XRP price could drop by over 20% in the coming weeks due to multiple on-chain indicators suggesting a local top formation, as 94% of its supply is currently in profit.

-

XRP’s rally to $3 has pushed 94% of supply into profit, historically marking macro tops.

-

XRP is in the “belief–denial” zone, echoing peaks in 2017 and 2021.

-

Historical data shows that high profitability often precedes significant price corrections.

XRP price analysis indicates potential for a 20% drop as on-chain metrics signal a local top. Stay informed on market trends!

What is XRP’s current price trend?

XRP’s price has surged to over $3, pushing nearly 94% of its circulating supply into profit. This level historically indicates a potential market top, raising concerns about a possible price correction.

How does XRP’s profitability affect its price?

High profitability among XRP holders typically signals overheated market conditions. For instance, in early 2018 and April 2021, similar profitability levels preceded significant price drops, indicating that traders may seek to realize profits soon.

Frequently Asked Questions

What does a 90% profit level indicate for XRP?

A 90% profit level among XRP holders typically signals an overheated market, often leading to price corrections.

How can XRP avoid a price drop?

XRP could avoid a deeper correction if it attracts fresh inflows driven by institutional demand and broader altcoin momentum.

Key Takeaways

- Profitability Levels: 94% of XRP supply is in profit, indicating potential market top.

- Historical Patterns: Previous instances of high profitability led to significant price drops.

- Market Dynamics: Fresh inflows could mitigate selling pressure and support price stability.

Conclusion

In summary, XRP’s current price trend and high profitability levels suggest a potential correction ahead. Investors should monitor market dynamics closely, as historical patterns indicate that significant price drops often follow such conditions. Staying informed is crucial for navigating the volatile crypto landscape.

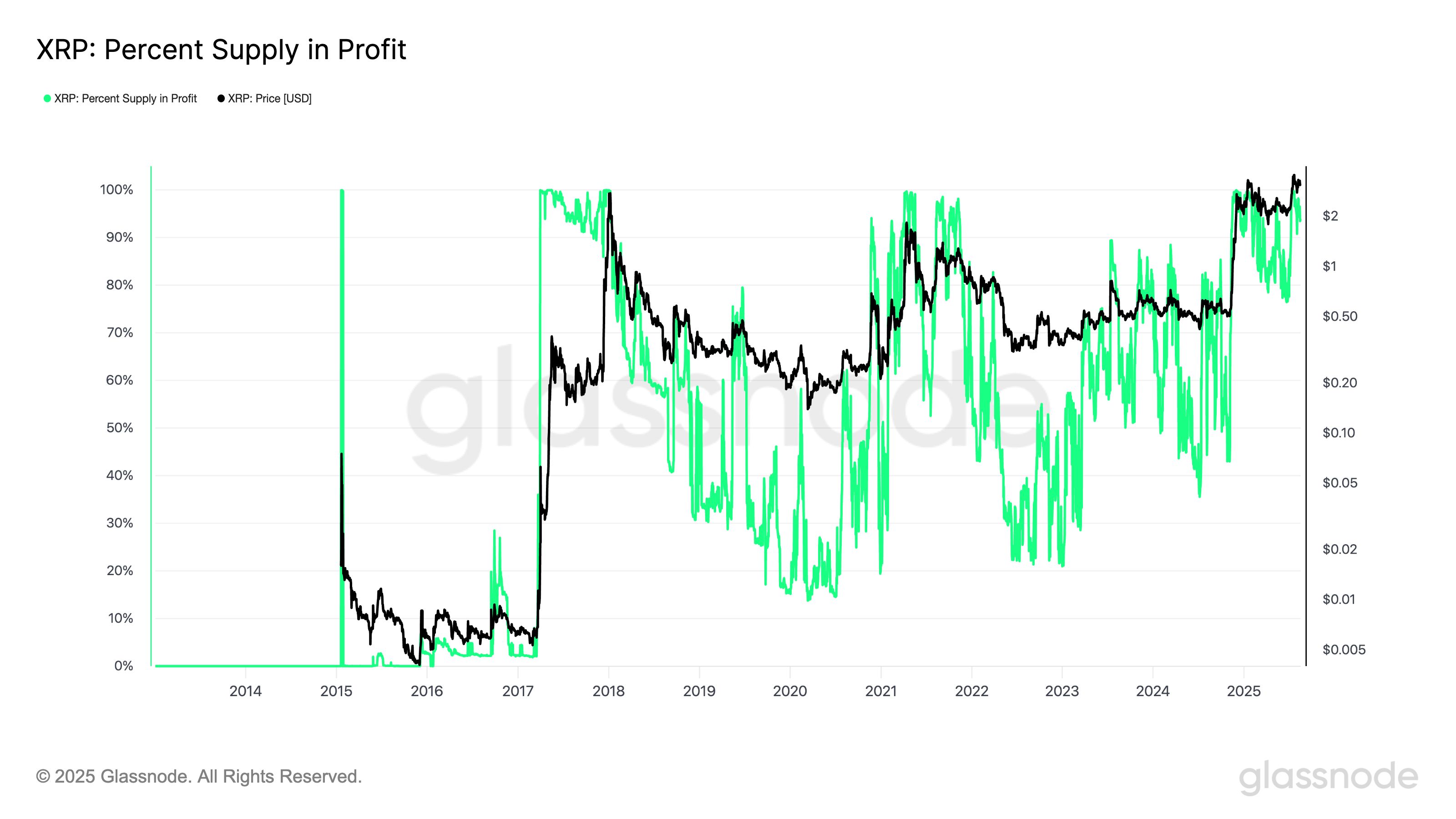

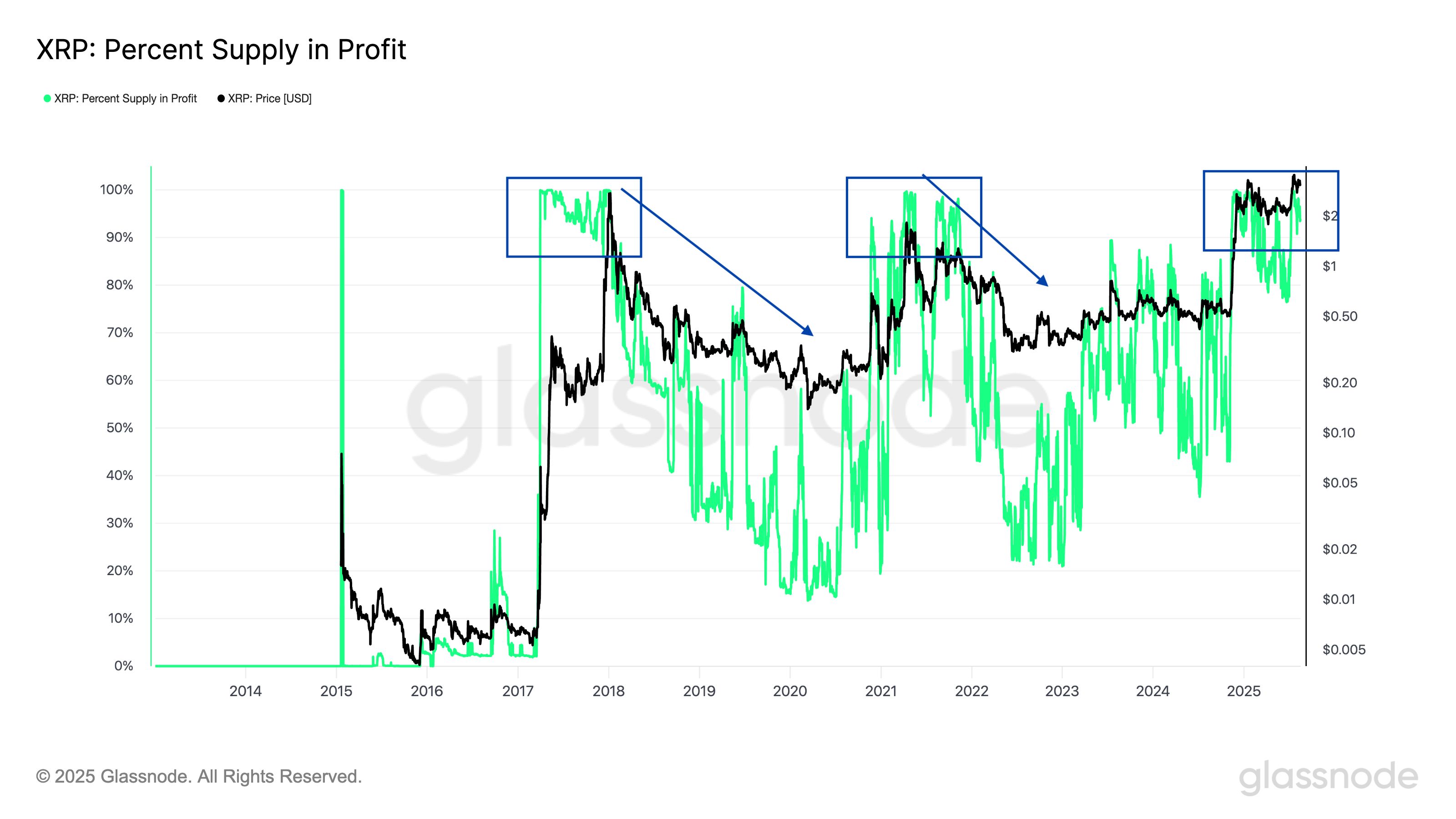

XRP percent supply in profit. Source: Glassnode

XRP percent supply in profit. Source: Glassnode

90%+ Supply in Profit is Usually an XRP Macro Top

Such high profitability has historically signaled overheated conditions.

In early 2018, over 90% of holders were in profit just as XRP peaked near $3.30 before a 95% price reversal. A similar setup appeared in April 2021, when profitability levels above 90% preceded an 85% crash from the top near $1.95.

XRP percent supply in profit. Source: Glassnode

XRP percent supply in profit. Source: Glassnode

The broad profitability underscores strong investor gains, which typically heightens the risk of distribution as traders may seek to realize profits. A similar scenario could be unfolding now.

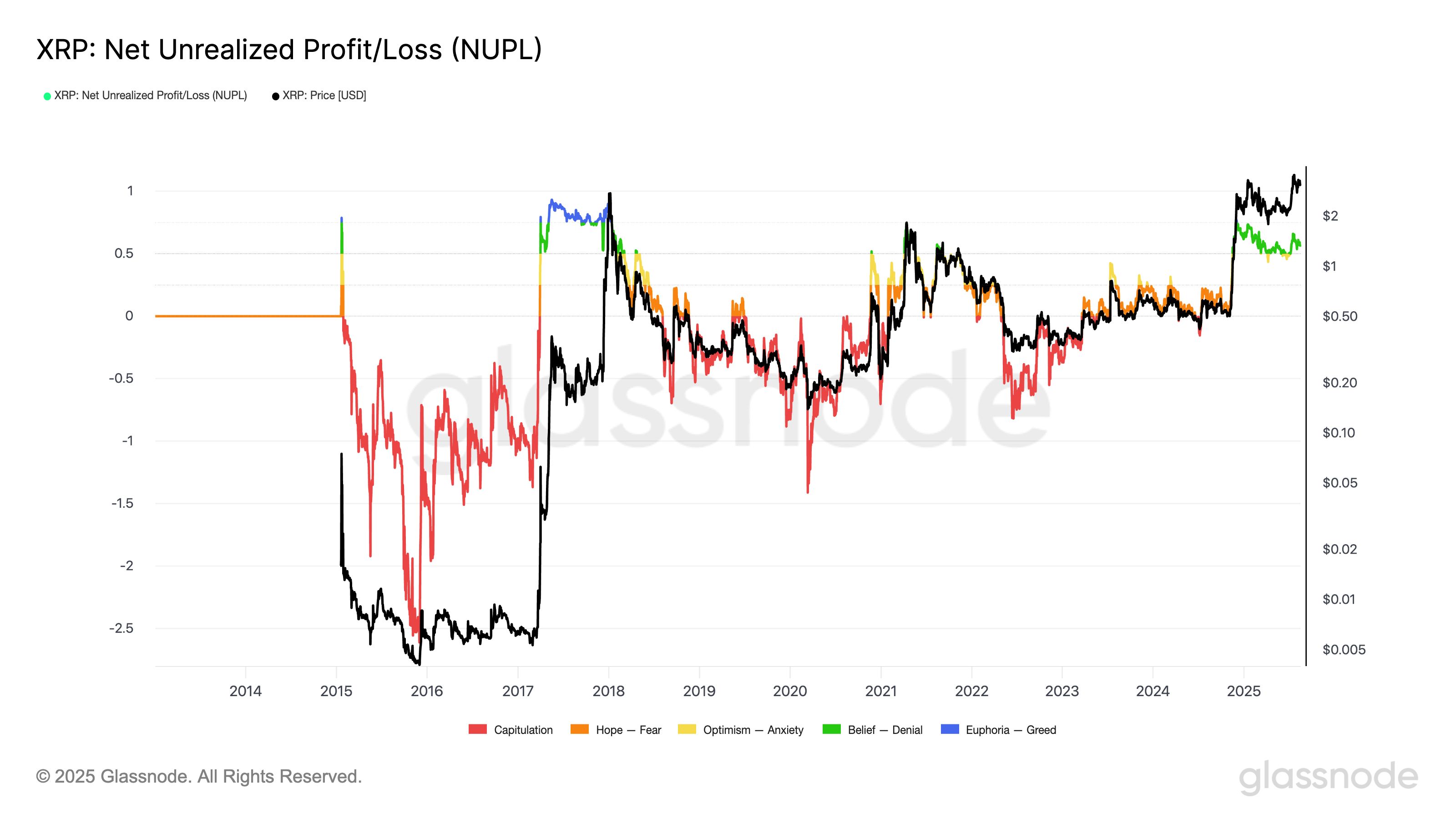

XRP’s NUPL Mirrors 2017 and 2021 Price Peaks

XRP’s Net Unrealized Profit/Loss (NUPL) is further signaling top risks.

The indicator, which tracks the difference between unrealized gains and losses across the network, has entered the “belief–denial” zone, a phase historically observed before or during market tops.

XRP net unrealized profit/loss (NUPL). Source: Glassnode

XRP net unrealized profit/loss (NUPL). Source: Glassnode

For example, in late 2017, XRP’s NUPL spiked to similar levels just as XRP price peaked above $3.30. A comparable pattern unfolded in April 2021, when NUPL readings above 0.5 coincided with XRP’s top near $1.95 before another sharp downturn.

The current trajectory suggests investors are heavily in profit but not yet in full “euphoria.” But the risk of profit-taking and distribution will intensify if NUPL rises toward greed levels for the first time since 2018.

XRP might absorb potential selling pressure and avoid a deeper correction below $3 if it can attract fresh inflows, driven by institutional demand and broader altcoin momentum.

XRP’s Classic Bearish Setup Risks 20% Drop

XRP price is consolidating inside a descending triangle after rising above $3.

The pattern, typically bearish, is defined by lower highs against horizontal support near $3.05. Earlier this month, XRP briefly broke below the support in a fakeout, only to rebound back inside the structure.

XRP/USD four-hour price chart. Source: TradingView

XRP/USD four-hour price chart. Source: TradingView

The pressure from repeated retests of the lower trendline raises the risk of a decisive breakdown. A confirmed move below $3.05 could trigger a sell-off toward $2.39 by September, down about 23.50% from current price levels.

On the other hand, the bulls must break above the descending resistance line to regain upside momentum and invalidate the bearish setup. Many believe that the XRP price could rise to $6 in this scenario.