Ripple Closes SEC Lawsuit, Sparks XRP Institutional Interest

- Ripple’s lawsuit closure boosts institutional interest in XRP.

- XRP trades higher on ETF speculation.

- Regulatory clarity may reshape crypto markets.

Ripple (XRP) remains on a bullish trajectory following the closure of its SEC lawsuit, driven by institutional accumulation and ETF speculation as of August 13, 2023.

The settlement’s impact could lead XRP to multi-year highs, yet market sentiment remains cautious as stakeholders await regulatory clarity and potential ETF approval.

Ripple’s Lawsuit Closure Impact

Ripple has officially closed its lawsuit with the SEC, creating a bullish shift in the market. Institutional interest has surged, driven largely by speculation regarding a potential XRP-based ETF in the coming months.

Key players include Ripple Labs, led by CEO Brad Garlinghouse, and SEC officials, with significant market reaction following the closure. Institutional players, including major exchange operators, anticipate regulatory changes favoring XRP.

Financial Implications and Market Activity

The crypto market saw an uptick in trading volumes following the lawsuit closure. Major financial implications are apparent, with Ripple’s chief legal officer thanking SEC Chair Atkins for regulatory advancements.

“Thank you for your leadership in moving America towards clear rules of the road for crypto, Chair Atkins.” – Stuart Alderoty, Chief Legal Officer, Ripple

Speculation regarding the potential approval of an XRP ETF suggests a broader industry impact. Institutional inflows surged, reflecting significant financial ramifications for Ripple and overall market sentiment.

XRP’s Unique Market Standing

Ripple’s market activity remains distinct, with high trading volumes and price increases. Analysts predict a bullish trajectory for XRP based on historical data, with expected targets between $5 and $8 if ETF inflows materialize.

Analyst insights highlight the potential for regulatory clarity to spur XRP investment. Historical trends, such as the 2017 breakout, offer a precedent for potential outcomes and underscore XRP’s unique market standing.

“We believe approval [of an XRP ETF] could come as early as this year, building on the newly published listing standards by NASDAQ, NYSE, and CBOE.” – Steven McClurg, CEO, Canary Capital

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

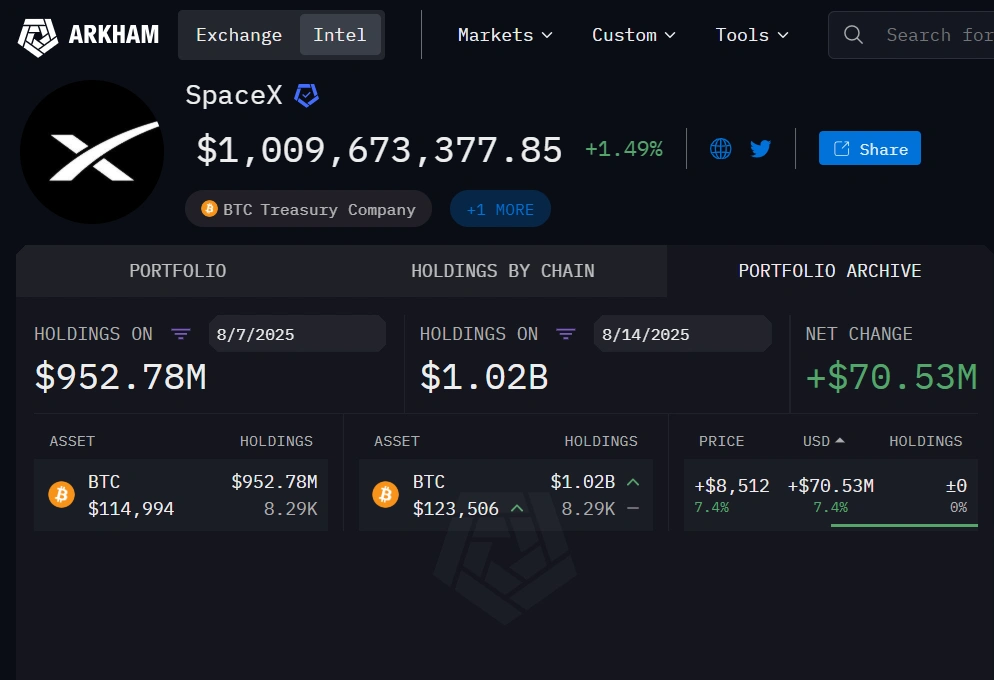

Norway hands Musk Tesla boost as SpaceX BTC holdings expand past $1B

Share link:In this post: Tesla’s sales in Norway have surged despite growing discontent among Norwegians regarding Elon Musk’s political stance. SpaceX’s BTC holdings have crossed the $1 billion mark again. Tesla’s deep ties in Norway influence its consistent sales numbers, but it is slowly losing its dominance as more rivals make headway.

Musk tips Google to dominate AI as it commits extra $9B to Oklahoma AI, cloud infrastructure

Share link:In this post: Elon Musk says Google currently has the highest probability of leading AI due to its compute and data advantage. Google will invest $9 billion in Oklahoma to expand AI and cloud infrastructure over the next two years. The plan includes a new Stillwater data center campus and expansion of its Pryor facility.

Nvidia partner Foxconn reports strong surge in AI server sales

Share link:In this post: Hon Hai Precision Industry (Foxconn) reported a 27% increase in Q2 profits, driven by sales in its AI server business. The company reported a net income of NT$44.36 billion for the period, surpassing an average analyst projection of NT$36.14 billion. It also expects significant growth in Q3 and the rest of the year.

US PPI beats estimates with 3.3% annual gain in July

Share link:In this post: US PPI jumped 3.3% in July, the highest annual gain since February. Monthly PPI rose 0.9%, blowing past the 0.2% forecast. Service costs surged, led by machinery wholesaling and portfolio fees.