How High Can Chainlink Price Go This Month?

Chainlink (LINK) has quietly transformed from a DeFi oracle provider into one of the most critical pieces of infrastructure in the blockchain economy. With the launch of the Chainlink Reserve and the expansion of Payment Abstraction, LINK now has a built-in demand engine fueled by enterprise adoption and onchain service usage. At the same time, its price action is heating up, with LINK breaking above $20 and pushing toward the key $25 resistance. The big question now is whether these fundamentals and technical signals can carry LINK to the next milestone at $30.

Why the Chainlink Reserve Matters?

The Chainlink Reserve is designed to funnel both onchain and offchain revenue directly into LINK, supporting long-term growth. This is made possible by Payment Abstraction, a system that allows enterprises and users to pay in their preferred tokens or stablecoins, which are then automatically converted to LINK. With offchain enterprise revenue now flowing into the Reserve, Chainlink has effectively built a demand engine that constantly absorbs LINK supply.

This upgrade positions Chainlink differently from other networks that rely only on transaction fees. By tying enterprise adoption and tokenization infrastructure directly to LINK accumulation, the Reserve acts as both a stabilizer and a growth driver for the token.

Chainlink Price Prediction: LINK Price Action

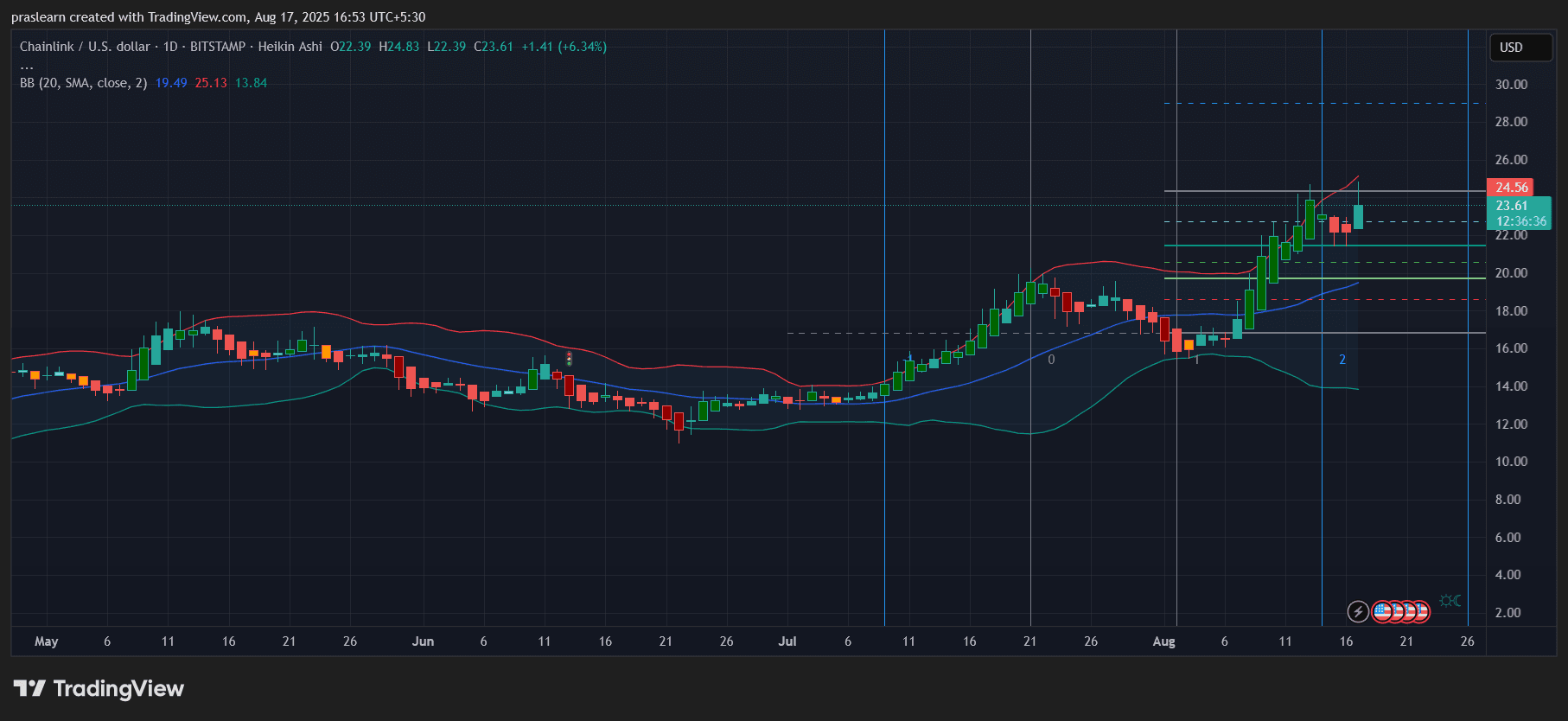

LINK/USD Daily Chart- TradingView

LINK/USD Daily Chart- TradingView

Looking at the daily chart, LINK is trading at $23.61, up 6.34% on the day. A strong rally from early August pushed price through the psychological $20 barrier, marking a clear breakout from its prior consolidation.

The Bollinger Bands (BB) show widening volatility, with price hugging the upper band near $25.13, signaling bullish momentum but also short-term overextension. The recent wick rejection at $24.83 suggests profit-taking near resistance.

Key levels to watch:

- Immediate support: $22.00 (mid-range consolidation zone)

- Critical support: $19.50 (20-day SMA, bottom of BB range)

- Resistance zone: $25.50–26.00 (upper band and Fib extension)

- Breakout target: $30.00 (major psychological and Fib projection)

As long as LINK holds above $22, momentum favors bulls. A close above $25 would likely set the stage for a run toward $28–30.

Chainlink’s Expanding Role Beyond Oracles

Chainlink is no longer just about price feeds. With over 2,000 oracles powering 60+ blockchains and securing $80B+ in value, Chainlink is now an institutional-grade infrastructure layer. Its Cross-Chain Interoperability Protocol (CCIP), automation tools, and compliance-ready features give it a unique position to power tokenized assets—a market projected in the trillions.

Where rivals offer fragmented services, Chainlink delivers a modular, unified platform. This integrated ecosystem makes it easier for enterprises to adopt blockchain solutions at scale while keeping compliance and privacy intact. The net effect: sustained demand for LINK.

Chainlink Price Prediction: What to Expect Next for LINK Price?

The LINK rally is backed by both fundamentals and technicals:

- Bullish case: If adoption momentum and Reserve-driven demand persist, LINK could push toward $28–30 in the coming weeks.

- Neutral case: Consolidation between $22–25 while traders wait for clearer signals.

- Bearish risk: A breakdown below $19.50 could pull LINK back into the mid-teens, though fundamentals make this scenario less likely in the short term.

With Payment Abstraction tying enterprise revenue directly to LINK demand, the token has a structural advantage compared to other altcoins. The next decisive breakout above $25 will be crucial for confirming a new leg higher.

LINK’s fundamentals through the Chainlink Reserve are stronger than ever, while the chart signals momentum toward $30 if resistance breaks. Traders should watch the $22 support and $25 resistance closely for the next big move.

LINK简介

Chainlink是一个去中心化预言机网络,为区块链提供现实世界的数据和信息流。LINK是其平台的原生代币,广泛应用于抵押和支付费用等场景。

$LINK, $Chainlink, $LINKPrice, $ChainlinkPrice

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Gold retreats to around $4,610 as tensions with Iran ease and expectations for Fed rate cuts diminish

Bitcoin Sheds 30% of Open Interest: Is a Rebound Imminent?

BlackRock closes on 50% mark of $30B Microsoft AI funding deal

Why Beyond Meat (BYND) Shares Are Rising Today