Key Market Intelligence on August 13th, how much did you miss out on?

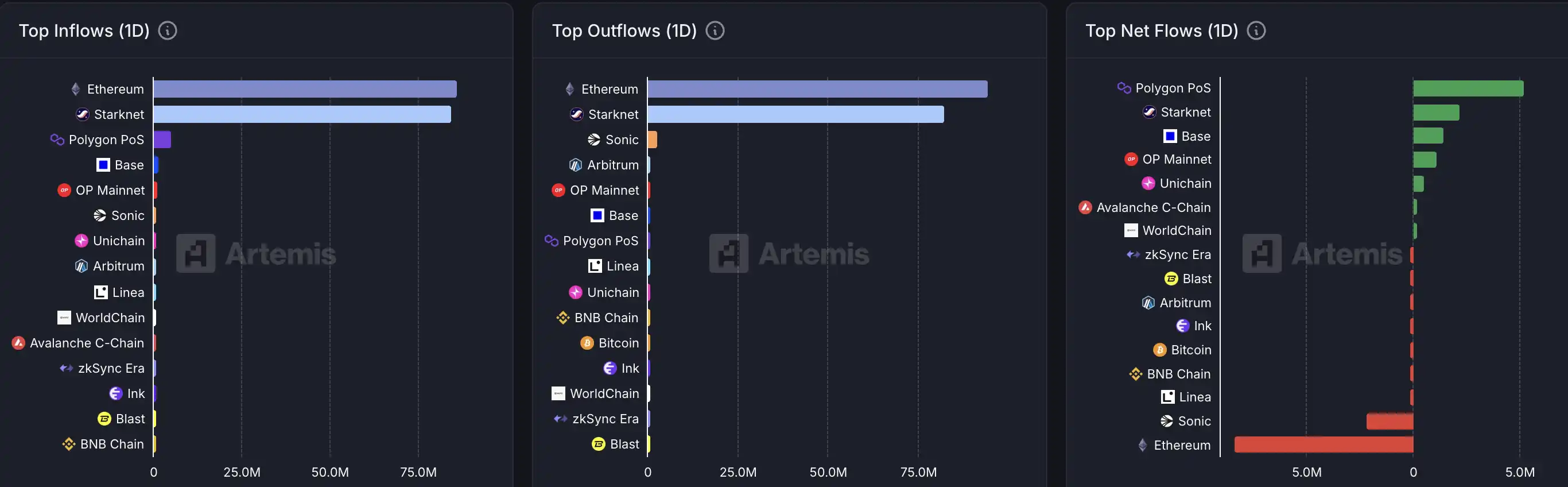

1. On-chain Funds: $5.3M Flows into Polygon PoS; $94.5M Flows out of Ethereum 2. Largest Price Swings: $IMAGE, $GP 3. Top News: CEX Platform Tokens See Broad Rally, BGB Surges Over 15%, GT Surges Over 30%

Top News

1. CM International Launches First On-Chain Public Offering Fund on Solana

2. CEX Platform Tokens See Collective Price Surge, BGB Up Over 15%, GT Up Over 30%

3. a16z Proposes to US SEC to Provide Regulatory Safe Harbor for DeFi Project Websites and Apps

4. Pump.fun Officially Completes Buyback of 175.3 Million PUMP Tokens from the Market in the Past 24 Hours

5. Ethereum Withdrawal Accelerates, with CEX Net Outflow Reaching 182.4K ETH in the Past 24 Hours

Trending Topics

Source: Overheard on CT, Kaito

[XMR]

Today's discussions about XMR mainly focus on reports of the Qubic mining pool launching a 51% attack on the Monero network. It is claimed that this mining pool has gained control of the majority of Monero's hashrate, leading to concerns about potential chain reorganization, double-spending attacks, and transaction censorship. There is a community split regarding the sustainability and economic feasibility of this attack, with some claiming a daily cost as high as $75 million, while others believe it could be as low as $7,000–$10,000 per day. Despite the attack, some believe Monero will emerge stronger, while others emphasize the network's vulnerabilities.

[SUI]

SUI has garnered significant attention due to Grayscale's launch of an investment trust for the Sui protocol's DeepBook and Walrus, which is expected to drive demand for tokens associated with SUI. The Sui ecosystem is rapidly expanding through new products and partnerships, including integration with Dfns to provide secure wallet infrastructure and the launch of the native crypto payment product Sui Pay. Furthermore, SUI has seen rapid user growth, with 2 million new accounts added in just one day. With its scalability and efficiency, Sui is viewed as a potential leader in the blockchain space.

[SURF]

SURF received significant attention today, mainly due to its association with the AI Agent—Surf Copilot, a tool recognized for its utility in crypto research and market analysis. The tweets emphasized Surf Copilot's capability in providing deep insights and strategies, making it a valuable tool for investors and researchers. Furthermore, the $CYBER token associated with Surf Copilot recently experienced a price surge, further driving market discussions as users showed interest in its future growth potential.

[WAL]

Today, the primary discussions surrounding WAL focused on Grayscale's announcement of the Walrus Trust, a trust built on the Sui network aimed at providing scalable decentralized data management. This news increased market interest and recognition in the Walrus Protocol ecosystem, with the community speculating on its potential listing on Kaito and the impact of community reward mechanisms. The Walrus Trust, along with the DeepBook Trust, is seen as a significant move to bring institutional funds into the Sui data and liquidity layer, further enhancing the credibility and adoption of the Sui ecosystem.

[PEPE]

Today, discussions about PEPE focused on its significant market volatility and community activity. Of note, PEPE has seen a substantial price increase recently, with some users claiming gains of up to 76x. The community actively discussed its potential for further growth, especially compared to other meme coins like DOGE and TROLL. Additionally, there were speculations about creator Matt Furie's involvement and a broader discussion on the significance of meme coins in the crypto market. The discussions also highlighted the role of platforms like BagsApp in monetizing meme content and PEPE's strategic position in the meme coin ecosystem.

Featured Articles

1.《Old Trees Rejuvenated: The Summer Counterattack of DeFi Veteran Projects》

The DeFi market is witnessing a long-awaited wave of "veteran revival." As of now, the total value locked (TVL) in the DeFi market has risen to $197 billion, just a step away from the all-time high of $206 billion. The key point is that the leaders of this rebound are not newly emerged projects but a group of "veterans" that once shone brightly during DeFi Summer. From the earliest speculative demand to the current "old trees rejuvenated." Behind the collective growth of the DeFi market is institutional funds accelerating their entry (RWA, compliant lending, 401k crypto investments), the resurgence of retail investors' demand for on-chain yields in a bull market, and new usage scenarios brought about by technological iteration. The veterans' return is a reflection of market confidence and the prelude to a new round of DeFi competition. In this article, BlockBeats has compiled the main reasons for the recent price surges and TVL increases of DeFi "veteran players" such as Aave, Uniswap, Euler, Pendle, Fluid, and Spark.

2.《How Will Circle Make Money Next? CEO Responds on Profit Model, Bank Competition, and Arc Chain Strategy》

On the first earnings call after going public, Circle presented a complex answer sheet of "book loss, operational growth": The total revenue and reserve earnings for the second quarter were $658 million, a 53% year-on-year increase, with adjusted EBITDA of $126 million, a 52% year-on-year increase. Meanwhile, USDC continued to expand on the circulation side, with an end-of-period circulation volume of $61.3 billion and a stablecoin market share of 28%. However, the company recorded a net loss of $482 million due to two non-cash factors, including a substantial stock-based compensation triggered by the IPO and fair value changes of convertible bonds totaling $591 million. Beyond the earnings report day, the industry's competitive landscape was quickly rewritten this summer. The "GENIUS Act" was formally enacted, putting the boundary between "bank-issued stablecoins" and "licensed non-bank issuers" on the table. In a recent interview, Circle's Chief Strategy Officer Dante Disparte stated: True competition has just begun, and it is still unknown whether banks will rashly issue currencies. Circle's partnership map is also expanding.

On-chain Data

On-chain Fund Flow for the Week of August 13

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Popeyes operator managing more than 130 restaurants files for bankruptcy protection

Musk and Ryanair CEO clash over cost of Starlink Wi-Fi on planes

Dollar Weakens While Yen Strengthens Following Verbal Warnings

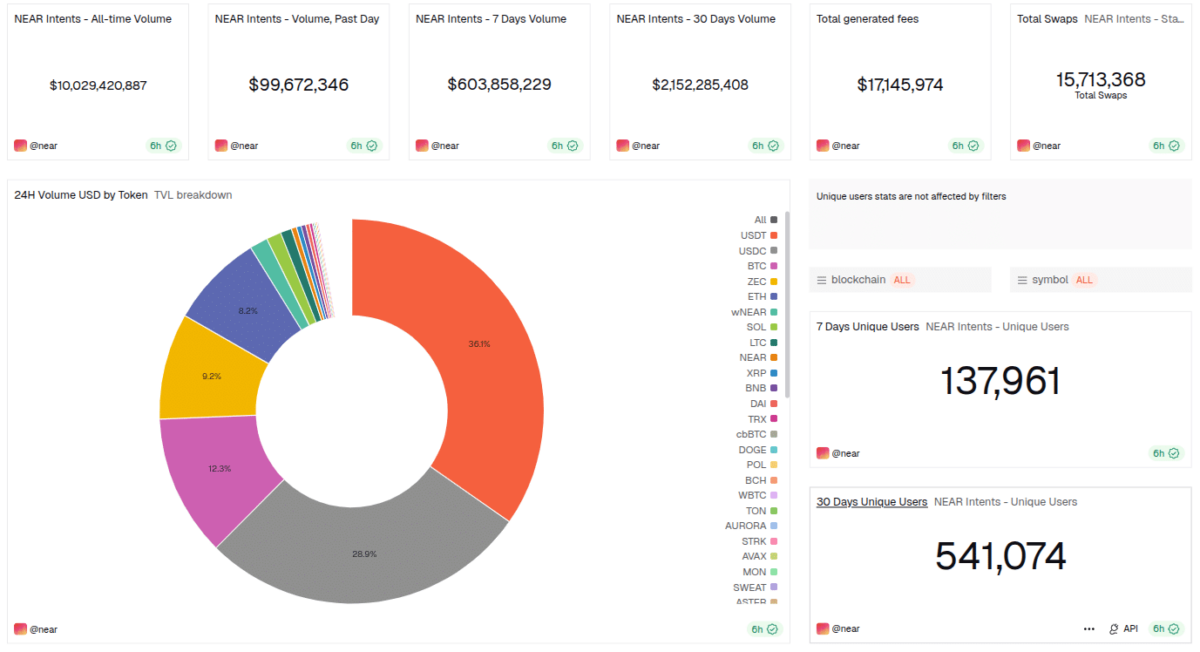

NEAR Intents Achieves $10B in Swap Volume as Industry Support, Adoption Grow