Bitcoin vs Google: Can BTC Keep Its Lead After U.S. Data Release?

Bitcoin vs Google: A New Market Cap Rivalry

In a headline-grabbing achievement, Bitcoin has overtaken Google (Alphabet Inc.) to secure the 5th spot among the world’s most valuable assets. This milestone cements BTC’s place alongside the largest companies and commodities in the global economy, reinforcing its role as a legitimate store of value.

But the timing is critical. With major U.S. economic data about to be released, the key question is: Can Bitcoin maintain its lead over Google, or will market forces knock it back?

Google’s Policy Reversal Adds to Crypto Momentum

In a notable shift, Google has reversed its plan to ban non-custodial crypto wallets from the Play Store. This ensures Android users worldwide can continue to access wallets like MetaMask and Trust Wallet, preserving the principles of decentralization and user control.

For Bitcoin and the wider crypto market, this is an indirect win; it removes a potential barrier to adoption and keeps the self-custody narrative alive, which is critical for long-term trust in digital assets.

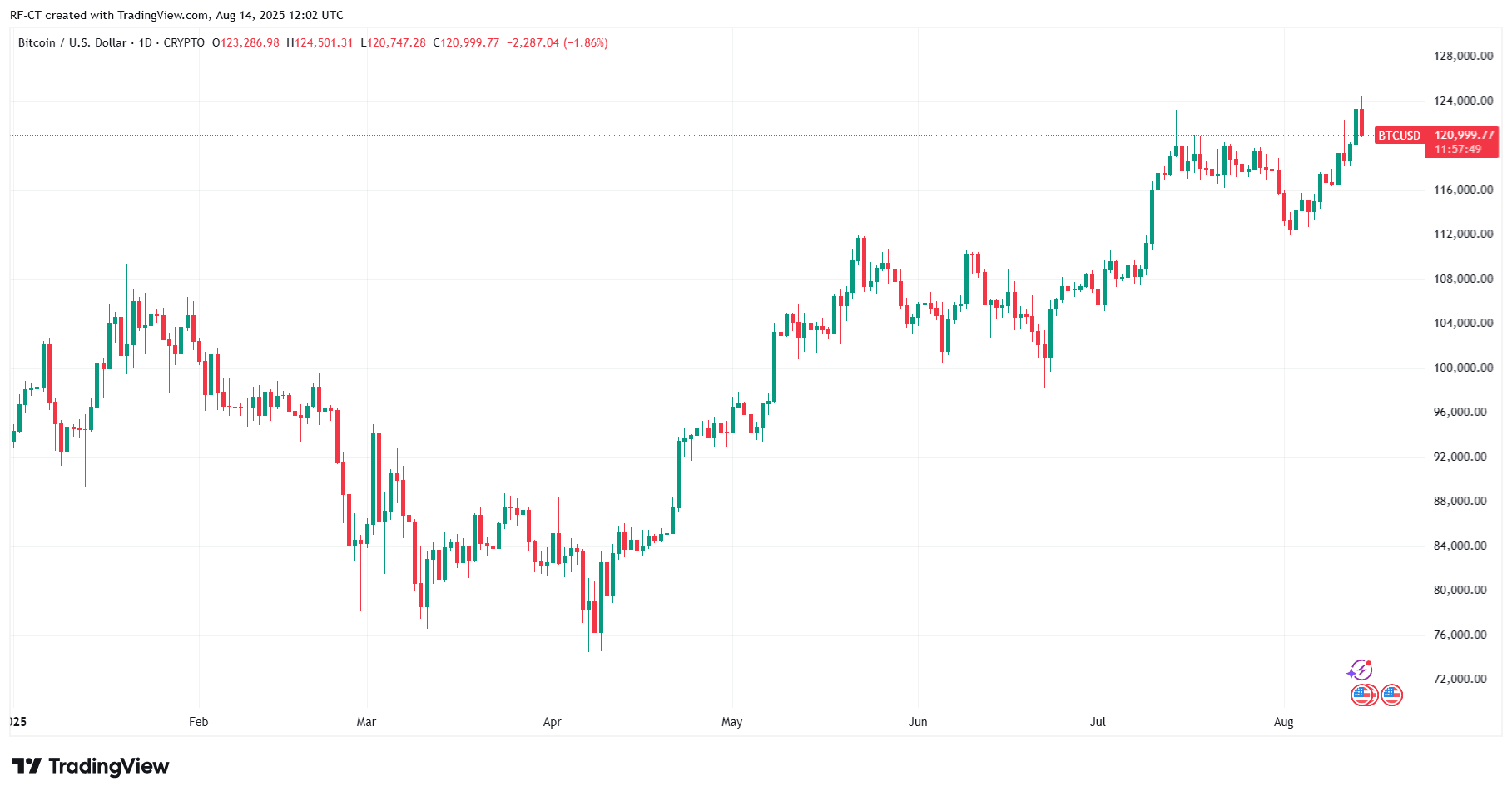

Bitcoin’s $124,501 All-Time High

Riding a wave of optimism, Bitcoin surged to a fresh all-time high of $124,501, powered by both institutional demand and retail enthusiasm. This rally not only pushed BTC past Google in market capitalization but also positioned it strongly ahead of a potentially market-shifting U.S. data release.

By TradingView - BTCUSD_2025-08-14 (YTD)

By TradingView - BTCUSD_2025-08-14 (YTD)

U.S. Data Could Decide the Winner – What It Means for Bitcoin

At 8:30 AM ET, three key U.S. economic reports will drop:

1. Producer Price Index (PPI)

Measures wholesale-level inflation — what producers are paid for their goods and services.

- Why it matters: High PPI can signal that consumer prices will rise later; low PPI suggests easing inflation.

- Impact on BTC:

- Lower PPI → Bullish for Bitcoin as it increases the likelihood of Fed rate cuts.

- Higher PPI → Bearish as it may keep rates high, reducing appetite for risk assets.

2. Core PPI

Same as PPI but excludes volatile food and energy prices.

- Why it matters: Gives a clearer picture of underlying inflation trends.

- Impact on BTC:

- Lower Core PPI → Strong bullish signal; could push BTC toward $130K+.

- Higher Core PPI → Could trigger a pullback as markets price in longer-term higher rates.

3. Initial Jobless Claims

Measures how many people filed for unemployment benefits for the first time in the past week.

- Why it matters: Reflects the health of the labor market and economic momentum.

- Impact on BTC:

- Higher claims → Signals economic weakness, increases chance of rate cuts → Bullish for BTC.

- Lower claims → Signals a strong economy, could delay cuts → Potentially bearish short-term.Why This Data Moves Crypto

All three reports directly influence the Federal Reserve’s interest rate policy. Rates dictate the flow of liquidity in markets:

- Lower rates or rate-cut expectations → More liquidity, investors seek higher returns → Bullish for Bitcoin.

- Higher rates or delayed cuts → Stronger dollar, safer yields in bonds → Could pressure Bitcoin prices.

For Bitcoin , the reaction is often instant; traders adjust positions within seconds, leading to sharp price swings. A favorable reading could help BTC solidify its lead over Google, while a disappointing one could see it slide back down the rankings.

Before and After the Data: Market Playbook

- Before: Expect cautious trading, lower liquidity, and choppy moves as traders wait for the numbers.

- After: Volatility will spike. Positive data could launch Bitcoin toward $130K+, while negative readings may trigger a swift correction. Altcoins are likely to follow BTC’s lead once the dust settles.

The clock is ticking: will BTC extend its lead over Google , or will a market shake-up put the tech giant back on top?

$BTC, $Bitcoin

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

When Belief Becomes a Cage: The Sunk Cost Trap in the Crypto Era

As cryptocurrencies transition from idealism to mainstream finance, participants need to be wary of the sunk cost effect and soberly assess whether they are still striving for a worthwhile future.

Ultiland: The new RWA unicorn is rewriting the on-chain narrative of art, IP, and assets

Once attention forms a measurable and allocatable structure on-chain, it establishes the foundation for being converted into an asset.

Crypto 2026 in the Eyes of a16z: These 17 Trends Will Reshape the Industry

Seventeen insights about the future summarized by several partners at a16z.