In the past 24 hours, HBAR’s price fluctuations created a notable stir in the markets. From 3:00 PM on August 14 to 2:00 PM on August 15, the token moved between $0.244 and $0.259, marking a nearly 6% difference. The evident volatility and increased trading volume indicated a rising interest among market participants.

Intense Buying and Selling Pressure

On the evening of August 14, HBAR fell to $0.244 due to significant selling pressure. Shortly after reaching this low point at around 9:00 PM, an upward movement commenced. By 8:00 AM on August 15, the price had recovered strongly to $0.259.

During this period, trading volume rose to 65.56 million, significantly surpassing the 24-hour average. Analysts consider that the increased trading volume has heightened interest in the market. A strong support level formed in the $0.248-$0.249 range, where systematic buyer entry was observed.

Technical Levels and Distribution Movements

A resistance level emerged in the $0.255–$0.256 range. Concentrated selling at this level led to a downward price movement once again. The rise supported by trading volume pointed to a short-term accumulation period. Meanwhile, profit-taking at the resistance line caused a limited pullback to $0.251.

Experts indicate that prices may move horizontally in this narrow band in the short term. Investors are focusing on short-term risks and possible consolidation during this period.

Institutional Developments and Market Dynamics

In the broader market dynamics, institutional steps came to the fore. Grayscale made potential spot ETF applications for HBAR and Cardano $0.953016 in Delaware. The company reported that it applied the same structure it adopted for crypto financial products in the past to these applications.

Grayscale officials stated, “Our ETF applications aim to strengthen institutional access to crypto assets.”

Meanwhile, Binance ‘s addition of HBAR and SUI support to BNB Smart Chain made cross-chain transactions more efficient. This change particularly facilitated retail investors’ access to HBAR, leading to expectations that institutional interest in the sector might strengthen.

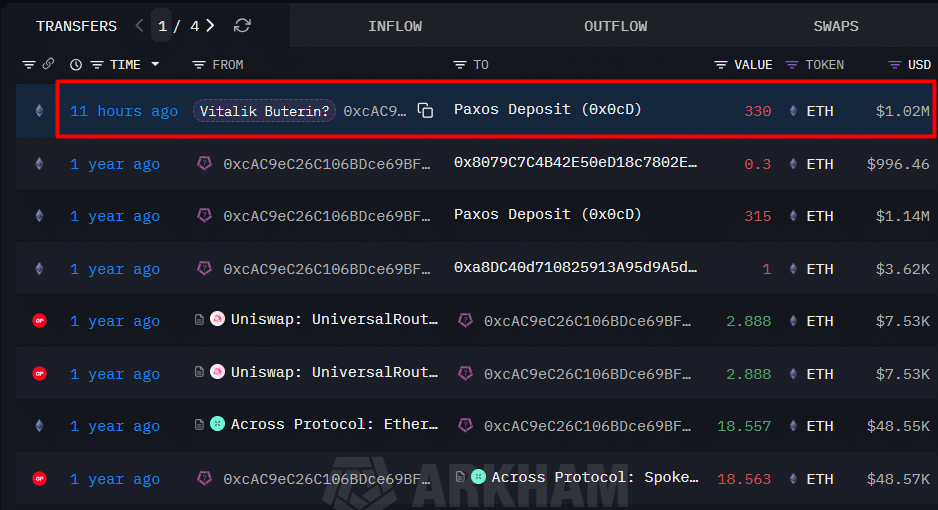

Technical indicators highlighted that the price range was $0.015 during the day and that concentrated trading volume in support and resistance regions increased market volatility. In the last hour of trading, especially between 1:35 PM and 1:45 PM, a notable price decrease showed institutional distribution tendencies.

As an editorial note, it was stated that some parts of the report were prepared with the support of AI tools and reviewed by the publication team for accuracy. Users are advised to follow the current developments before making investment decisions.