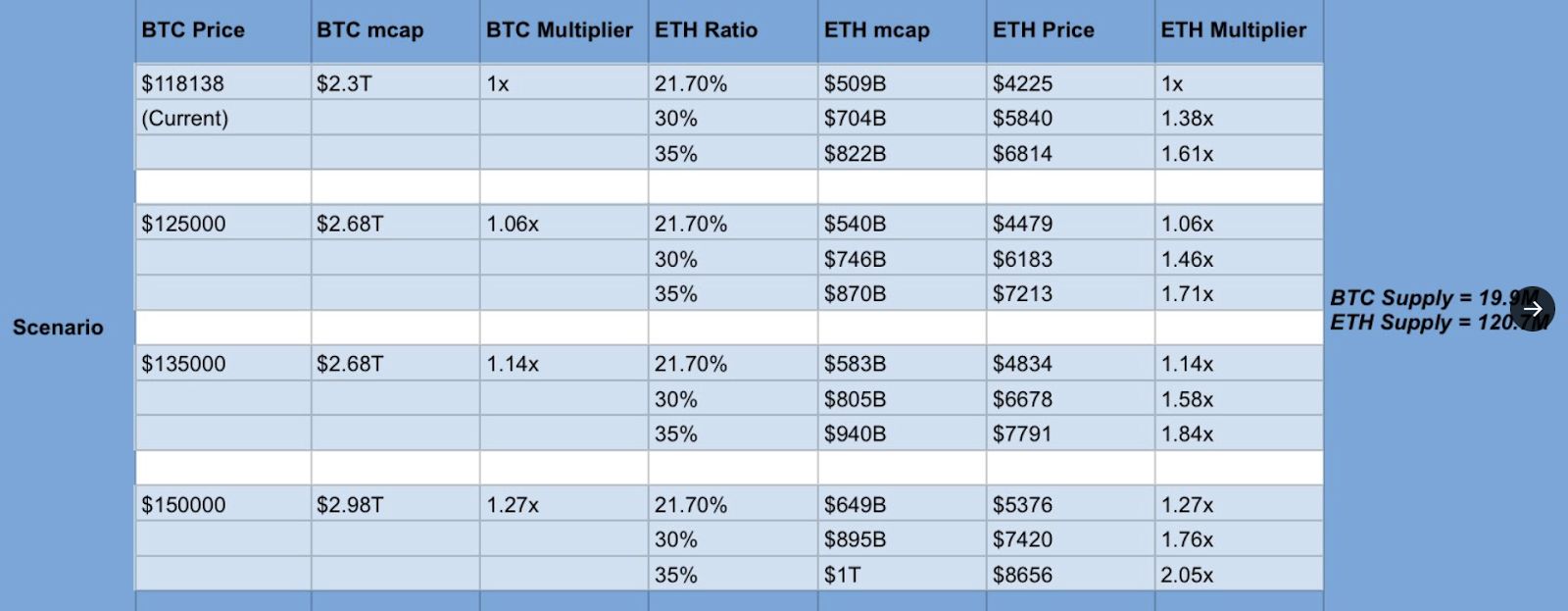

Ether (ETH) could potentially reach $8,656 if Bitcoin (BTC) hits $150,000, based on historical market trends where ETH typically captures 30-35% of BTC’s market cap during bull runs.

-

Bitcoin’s price target of $150,000 could lead to significant gains for Ether.

-

ETH has historically reached 30-35% of BTC’s market cap during major bull runs.

-

Institutional interest and ETF demand are driving Ether’s price upward.

Ether’s potential price surge is linked to Bitcoin’s anticipated rise, making it a focal point for investors. Discover more about this trend!

What is the potential price of Ether if Bitcoin reaches $150,000?

If Bitcoin (BTC) reaches $150,000, Ether (ETH) could climb to approximately $8,656, based on historical patterns where ETH captures 30-35% of BTC’s market cap. This analysis highlights the strong correlation between the two cryptocurrencies during bull markets.

How does institutional demand affect Ether’s price?

Institutional demand has significantly influenced Ether’s price trajectory. Recent reports indicate that blockchain firms are raising substantial funds for ETH purchases, and spot Ether ETFs have recorded unprecedented inflows. This growing interest suggests a bullish outlook for Ether.

Frequently Asked Questions

What factors could drive Ether’s price to new highs?

Ether’s price could surge due to increased institutional investment, ETF demand, and a favorable market environment, potentially leading to new all-time highs.

How does the current market compare to previous bull runs?

The current market setup resembles previous bull runs, with Ether’s total value locked (TVL) exceeding $90 billion, indicating strong investor confidence.

Key Takeaways

- Price Correlation: Ether often reaches 30-35% of Bitcoin’s market cap during bull markets.

- Institutional Interest: Growing demand from institutions and ETFs is boosting Ether’s market potential.

- Market Trends: Historical patterns suggest a bullish outlook for Ether as Bitcoin approaches $150,000.

Conclusion

In summary, Ether’s price could reach $8,656 if Bitcoin hits $150,000, driven by historical trends and increasing institutional interest. As the market evolves, investors should keep a close eye on these developments for potential opportunities.

Based on historical patterns, Ether may reach as high as $8,656 if Bitcoin taps $150,000. Source: Yashasedu

Based on historical patterns, Ether may reach as high as $8,656 if Bitcoin taps $150,000. Source: Yashasedu