Ethereum Foundation Offloads Millions in ETH as Prices Hit Multi-Year Highs

The Ethereum Foundation has intensified its ETH liquidations, unloading a fresh batch of tokens just as the cryptocurrency surges to levels last seen in 2021.

The Ethereum Foundation has intensified its ETH liquidations, unloading a fresh batch of tokens just as the cryptocurrency surges to levels last seen in 2021.

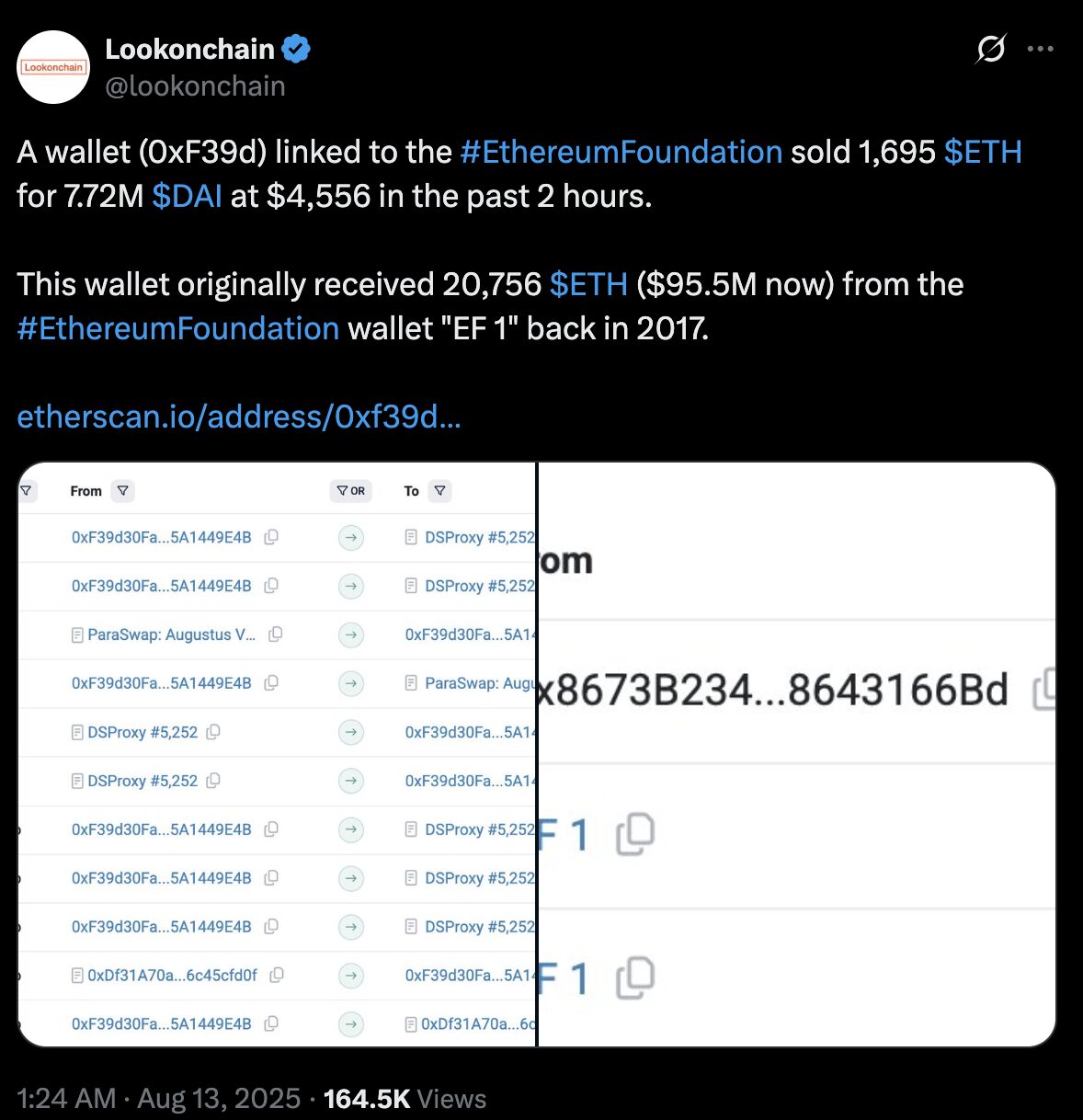

Blockchain tracking platform Lookonchain reported that in the past 24 hours, the non-profit initiated a series of sizable transactions, starting with the sale of 1,695 ETH for $7.7 million worth of DAI stablecoin. Shortly afterward, another 1,100 ETH was converted to $5.06 million in DAI. In total, the Foundation has now sold roughly $12.8 million in ETH in this latest round of disposals.

Source:

Lookonchain

Source:

Lookonchain

On-chain data shows that the ETH originated from a wallet first funded in 2017 by another address labeled “EF 1,” also linked to the Foundation. The timing of these sales coincides with Ethereum’s sharp rally, with the asset climbing 8.3% over the past day to trade just under $4,635. The second-largest cryptocurrency by market value briefly reached $4,683 — a price point not seen since November 2021.

Market analysts attribute ETH’s resurgence to mounting institutional interest. Ethereum exchange-traded funds have recorded a record-breaking $1.02 billion in single-day inflows, extending a five-day streak of strong capital movement. Corporate treasuries are also increasing exposure, with more than $14 billion reportedly allocated to ETH in recent months. This momentum has strengthened expectations for a retest — and possible breakout — of the $4,800 all-time high.

The Foundation’s latest liquidations follow a pattern of periodic sales that have occasionally stirred community debate, especially when executed during strong market rallies. The most recent comparable transaction in January drew criticism over its potential to weigh on prices.

However, Foundation leadership has consistently defended the strategy, describing the sales as pre-planned conversions to cover operational needs, grants, and salaries, rather than opportunistic profit-taking. Aya Miyaguchi, the Foundation’s executive director, has reiterated that stablecoins are often required to meet these obligations.

For now, Ethereum’s rally appears unshaken by the sales. But if the selling pressure continues, market watchers warn it could reignite concerns over the timing and scale of the Foundation’s moves.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

DeepMind CEO says China’s AI is just months behind U.S. and closing the gap fast

Bitcoin Rally: Why the Surge to $100K May Signal a Cautious Rebound, Not a Bullish Reversal

Bitcoin ETFs Achieve Remarkable $104.1M Net Inflows for Fourth Straight Day

Citigroup: TSMC's Advanced Process Chip Supply May Remain Tight