Date: Fri, Aug 15, 2025 | 06:50 AM GMT

The cryptocurrency market is experiencing a pullback following the latest U.S. Producer Price Index (PPI) data release, which triggered a wave of sight selling pressure. Ethereum (ETH) has cooled from above $4,700 to around $4,600, weighing on major altcoins — including Manta Network (MANTA).

MANTA is down 5% on the day, trimming its weekly gains to 4%. But beyond the day-to-day price noise, the chart is flashing a compelling bullish setup — one that strongly resembles the explosive breakout recently seen in Skale (SKL).

Source: Coinmarketcap

Source: Coinmarketcap

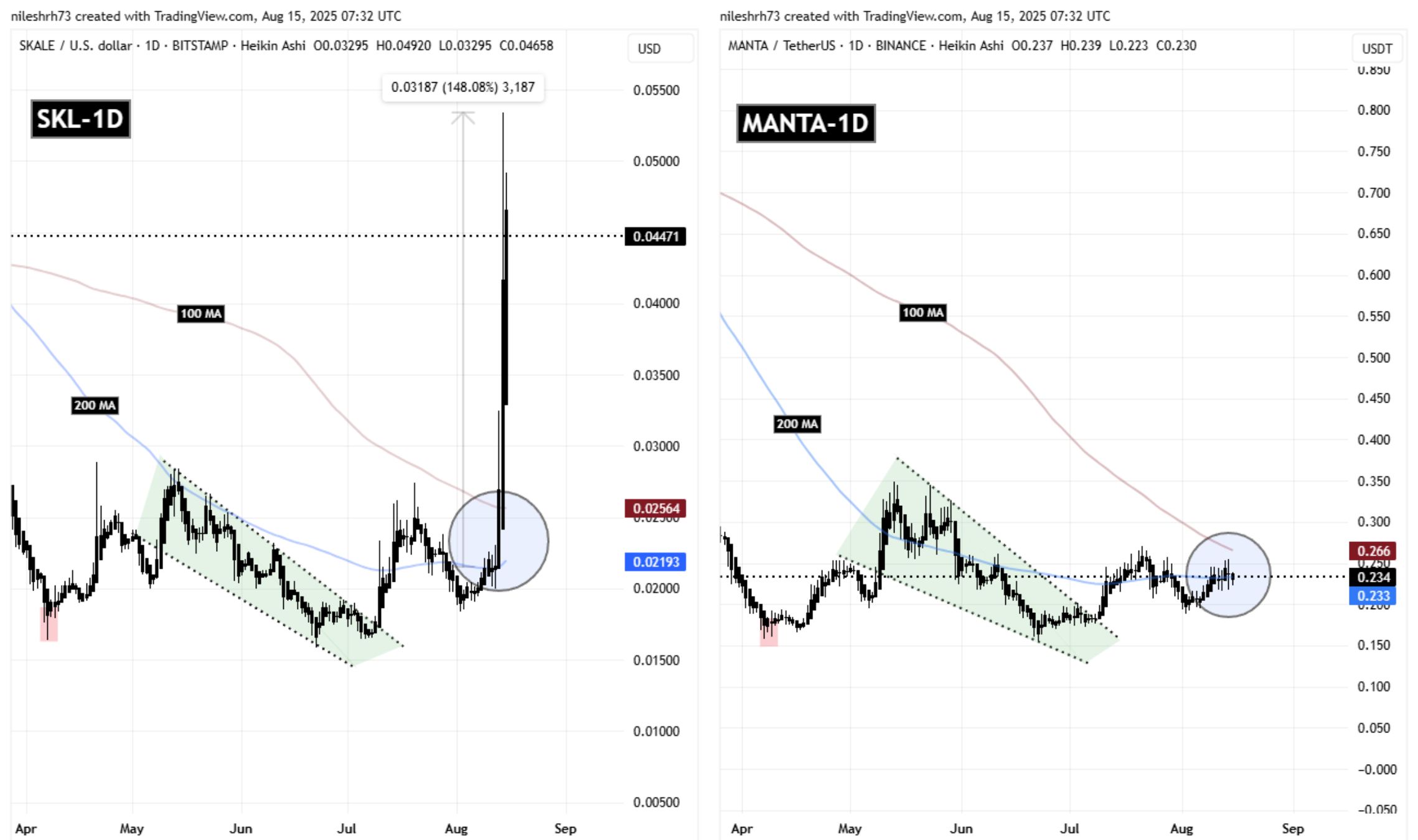

MANTA Mirrors SKL’s Breakout Structure

On SKL’s chart, a textbook falling wedge pattern — a well-known bullish reversal formation — recently played out. Once SKL broke above the wedge structure, it quickly flipped both the 200-day and 100-day moving averages into support. That technical confirmation triggered an aggressive rally of nearly 148% in just a short span.

SKL and MANTA Fractal Chart/Coinsprobe (Source: Tradingview)

SKL and MANTA Fractal Chart/Coinsprobe (Source: Tradingview)

Now, MANTA appears to be following the same script.

Like SKL, MANTA broke out from its own falling wedge and has already printed a higher high and higher low. It is currently consolidating just below the 200-day and 100-day moving average cluster, with the 100-day MA sitting near $0.266. This kind of sideways action beneath major resistance often precedes a breakout if buying pressure builds.

What’s Next for MANTA?

To confirm the bullish fractal, MANTA must hold above the 200-day MA support near $0.233 and then break decisively above the 100-day MA at $0.266. A strong move through this zone — ideally on expanding volume — could set the stage for a measured rally toward $0.58, mirroring SKL’s 150% surge.

That said, traders should be prepared for the possibility of extended consolidation or even a false breakout if the move lacks momentum. Still, the similarity between SKL’s recent breakout and MANTA’s current structure is hard to ignore. If history repeats itself, MANTA could be gearing up for a sharp upside move.