How Far Are We from a Full-Blown Altseason? | Trader's Insight

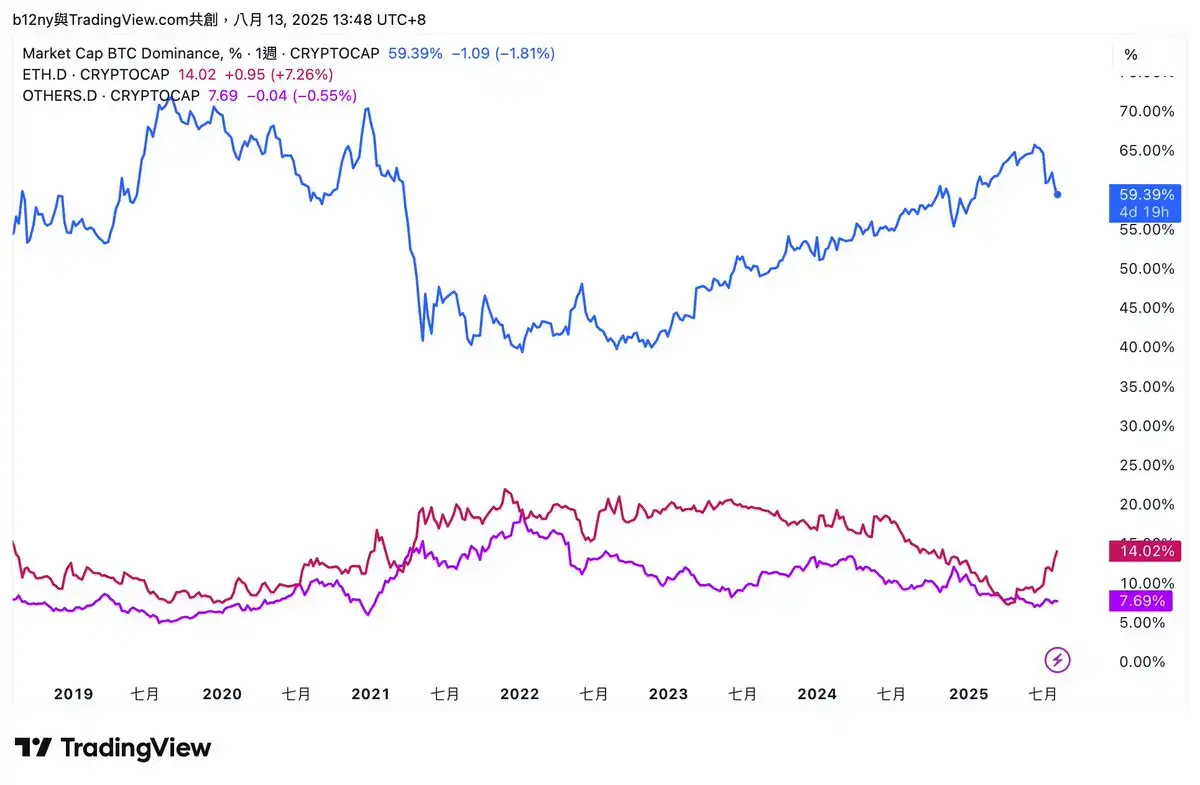

Bitcoin Dominance has decreased, while Ethereum Dominance is on the rise

On August 12, Ethereum broke through $4700, hitting a new high in four years. Last week, @CryptoHayes, who had taken profits early, also bought back Ethereum on August 9. Bitcoin also hit a new high, pushing the total cryptocurrency market value above $4.2 trillion, igniting market sentiment.

The traditional market was also booming. The S&P 500 and Nasdaq 100 both set new historical records, with global liquidity accelerating into risk assets. The U.S. Dollar Index (DXY) fell below 98, opening the floodgates for capital inflows into the stock market and the crypto market. This macro environment not only solidified the upward trend but also boosted investor confidence in high-risk assets.

At the same time, the market is almost certain that the Federal Reserve will cut interest rates at the September 17 meeting, with the probability nearing 100%, lowering the benchmark interest rate to the 4.00%-4.25% range. This expectation has provided additional fuel for liquidity-dependent markets, especially cryptocurrency. The wealth effect of altseason is now a hot topic in the market, with the key question being when it will fully kick in.

Next, BlockBeats has compiled traders' views on the upcoming market situation to provide some directional reference for your trades this week.

@b66ny

BTC.D has recently shown a clear downward trend, falling from its previous high to around 57.7%. Combined with the trend of ETH.D, I believe this is a typical capital rotation signal: market funds are beginning to withdraw from relatively stable assets and are turning to seek targets with higher risk and potential returns. Looking back at history, the continuous decline of BTC.D is often a necessary condition for the start of altseason.

ETH.D not only represents the strength of Ethereum itself but is also often seen as the leader of the entire altcoin market. Currently, ETH.D is showing strength, with a dominance rate rising to 14.0%. Along with the rapid rise in the price of ETH, ETH/BTC has risen over 4% in the past 24 hours, indicating a clear trend of funds flowing from Bitcoin to Ethereum.

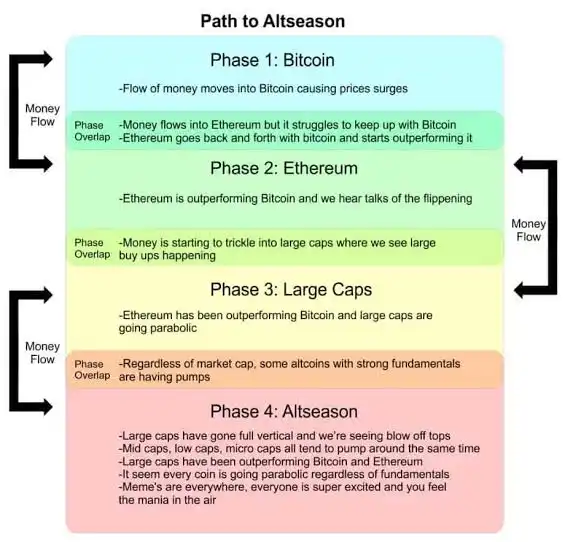

This trend follows the classic script of capital rotation: in the first stage, BTC stagnates or even falls, and funds begin to flow into ETH. The rise of ETH not only boosts market confidence but also creates conditions for more liquidity to flow into the altcoin market.

Next, what's worth paying attention to is OTHERS.D (the market cap share of small to mid-cap altcoins excluding top coins like BTC and ETH). Currently, OTHERS.D is still in a long bottom consolidation phase and has not seen explosive growth similar to ETH.D, indicating that the fund's interest is still concentrated on a few top assets like ETH. Although SOL also showed significant gains today and signs of fund rotation are becoming more apparent, it has not yet spread to the high-risk, low-cap speculative sector.

Looking at the three main indicators, the market is likely in the early stages of rotation:

Already Happened: BTC.D trending downwards, funds flowing out.

Currently Happening: ETH.D trending upwards, funds concentrating into ETH.

Yet to Happen: OTHERS.D trending upwards, funds spreading to small-cap altcoins.

@im_BrokeDoomer

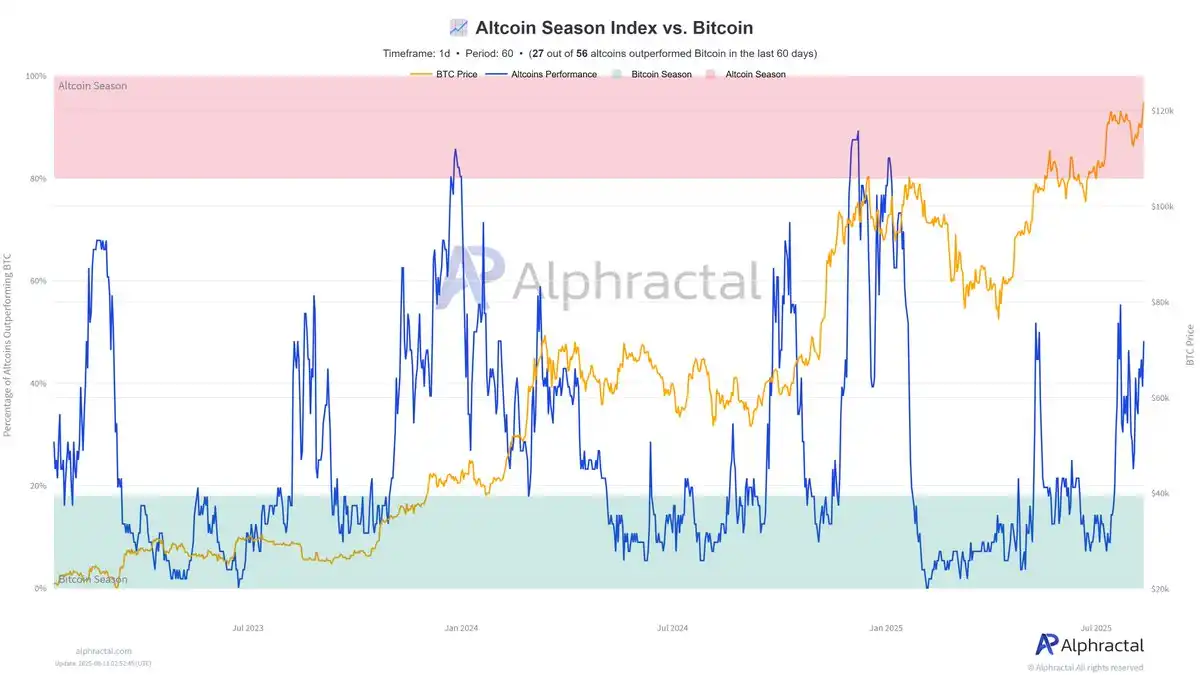

Looking at the comparison between altcoin and Bitcoin market caps from 2017 to the present, we are currently at a critical support level near the lower boundary of the channel. This level has historically been a sensitive area for fund inflow, often accompanied by a warming market sentiment and accelerated rotation. If this support is confirmed, the altcoin sector is expected to experience a collective breakout, marking the official start of a new alt season.

The typical initiation process of an alt season is as follows: Bitcoin (BTC) starts the rally → Ethereum (ETH) follows the rise → BTC rallies again → ETH breaks its all-time high (ATH) → Large-cap altcoins surge → BTC hits a new high → ETH and large-cap altcoins hit new highs together → Mid-cap altcoins take off → Small-cap altcoins see a comprehensive surge

Currently, we are in the third stage, with ETH and large-cap altcoins hitting new highs, and we can look forward to the subsequent breakout of other altcoins.

@ZssBecker

In the last bull run of 2020, most altcoins' narratives did not take off from the beginning but waited until the ETH price broke its all-time high and surged threefold before fully launching. At that time, funds flooded into new narratives like a tsunami—such as the gaming sector—driving related tokens to skyrocket by 10, 20, or even 50 times, with Sandbox even briefly soaring 80 times. Even the most hollow, most fringe gaming projects could achieve double-digit increases. This phenomenon truly occurred only later in the bull market, but once initiated, it became a period of concentrated wealth explosion.

I believe this scene will replay in this round of the market cycle. Currently, we are still in the first phase of the altcoin season—dominated by BTC and ETH. We have to wait for ETH to break above $5,000, for mainstream altcoins to complete a 2–3x increase, and only then will market funds crazily seek the next narrative. The most likely contenders to take the lead will be AI, RWA, and gaming, as these three areas have already been efficiently tapped into and profitable in the crypto industry, with strong narratives and high potential returns.

The initiation of the gaming narrative in the last cycle turned countless people's initial capital of a few thousand dollars into assets worth millions of dollars; and this time, with a larger market capitalization and higher risk appetite, once initiated, the force of capital driving will only be more intense. For investors, the key is not to anxiously chase now, but to wait patiently and position themselves early. The climax of the altcoin season will only truly arrive when the narrative switching signal appears.

@lanhubiji

Understanding market structure, one will understand that the altcoin season is bound to come, but its form may be completely different from the past two rounds. Previously, the number of altcoins was limited, and funds were relatively concentrated, with almost all top sectors experiencing a general rise; whereas now there are millions of coins on the market, and the competition is extremely dispersed, making it impossible for funds to cover all targets.

This means that what is more likely to occur in this market cycle is a "partial altcoin season"—funds will concentrate in a few sectors or individual tokens with strong narratives, communities, and liquidity to form localized frenzies, while most coins will still be overlooked by the market. For investors, opportunities still exist, but the probability of choosing the right targets is much lower than in the past, with the AI sector being more promising at the moment.

@joao_wedson

The real altcoin season has yet to begin. The typical flow path of smart money is: first from BTC to ETH, then into major cap coins, and finally spreading to mid- and small-cap tokens. The current market has just stepped into the first half; the true "altcoin frenzy" is still on the road, perhaps continuing all the way until November. In other words, the current price surge is just the "appetizer," and the real "main course" has not yet been served.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Bitcoin looks increasingly like it did in 2022: Can BTC price avoid $68K?

Bitcoin rejects at key $93.5K as Fed rate-cut bets meet 'strong' bear case

Bitcoin price action, investor sentiment point to bullish December

Ether outpaces Bitcoin’s trend change: Is ETH on track for a 20% rally?