Will Avalanche’s First Token Unlock In 3 Months Trigger Price Drop to $20?

Avalanche faces potential price drop due to a $42 million token unlock; price may dip to $20 if supply overwhelms demand.

Avalanche (AVAX) has seen a notable surge in price recently, benefiting from broader market bullish cues. However, the altcoin now faces a potential bearish event that could impact its price dynamics in the coming days.

The upcoming token unlock could increase the circulating supply, potentially causing price fluctuations.

Avalanche Awaits Token Unlock

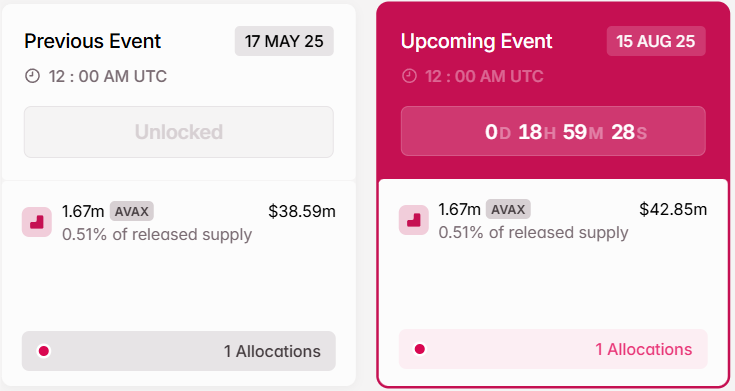

In the next 24 hours, Avalanche will experience its first token unlock in nearly three months, releasing 1.67 million AVAX tokens into the market. This unlock is considered a bearish event because the sudden increase in supply could outpace demand, putting downward pressure on the price.

This $42.85 million unlock could affect the price of AVAX by overwhelming the market with additional supply. As a result, the altcoin could face difficulty maintaining its recent upward momentum. The timing of this event, following a period of price gains, suggests that AVAX may experience heightened volatility.

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter.

Avalanche Token Unlock. Source:

Avalanche

Avalanche Token Unlock. Source:

Avalanche

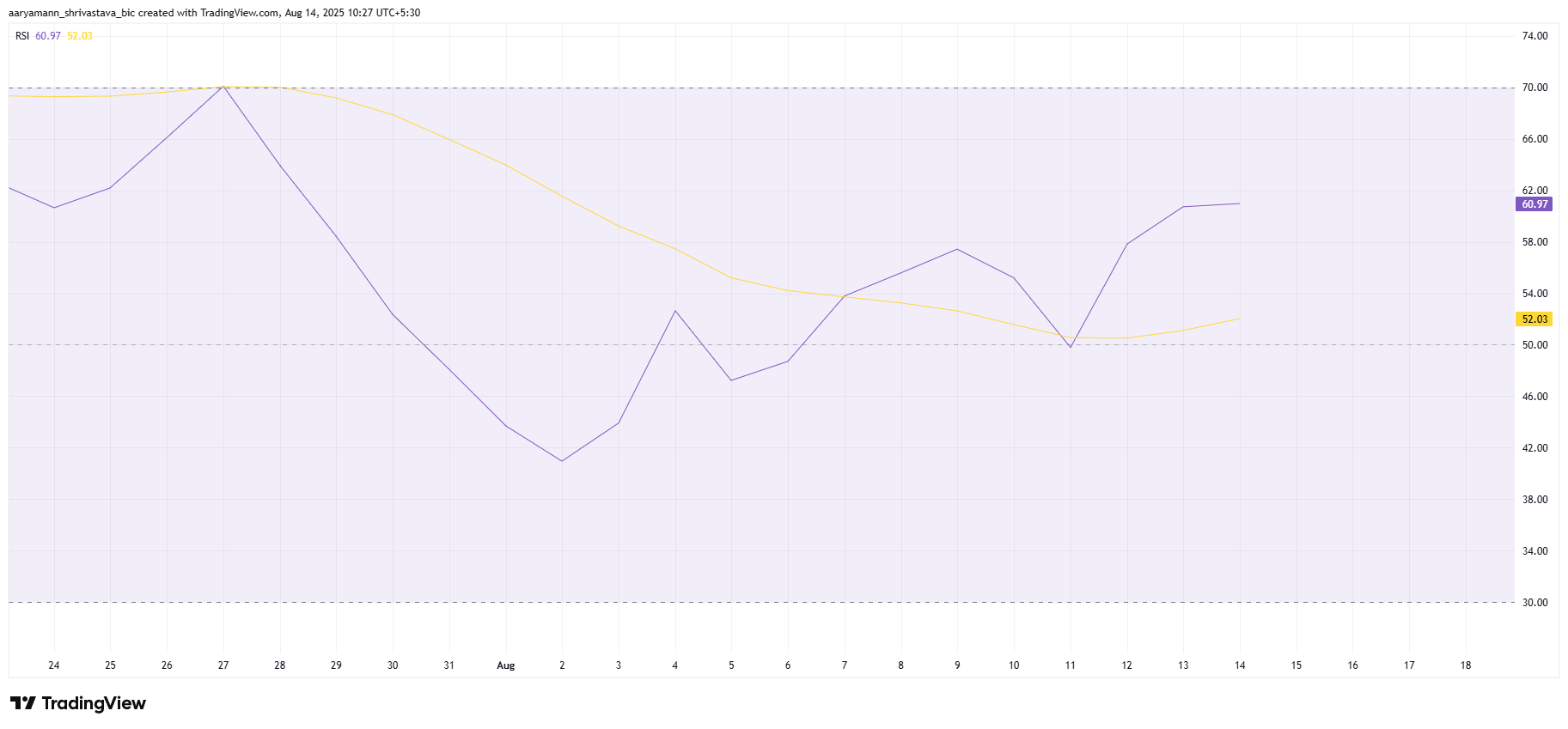

Despite the concerns over the token unlock, technical indicators for AVAX show potential for continued bullish momentum. The Relative Strength Index (RSI) has recently shown an uptick, sitting comfortably above the neutral mark of 50.0.

The RSI’s position in the bullish zone signals that AVAX has the capacity to resist downward pressure. As a result, it could continue to push upward if market conditions remain favorable.

Avalanche RSI. Source:

TradingView

Avalanche RSI. Source:

TradingView

AVAX Price Pushes Further

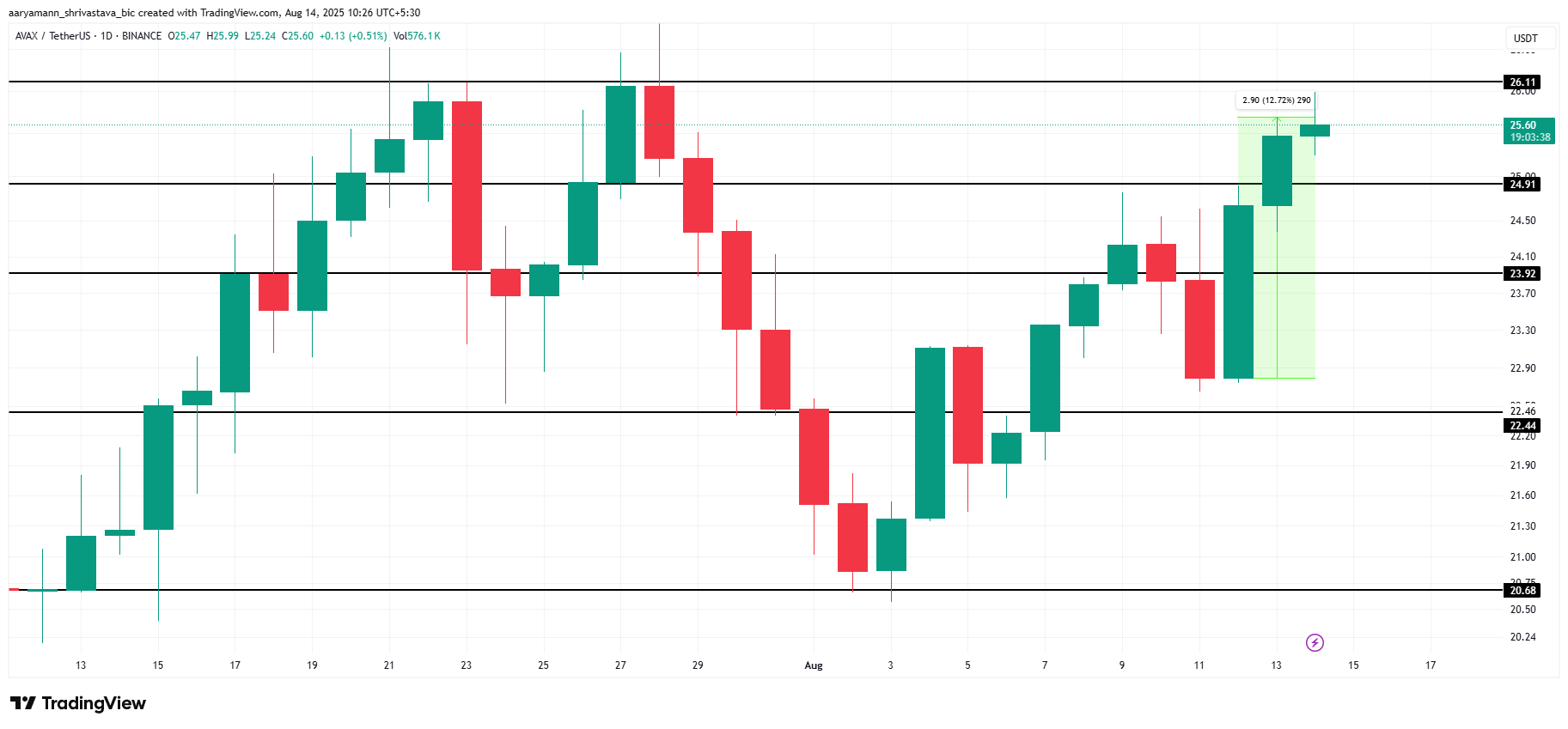

At the time of writing, AVAX is trading at $25.6, having risen by 12.7% in the last 24 hours. The altcoin seems to be targeting the $26.1 resistance, which has kept AVAX from advancing for over a month. Breaking this resistance is crucial for the continuation of the uptrend.

However, the altcoin may struggle to breach this key resistance and could continue consolidating under $26.1. The supply pressure from the upcoming token unlock could limit the price action, with AVAX likely holding above $24.9. If the token unlock’s impact is mild, the price may stabilize at this level.

Avalanche Price Analysis. Source:

TradingView

Avalanche Price Analysis. Source:

TradingView

On the other hand, if the unlock causes a stronger bearish reaction, AVAX could fall below the $24.9 support level. A further decline could lead to a drop to $23.9 or lower, potentially reaching $22.4. Such a drop would invalidate the neutral thesis, signaling a shift in sentiment and market correction for AVAX.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

2025 TGE Survival Ranking: Who Will Rise to the Top and Who Will Fall? Complete Grading of 30+ New Tokens, AVICI Dominates S+

The article analyzes the TGE performance of multiple blockchain projects, evaluating project performance using three dimensions: current price versus all-time high, time span, and liquidity-to-market cap ratio. Projects are then categorized into five grades: S, A, B, C, and D. Summary generated by Mars AI This summary was generated by the Mars AI model, and the accuracy and completeness of its content are still being iteratively updated.

Mars Finance | "Machi" increases long positions, profits exceed 10 million dollars, whale shorts 1,000 BTC

Russian households have invested 3.7 billion rubles in cryptocurrency derivatives, mainly dominated by a few large players. INTERPOL has listed cryptocurrency fraud as a global threat. Malicious Chrome extensions are stealing Solana funds. The UK has proposed new tax regulations for DeFi. Bitcoin surpasses $91,000. Summary generated by Mars AI. The accuracy and completeness of this summary are still being iteratively updated by the Mars AI model.

How much is ETH really worth? Hashed provides 10 different valuation methods in one go

After taking a weighted average, the fair price of ETH exceeds $4,700.

Dragonfly partner: Crypto has fallen into financial cynicism, and those valuing public blockchains with PE ratios have already lost

People tend to overestimate what can happen in two years, but underestimate what can happen in ten years.