Hong Kong Securities and Futures Commission's Ye Zhiheng: When a company claims to apply for a stablecoin license, its stock price rises, and investo

Ye Zhiheng, Executive Director of the Intermediaries Division of the Hong Kong Securities and Futures Commission, said on the wireless program "Explaining Clearly" that after the recent implementation of the "Stable Coin Regulations", some companies claimed to have applied for a license or intended to apply for a license, causing their stock prices to rise. He pointed out that investors' reactions are enthusiastic, and urged investors to stay "rational", as the Securities and Futures Commission is concerned about the increased risk of fraud.

Ye Zhiheng stated that in the first half of this year, there were 265 complaints about virtual asset transactions, mainly involving overseas investors and overseas investments, resulting in financial losses. The reasons include falling victim to fraud, assets being stolen after platform intrusion, platforms not acknowledging winnings, or the counterparty being accused of money laundering and funds being suddenly frozen. He pointed out that when investors trade virtual assets without using a licensed platform, they are actually taking risks and playing "Russian roulette". In addition, he mentioned that the Securities and Futures Commission stated that they are still investigating the JPEX fraud case.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Powell admits that a rate cut in December is hard to determine, with officials remaining divided.

The probability of a Federal Reserve rate cut in December remains uncertain, with officials expressing both hawkish and dovish views. This meeting is filled with suspense!

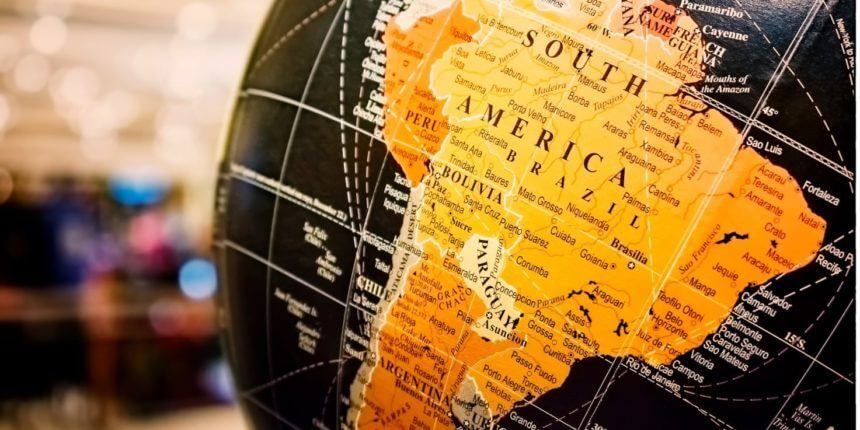

Latin America's Crypto Gold Rush: Seizing Opportunities in Web3 On-Chain Digital Banking

From the perspective of traditional digital banking, Web3 on-chain banks built on blockchain and stablecoin infrastructures will, in the future, meet user needs and serve those populations that traditional financial services cannot reach.

Even major short sellers have started paid groups

Real opportunities only circulate quietly within closed circles.

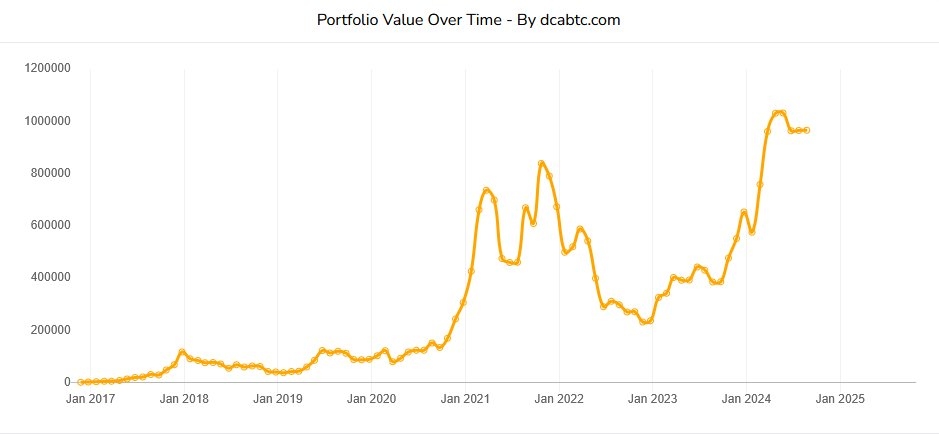

How to Survive the Bitcoin Winter? Investment Strategies, Advice, and Bottom Identification

Bitcoin is an outstanding savings technology for patient investors, but for those who lack patience or are excessively leveraged, it becomes a "wealth-destroying" tool.