SHIB and DOGE Stabilize as PEPE and WIF Show Signs of Weakness

The meme coin rally has hit a pause after a week of sharp gains and now the top tokens Shiba Inu, PEPE, Dogecoin, and WIF have pulled back into a consolidation phase. Surely, traders now are in a “wait-and-watch” mode. Although strong support zones have resisted a deeper selloff so far, the market is all but in a tug-of-war.

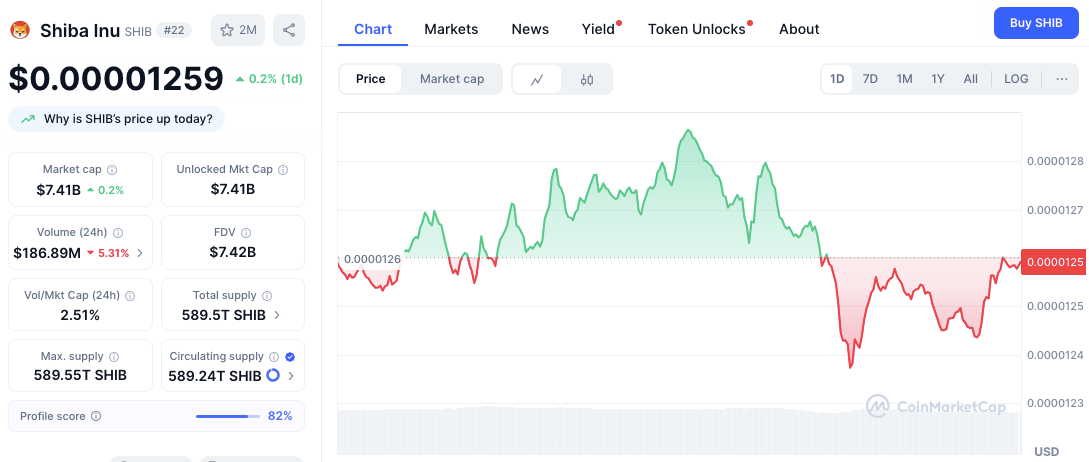

Shiba Inu and PEPE Struggle for Momentum

Shiba Inu is trading at $0.00001258, with a mild 0.18% pullback in the last 24 hours. The price tested highs near $0.00001290 but has since slipped into consolidation.

Support remains firm around $0.00001230, while resistance near $0.00001285 continues to cap upside attempts. The narrowing range signals indecision, yet a break above resistance could spark a run toward $0.00001320.

Related: Top Meme Coin Gainers: WIF, PEPE, DOGE Lead Market Rally

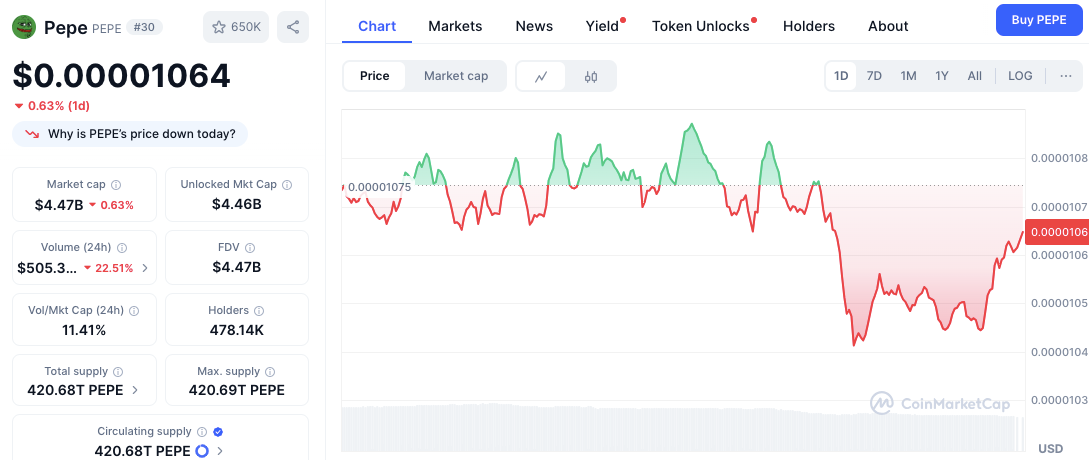

Meanwhile, PEPE shows a sharper slowdown, slipping 1.19% to $0.00001061. More concerning is its 21% drop in daily trading volume, signaling fading participation.

The token is moving sideways between $0.0000104 and $0.0000108, where both buyers and sellers are cautious. A clear breakout from this tight band will likely decide the next leg, but the weakening volume suggests bulls need to return with strength.

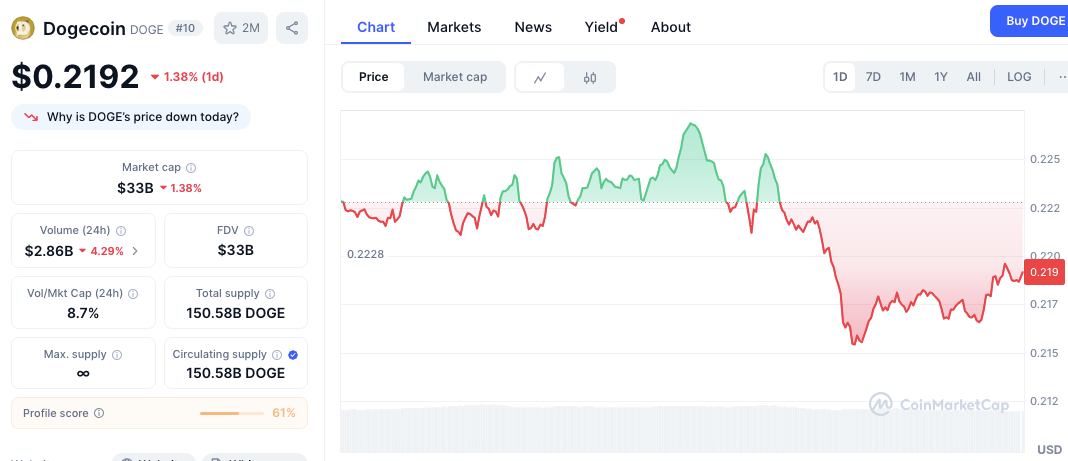

Dogecoin and WIF Hover Around Key Levels

Dogecoin remains the largest in this group, priced at $0.2187 with a $32.9B market cap. The coin briefly surged to $0.225 before retreating toward $0.215. This level has acted as a strong floor, cushioning further decline.

However, DOGE must regain $0.223–$0.225 to confirm renewed bullish pressure. Otherwise, a drop below $0.215 could extend losses toward $0.210.

Related: Meme Coins Like PEPE, WIF, and BONK Outshine Tech Tokens in 2025

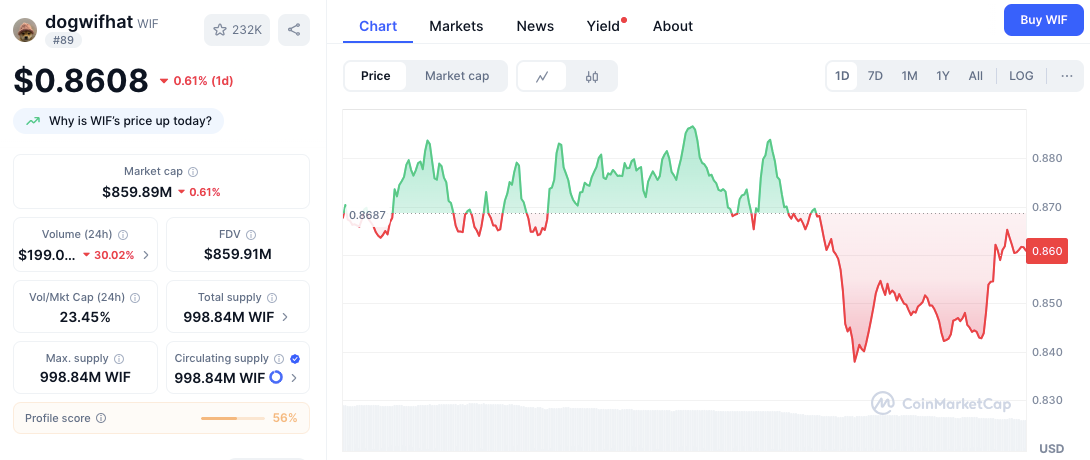

WIF, the Solana-based newcomer, trades at $0.861 after intraday swings. It rallied to $0.880 early in the session but later reversed sharply.

Support lies near $0.845, while resistance at $0.870 is proving difficult to clear. With volume down 31%, momentum appears fragile, making decisive moves harder to sustain.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Can the 40 billion bitcoin taken away by Qian Zhimin be returned to China?

Our core demand is very clear—to return the assets to their rightful owners, that is, to return them to the Chinese victims.

Bitcoin Surges but Stumbles: Will Crypto Market Recover?

In Brief Bitcoin fails to maintain its position above $93,000 and faces heavy selling pressure. Altcoins experience sharp declines, with some showing mixed performance trends. Shifts in U.S. spot Bitcoin ETF flows highlight cautious investor behavior.

Qubic and Solana: A Technical Breakthrough by Studio Avicenne