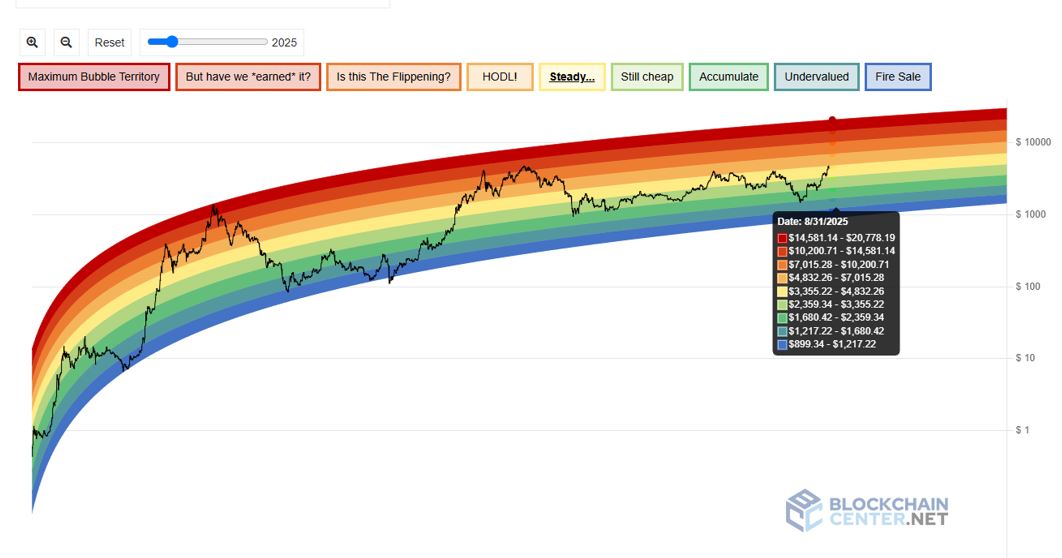

Ethereum Rainbow Chart predicts ETH price for August 31, 2025

Ethereum’s (ETH) recent rally has cooled, with the asset slipping below the $4,500 mark.

However, the Ethereum Rainbow Chart suggests that higher levels could still be in play by the end of the month for the cryptocurrency.

The chart, which applies logarithmic growth curves to long-term valuation bands, categorizes Ethereum’s price into colored ranges. Notably, the model doesn’t predict short-term moves but helps investors gauge whether the asset is undervalued or overheated.

For August 31, 2025, the chart outlines nine possible valuation zones. At the bottom, the ‘Fire Sale’ band spans $899 to $1,217, followed by ‘Undervalued’ ($1,217–$1,680), ‘Accumulate’ ($1,680–$2,359), and ‘Still Cheap’ ($2,359–$3,355). The ‘Steady’ band, often viewed as fair value, ranges from $3,355–$4,832, close to Ethereum’s current trading level.

Above that, ‘HODL!’ covers $4,832–$7,015, ‘Is this The Flippening?’ spans $7,015–$10,200, and ‘But have we earned it?’ runs from $10,200–$14,581. At the very top, ‘Maximum Bubble Territory’ is between $14,581 and $20,778.

With Ethereum trading around $4,400, it sits within the ‘Steady’ zone. If it holds this band into the end of August, the model suggests a likely target between $3,355 and $4,832, indicating historical standards fairly value the asset.

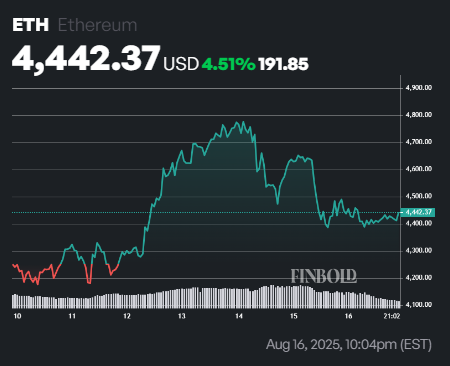

Ethereum price analysis

By press time, Ethereum was priced at $4,442, down 0.15% over the past 24 hours but up 4.5% on the week.

From a technical perspective, the 50-day Simple Moving Average (SMA) of $3,413.61 and the 200-day SMA of $2,596.84 remain well below current price levels, confirming strong upward momentum and a sustained bullish trend.

Meanwhile, the 14-day Relative Strength Index (RSI) at 66.86 signals strong buying pressure, nearing the overbought threshold of 70. This suggests further gains are possible for Ethereum, though momentum may cool or face minor corrections if buying becomes excessive.

Featured image via Shutterstock

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

After a 1460% surge, re-examining the value foundation of ZEC

Narratives and sentiment can create myths, but fundamentals determine how far those myths can go.

Wall Street is counting on bitcoin's high volatility for year-end bonuses

ETF has not "tamed" bitcoin; volatility remains the most attractive indicator of the asset.

Bitcoin Faces Intensifying Sell-Off as ETF Outflows and Leverage Unwinds Pressure Markets

Solana ETF Hit 18-Day Inflow Streak