Is Skale (SKL) Teaming Up With Google? Speculation Drives 51% Jump In Price

Skale (SKL) surges 51%, fueled by whale activity and Google partnership rumors; resistance at $0.049 could limit further gains.

Skale (SKL) has experienced a sharp surge this week, with a notable 51% price increase in the last 24 hours. The rally is attributed to several factors, including speculation about potential partnerships.

Most notably, rumors suggest that Skale’s team might be preparing for a collaboration with Google, as their founder was spotted at Google this week. Additionally, whale activity has played a significant role in driving SKL’s price upwards.

Skale Whale Act Bullish

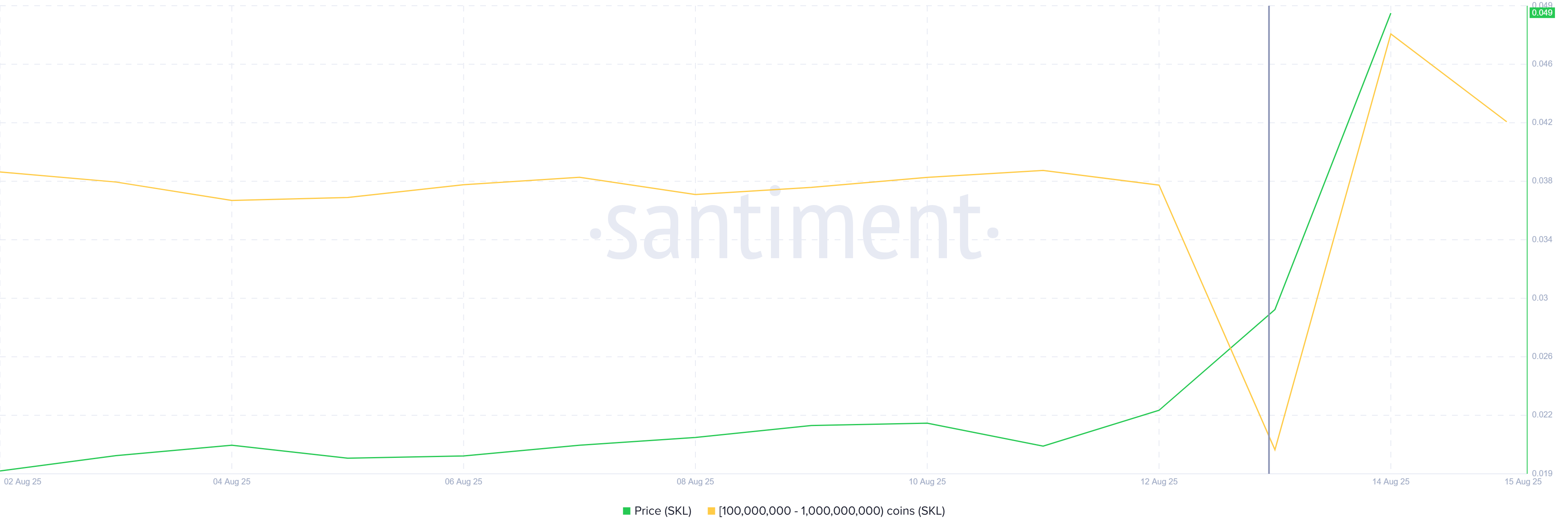

Whale activity has become increasingly bullish towards Skale. Addresses holding between 100 million and 1 billion SKL tokens accumulated more than 200 million tokens in just 24 hours. This purchase, worth over $8.6 million, highlights the confidence large holders have in the altcoin’s future.

Such significant accumulation by large holders typically signals strong market confidence and an expectation of rising prices. When whales increase their positions, it often leads to upward price momentum. This incluences smaller investors to follow suit, further reinforcing the bullish outlook for Skale.

SKL Whale Holding. Source:

SKL Whale Holding. Source:

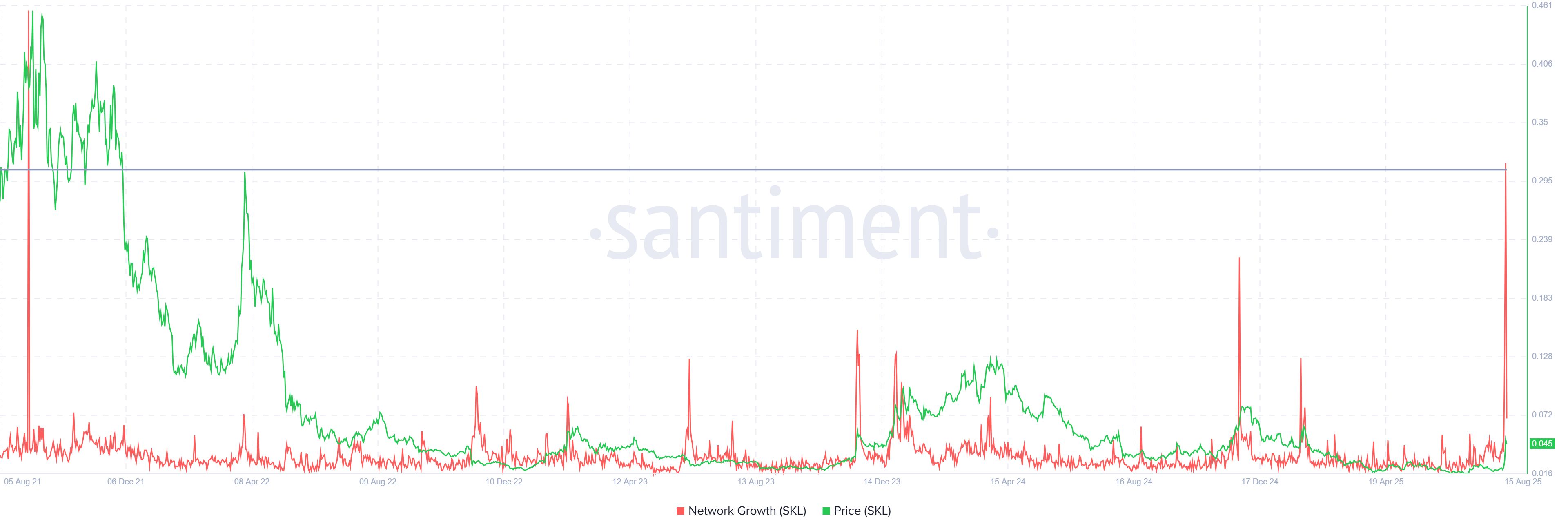

Skale’s network growth is showing impressive results, reaching a near three-year high. The growth is tracked by the rate at which new addresses are joining the network. Over the past two days, this rate has surged by 1,171%, increasing from 45 to 572 new addresses.

Although the rate slightly dipped today, this dramatic increase in new addresses signals growing investor interest in Skale. The increase in active participants on the network shows that the altcoin is gaining traction in the market.

SKL Network Growth. Source:

SKL Network Growth. Source:

SKL Price Faces Resistance

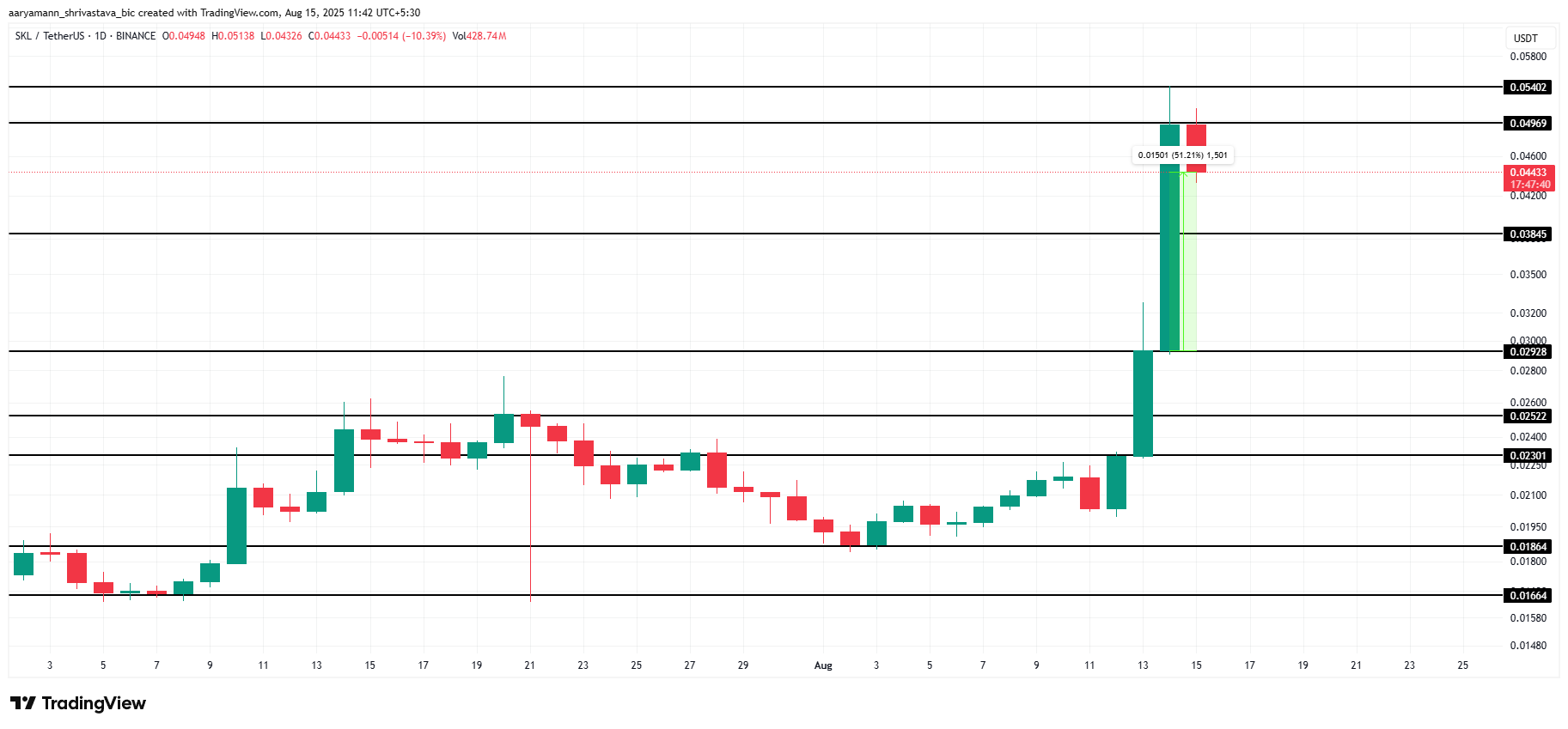

Skale’s price is currently trading at $0.044 after a remarkable 51% rise over the last 24 hours. Despite a 10% decline today, this surge follows a 118% increase noted earlier this week. The price action reflects investor excitement, although recent volatility has made the trend more unpredictable.

The price of SKL faces resistance at the $0.049 level. If investor confidence remains strong and selling pressure does not emerge, Skale could break through this resistance. A successful breach could send the altcoin to $0.050 or higher, setting the stage for further price gains.

SKL Price Analysis. Source:

SKL Price Analysis. Source:

However, if selling pressure mounts and investors decide to cash out their holdings, SKL may drop below the support of $0.038. A further decline could push the price down to $0.029, invalidating the bullish outlook for the altcoin and erasing the recent gains.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Upbit Investment Warning Shakes GoChain (GO): Critical Analysis of Blockchain Project Sustainability

Bitcoin Correlation: Cathie Wood’s Compelling Case for High-Return Portfolio Diversification

DeepMind CEO says China’s AI is just months behind U.S. and closing the gap fast

Bitcoin Rally: Why the Surge to $100K May Signal a Cautious Rebound, Not a Bullish Reversal