Norwegian Sovereign Wealth Fund Increases its Bitcoin Exposure by 83% | US Crypto News

Norway’s sovereign wealth fund boosts Bitcoin holdings by 83%, with a strategic hedge against currency risks. This move signals growing institutional crypto adoption.

Welcome to the US Crypto News Morning Briefing—your essential rundown of the most important developments in crypto for the day ahead.

Grab your coffee as the world’s largest sovereign wealth fund just made a quiet but dramatic move into Bitcoin (BTC), and while the details are subtle, the implications could be anything but.

Crypto News of the Day: World’s Largest Wealth Fund Makes Bold 83% Bitcoin Move

Norway’s sovereign wealth fund, the largest in the world, has significantly increased its Bitcoin exposure, amid a quiet but significant institutional shift toward the pioneer crypto.

Norges Bank Investment Management (NBIM) raised its Bitcoin-equivalent holdings by 83% in the second quarter (Q2) of 2025. Notably, NBIM oversees Norway’s $1.6 trillion oil-funded portfolio.

The fund’s exposure climbed from 6,200 to 11,400 BTC equivalents. Most of NBIM’s Bitcoin exposure is held indirectly through shares of MicroStrategy (MSTR), the largest corporate Bitcoin holder.

Nevertheless, NBIM initiated a smaller position, equivalent to 200 BTC, in Japan’s Metaplanet.

Geoff Kendrick, Head of Digital Assets Research at Standard Chartered, noted the magnitude of the move in a statement to BeInCrypto.

“I just ran my usual 13F filing spreadsheet for the BTC ETFs, MSTR, and Metaplanet…The most interesting detail, by far, this time was Norges Bank Investment Management’s buying of MSTR and Metaplanet,” Kendrick said in a statement.

While NBIM has not made any public statements on the increase, the move comes amid a broader wave of institutional participation in Bitcoin through listed equities and ETFs (exchange-traded funds).

Sovereign wealth funds, in particular, have been viewed as long-term, strategically cautious investments. This makes such a sizable increase in exposure notable.

The timing also coincides with a steady rise in Bitcoin’s price over the past quarter. Tailwinds draw from strong ETF inflows and increasing adoption by corporations and governments. Other factors include macroeconomic uncertainty.

For NBIM, which is mandated to ensure long-term returns for Norway’s future generations, the Bitcoin allocation represents a tiny fraction of its overall assets.

However, as indicated in a recent US Crypto News publication, it could be a strategic hedge against currency debasement and geopolitical risks.

NBIM’s latest move may not be an isolated case. Industry analysts point to a growing trend among sovereign wealth funds and large pension managers.

As BeInCrypto reported, some of these institutions are quietly exploring Bitcoin as part of diversified long-term portfolios.

If sustained, these quiet but decisive allocations could outsize Bitcoin’s liquidity profile and institutional credibility. This shift may mark the early stages of sovereign-backed Bitcoin adoption.

Chart of the Day

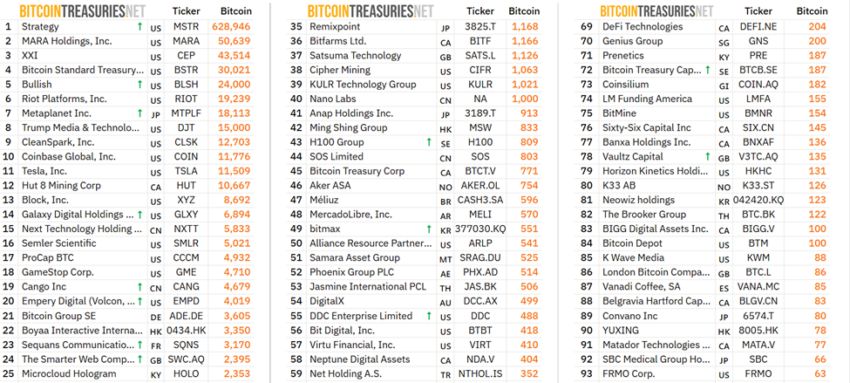

Public Bitcoin Treasury Companies. Source:

Bitcoin Treasuries

Public Bitcoin Treasury Companies. Source:

Bitcoin Treasuries

Byte-Sized Alpha

Here’s a summary of more US crypto news to follow today:

- Crypto market liquidations exceed $1 billion as PPI report sparks downturn.

- Bitcoin price closes the $117,400 CME Gap, sparking euphoria and caution.

- SEC filings reveal quiet Bitcoin ETF power moves of Wells Fargo and Abu Dhabi.

- Senator Lummis pushes for gold revaluation to bypass the 15% seized Bitcoin bottleneck.

- Experts are concerned about SKALE’s trading volume amid a 145% price surge.

- Ethereum faces second-highest yearly sell wave — is $5,000 still in play?

- Investors turn their backs on Pi Network: 3 Signs of a growing exodus.

- Meme coin dominance falls to 18-month low – what’s behind the drop?

- Is Skale (SKL) teaming up with Google? Speculation drives a 51% jump in price.

- Binance Bitcoin deposits surge, signaling potential sell-off ahead.

Crypto Equities Pre-Market Overview

| Company | At the Close of August 14 | Pre-Market Overview |

| Strategy (MSTR) | $372.94 | $373.23 (+0.078%) |

| Coinbase Global (COIN) | $324.89 | $325.00 (+0.034%) |

| Galaxy Digital Holdings (GLXY) | $28.57 | $28.84 (+0.95%) |

| MARA Holdings (MARA) | $15.75 | $15.77 (+0.12%) |

| Riot Platforms (RIOT) | $12.25 | $12.20 (-0.41%) |

| Core Scientific (CORZ) | $13.84 | $13.62 (-1.55%) |

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Morning Brief | a16z Crypto releases annual report; crypto startup LI.FI completes $29 million financing; Trump says the rate cut is too small

A summary of important market events on December 11.

Trend Research: The "Blockchain Revolution" is Underway, Remain Bullish on Ethereum

The integration trend in the crypto market and Ethereum's value capture.

Interest Rate Cuts Implemented, Why Are Assets Acting "Rebellious" Collectively?

Grasp Four Key Words to Get Ahead of the 2025 Crypto Mainstream Trends