Google Searches for Chainlink Hit 3-Year High as LINK Targets $47

Chainlink’s rally above $24, fueled by whale accumulation, record TVS, and surging investor interest, could spark a breakout to $47 if it clears the $25 resistance level.

Chainlink (LINK) has just recorded a significant milestone as its price surged past $24, marking its highest level in seven months.

If LINK can maintain its momentum and decisively break through the $25 zone, a medium-term target of $47 could become achievable.

New Target for Chainlink

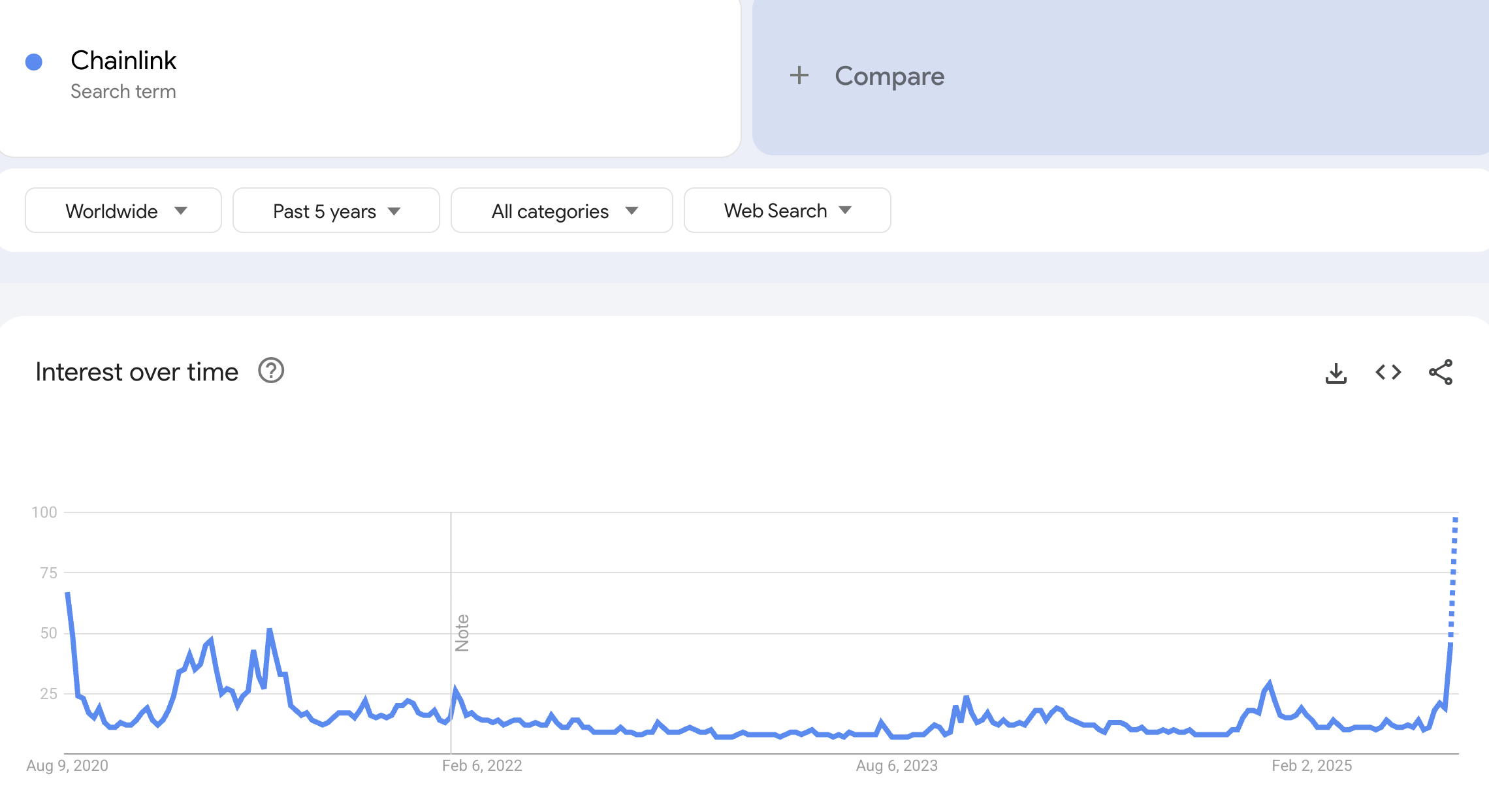

This Chainlink (LINK) price breakout is fueled by growing community interest. Searches for the keyword “Chainlink” on Google Trends have reached their highest level since May 2021. This reflects rising market enthusiasm and shows that LINK is becoming one of the hottest names in the altcoin space.

“Chainlink” search trend on Google Trends. Source:

Google Trends

“Chainlink” search trend on Google Trends. Source:

Google Trends

Given the current market moves, experts believe LINK could be the most obvious large-cap opportunity in this cycle.

The reason stems from Chainlink’s strong foundation as a decentralized data infrastructure. This foundation enables it to serve as a crucial bridge between blockchains and the real world (RWA). Additionally, it has been hitting record-breaking milestones in total asset value secured.

Data from Quinten Francois shows that the Total Value Secured (TVS) on the Chainlink network has reached an all-time high of over $93 billion.

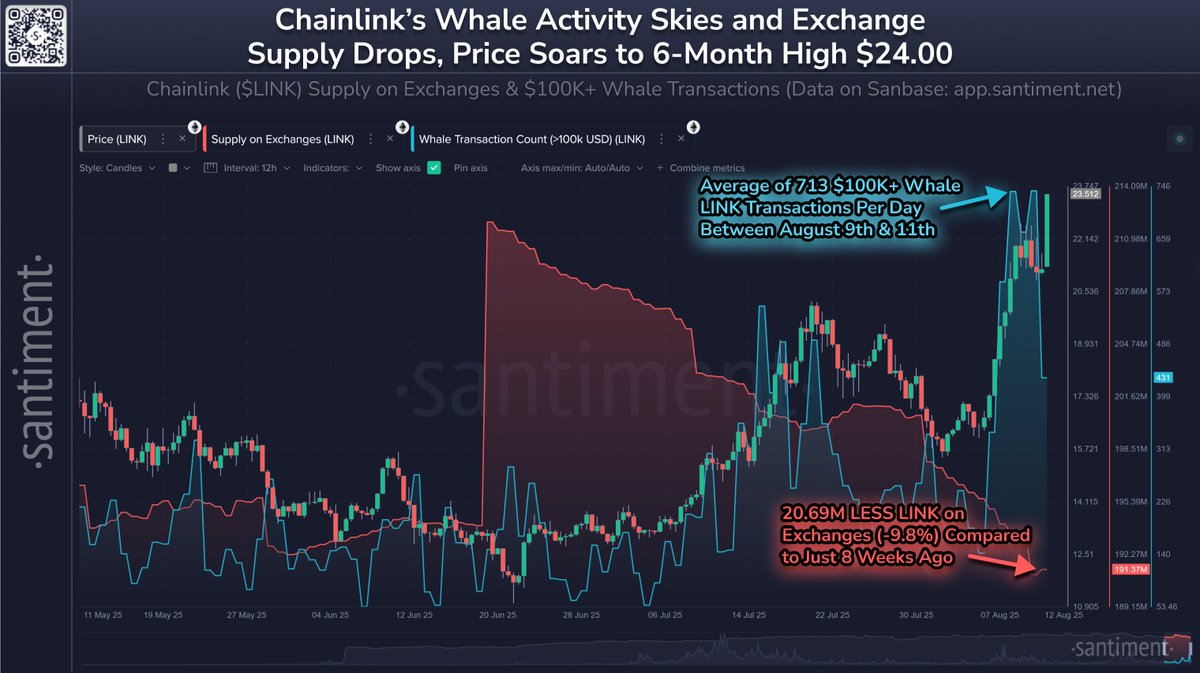

Meanwhile, on-chain metrics reveal notable shifts. Whale transaction volume for LINK has climbed to its highest level in three months, as reported by Santiment. This volume includes 713 large transactions per day over the past five days of price gains.

At the same time, LINK balances on exchanges have dropped nearly 10%, suggesting a reduction in selling pressure. This decline also indicates a growing accumulation trend among investors.

LINK whale activity. Source:

Santiment

LINK whale activity. Source:

Santiment

From a technical analysis perspective, LINK has completed the expected fifth wave of its uptrend and is now approaching the key $25 zone. Analysts suggest that if LINK surpasses this level, it could enter a direct breakout toward the $47 target on the long-term chart.

He also indicates a minimal likelihood of significant corrections until upward momentum fades. Trading scenarios also focus on the $22–$23 support range and the $25 resistance, with the bullish primary trend.

LINK price analysis. Source:

Morecryptoonl

LINK price analysis. Source:

Morecryptoonl

Combining technical strength, positive on-chain signals, and rising community interest creates favorable conditions for LINK’s next upward move. If LINK can maintain momentum and decisively break above $25, the $47 target could be within reach in the medium term.

With current developments, LINK has every chance to become one of the “stars” of the 2025 bull cycle.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Ethereum Privacy’s HTTPS Moment: From Defensive Tool to Default Infrastructure

A summary of the "Holistic Reconstruction of Privacy Paradigms" based on dozens of speeches and discussions from the "Ethereum Privacy Stack" event at Devconnect ARG 2025.

Donating 256 ETH, Vitalik Bets on Private Communication: Why Session and SimpleX?

What differentiates these privacy-focused chat tools, and what technological direction is Vitalik betting on this time?

Ethereum Raises Its Gas Limit to 60M for the First Time in 4 Years