Paradigm Envisions a Novel Prediction Market: Can You Bet Without Counterparties?

A New Private Prediction Market: Those who spot opportunities can receive rewards from those who take action.

Original Article Title: Opportunity Markets

Original Article Authors: Dave White, Matt Liston

Original Article Translation: Luffy, Foresight News

Imagine you have discovered an unsigned band that is destined for great success. Instead of hastily calling a record label, what if you could "bet" on them yourself?

The "Opportunity Market" described in this article is precisely that kind of private prediction market: where those who identify opportunities can be rewarded by those who take action.

Record labels, research labs, and venture capital firms all want to be ahead of the curve in finding the next big thing. However, those who first spot the opportunity often do not have the institutional channels. Historically, there has been a lack of a seamless way for these two parties to connect and transact.

Prediction markets extract valuable signals from dispersed participants by "having skin in the game." But if someone wants to bet $1 million that "XYZ will skyrocket," there must be someone else willing to bet $1 million against it. However, no one is willing to bet against the thousands of opportunities they have never heard of.

The natural counterpart in these markets should be those with the ability to take action: such as record labels, employers, funds, etc. But if they provide liquidity in open prediction markets, they are essentially "subsidizing" information that competitors can easily capitalize on.

The Opportunity Market addresses this issue by "only revealing market prices to the initiator."

A record label might provide $25,000 in liquidity for the target "We will sign artist XYZ in 2025," and this "no-questions-asked money" can be won by scouts who act quickly. When the label sees the price of the target rise, it serves as an early signal to dig deeper into this artist. Prices and positions are only made public after an "opportunity window" (e.g., two weeks). This is like a decentralized scouting program where anyone in the world can have skin in the game to participate.

The actual challenge is that traders operate in the dark for a long time without price or position feedback, akin to "blind operation," and the risk of self-trading is evident. However, we believe there is value to be unearthed here, with a vast design space.

Key Concept

Motivation

Imagine a music fan discovers an unsigned artist destined for stardom. The fan holds valuable information but lacks connections to record labels, while the record label that could sign this artist is completely unaware of their existence. Similarly, imagine a researcher finds a niche paper containing groundbreaking results related to autonomous driving, but they lack the resources to commercialize it, and the companies investing billions in R&D are oblivious to this paper.

This pattern repeats across multiple fields: small shop owners identify trends before big brands, local suppliers spot promising businesses before investors, and fans recognize sports prodigies before the general public.

In each case, those on the frontline with deep contextual professional knowledge hold incredibly valuable information for those with resources to act. However, there is no mechanism to connect the two: those with information cannot monetize their insights, while those with resources miss out on opportunities.

This article focuses on such opportunities: assessments and actions that require substantial resources, are competitive and time-sensitive, and therefore, knowing about these opportunities earlier than others capable of acting can provide a significant advantage.

Existing Mechanisms

Scouting programs are one solution to the aforementioned scenario. They provide a "small profit share for opportunity discovery" to specific individuals with contextual knowledge. However, such programs are limited by trust requirements and evaluation costs: an organization's scale cannot surpass its capacity to vet scouts and recommended content.

Prediction markets are a proven way to aggregate information from a broad, diverse group of people. However, there are incentive issues: if someone wants to bet big on an artist's success, others have to bear corresponding losses. Market makers have no incentive to wager a significant amount on an artist they have never heard of failing. Even if organizations subsidize market liquidity to obtain information, the prevalent prediction markets today often provide information as a "public good" — competitors can freely ride on these signals, eventually erasing the advantage. This is the core "information leakage" problem that opportunity markets aim to solve.

Mechanism Design

Example

Using an example is the easiest way to explain this concept. Suppose a record label wants to create a decentralized scouting program using an opportunity market.

They establish a series of private prediction markets with the question, "Will we sign Artist X in 2025?" Here, X can be any artist. Anyone can create new markets for artists not listed and include them in this series.

Here, "private" means: only the initiator (i.e., the record label) knows the market price at any given time. The following sections will discuss some of the challenges involved in this.

As a market maker, a record label may provide up to $25,000 in liquidity for each market. They can commit to providing this amount of liquidity or prove it in some way (such as running an automated market maker in a Trusted Execution Environment (TEE)). Scouts can win "blind funds" just by acting early. As scouts grow more confident in an opportunity, they buy more shares, driving up the market price. When the price of an opportunity rises, the issuer (record label) takes notice, investigates, and may eventually sign the artist. If a signing does happen, shares pay out, and the record label effectively rewards the decentralized scout with up to $25,000 in incentives.

Privacy Protection

For the opportunity market to function, only the issuer must be able to see the current price. If traders could see their order fulfillment immediately, they could reverse-engineer the market price through their trades.

However, traders eventually need to know their position. The solution is to set an "opportunity window" (e.g., two weeks), after which traders can see if their orders were filled. This allows the issuer time to investigate promising opportunities before information is public.

After the window, there are various design choices: publicizing all prices and positions, only revealing individual positions to traders, applying different rules for large and small orders, etc. More complex systems may allow for "close-out sell" or "close-out buy" limit orders before position disclosure or even permit trading agents to operate without revealing current positions.

Market Design Details

Liquidity Provision

A market can operate in either an automated market maker model or an order book model. In either case, liquidity may be concentrated in specific ranges. For example, an issuer may start providing liquidity from a 1% probability level (information below this level has no practical value) and stop providing it at a 30% probability level (market signals above this level offer limited additional value).

Unbounded Markets vs. "Top N" Markets

For most types of opportunities (like signing an artist), the issuer has a limited number of actions they can take within a specific timeframe. Therefore, if traders are willing to trust that the record label will fulfill payments, the company only needs to commit to markets with an unlimited quantity, such as "Will we sign Artist X by 2025?" Ensure that the sum of all market liquidity does not exceed the "can fulfill even if we sign too many artists" range. For a more "permissionless" approach, markets can achieve full collateralization through a "Top N" structure. For instance, in a market with the subject "Will XYZ be one of our Top 10 signed artists by 2025?" each market must collateralize funds equal to 10 times the maximum liquidity since only 10 such markets can pay out.

Restricting Exploitative Behavior

The initiator, possessing both special information about the market state and knowledge of their own operational processes, introduces an exploitative risk. For example, they may hint at utilizing Opportunity X while heavily selling in that market.

It is difficult to address this issue from a mechanism design perspective, as it heavily relies on trust and reputation effects. Ultimately, market participants will only be willing to engage in a market initiated by the initiator when the initiator has demonstrated fairness over the long term. The initiator can follow the guidelines below:

· Committing to never actively sell any share of a market they initiate;

· Committing to either return all proceeds from Opportunity Market trades to participating traders or use them to provide additional liquidity for future markets.

Running Opportunity Markets in a Trusted Execution Environment (TEE) and publicly disclosing all trades after market settlement can also provide some transparency and mitigate risks.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

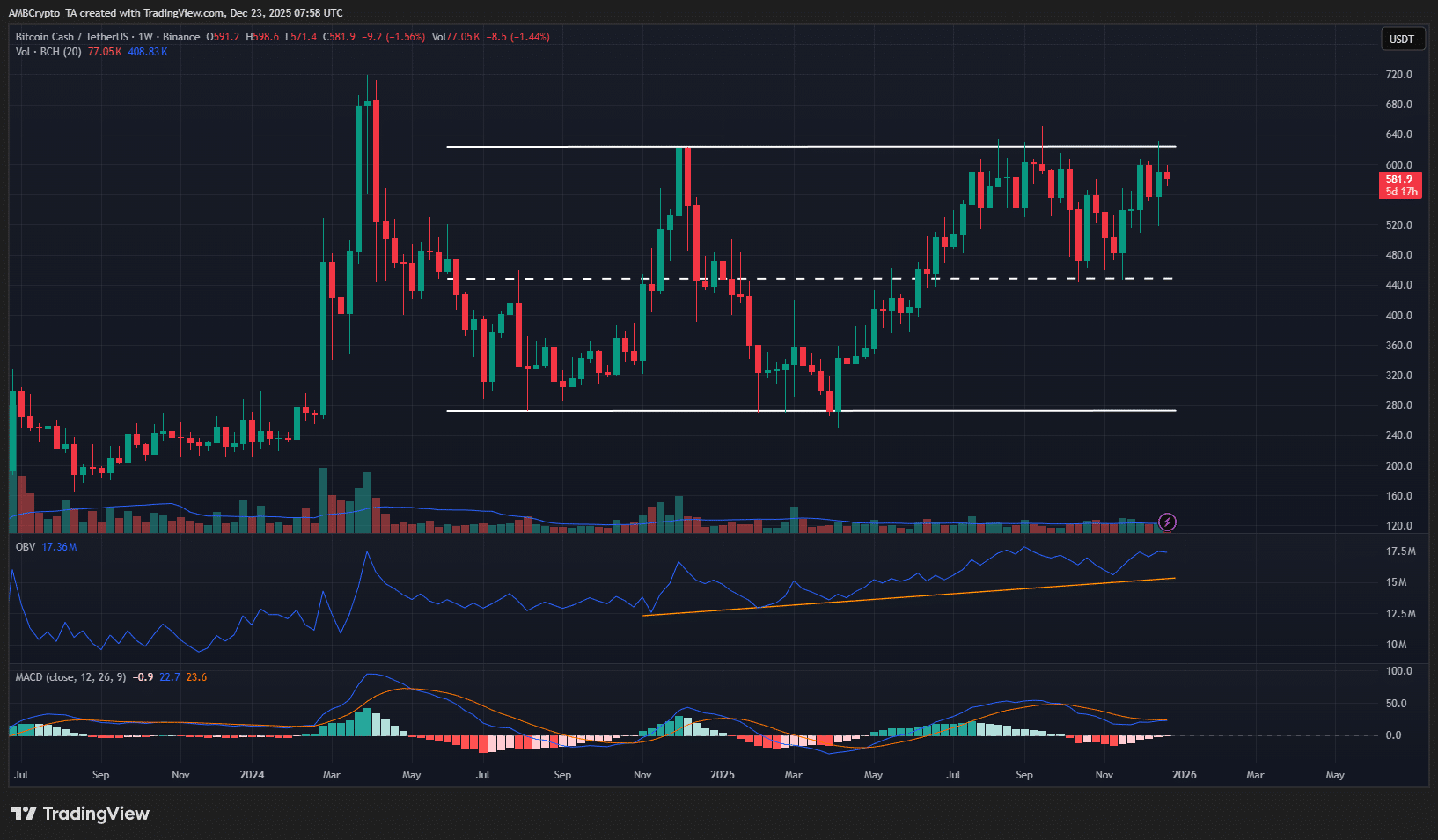

Bitcoin Cash – Why buying BCH before a $624 breakout is risky

Falcon Finance Strengthens USDF Expansion Through Chainlink Price Feeds and CCIP

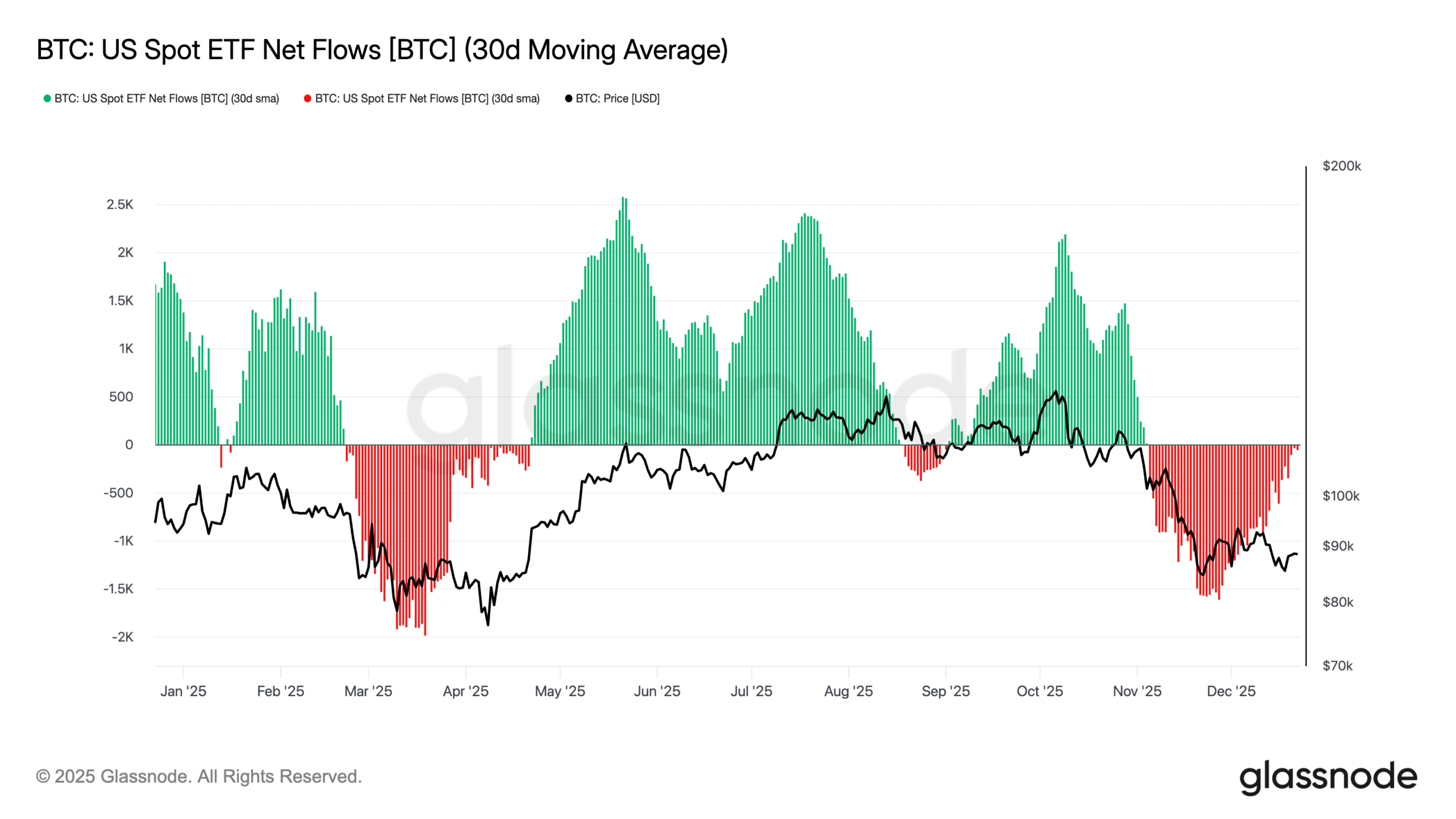

Bitcoin and Ethereum ETFs see persistent outflows as institutional appetite weakens

Zoox issues software recall over lane crossings