Solana Falls, But Long-Term Holder Accumulation Puts $200 Back on the Table

Despite a 10% decline over the past week, Solana’s long-term holders are increasing their positions, suggesting confidence in its mid-to-long-term prospects. If this trend continues, SOL may rebound and aim for $200.

Solana’s price performance has been weighed down by the broader market’s sluggish momentum over the past week. With trading sentiment leaning cautious, SOL has shed 10% of its value in the last seven days.

However, there is a catch. Long-term holders (LTHs) view this correction as a fresh buying opportunity, quietly increasing their exposure to the altcoin. How will this impact SOL’s performance in the near term?

Solana Holders Accumulate Despite Price Weakness

Glassnode’s data has shown a steady decline in SOL’s Liveliness since August 16. It started dropping after a peak of 0.7656, confirming the waning selloffs among investors who have held SOL for more than 155 days.

SOL Liveliness. Source:

Glassnode

SOL Liveliness. Source:

Glassnode

For token TA and market updates: Want more token insights like this? Sign up for Editor Harsh Notariya’s Daily Crypto Newsletter .

The Liveliness metric tracks the movement of long-held/dormant tokens by calculating the ratio of coin days destroyed to the total coin days accumulated. When it trends upward, more dormant tokens are being moved, signaling profit-taking by long-term holders.

Converesly, as with SOL, when an asset’s Liveliness falls, its LTHs are moving their assets off exchanges and choosing to hold.

This suggests that despite SOL’s recent price performance, its LTHs remain confident of its mid- to long-term prospects. If the accumulation trend continues, it could trigger a rebound in the near term.

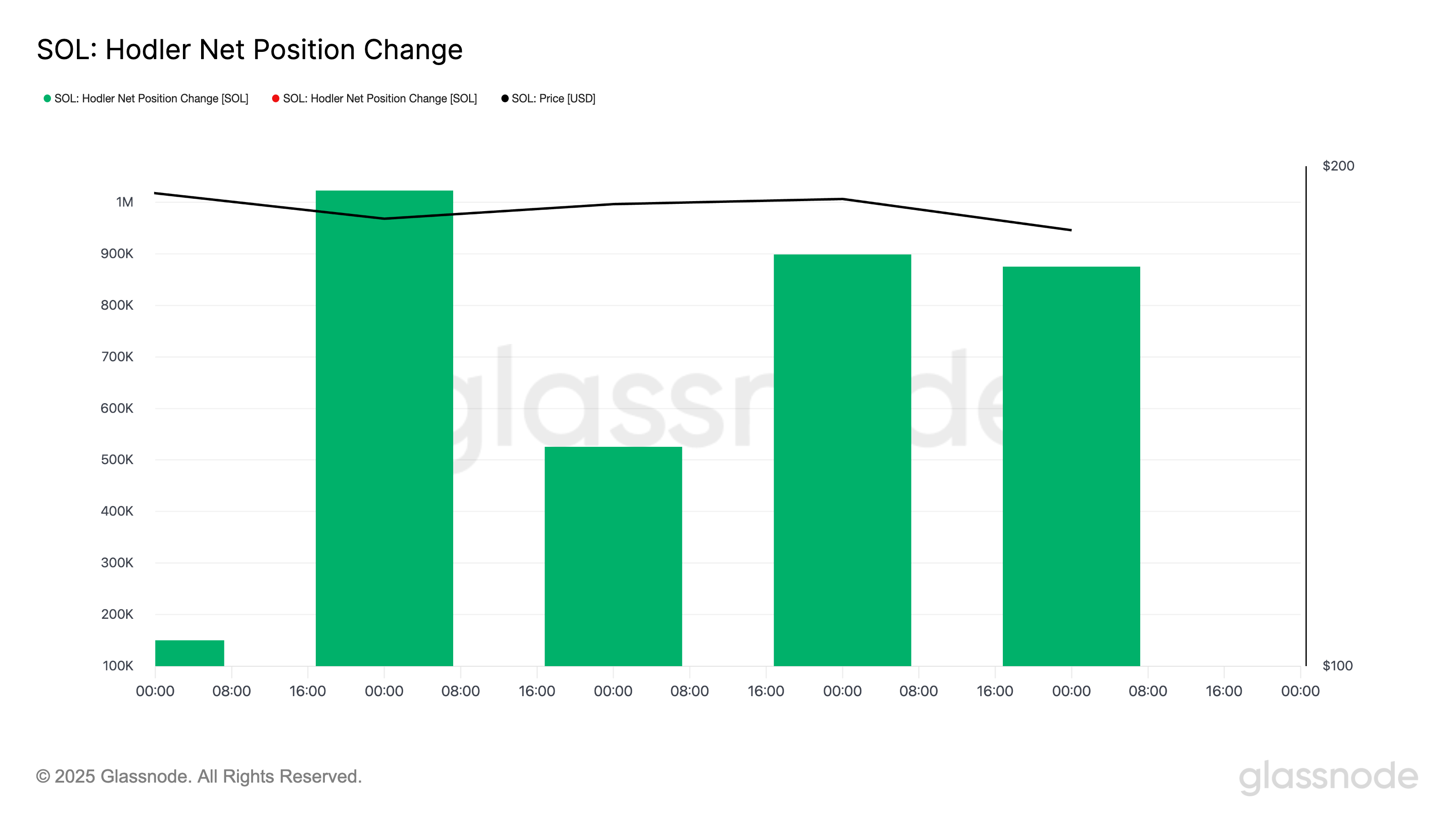

Moreover, readings from SOL’s Hodler Net Position Change confirm the reduced selloffs from these key holders. Per Glassnode, this metric, which measures the 30-day change in the supply held by LTHs, rose by 64% between August 16 and 18.

SOL Hodler Net Position Change. Source:

Glassnode

SOL Hodler Net Position Change. Source:

Glassnode

When this metric rises like this, it indicates that LTHs are accumulating more coins than selling them. This means more SOL coins are being moved into long-term storage, despite the asset’s recent price decline.

$200 Solana Back in Sight, If Buyers Can Overcome Fading Inflows

If the accumulation trend continues, SOL could see a swift rebound and attempt to breach the resistance at $195.55. Once this happens, SOL could regain the $200 mark and rally toward the February high of $219.21.

However, risks remain. SOL’s Chaikin Money Flow (CMF), which measures capital inflows, is trending lower, implying that liquidity is drying up. Without renewed inflows, any rebound led by LTHs could struggle to gain sustained momentum.

SOL Price Analysis. Source:

TradingView

SOL Price Analysis. Source:

TradingView

In this case, its price could break below $171.81.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Interview with VanEck Investment Manager: From an Institutional Perspective, Should You Buy BTC Now?

The support levels near $78,000 and $70,000 present a good entry opportunity.

Macroeconomic Report: How Trump, the Federal Reserve, and Trade Sparked the Biggest Market Volatility in History

The deliberate devaluation of the US dollar, combined with extreme cross-border imbalances and excessive valuations, is brewing a volatility event.

Vitalik donated 256 ETH to two chat apps you've never heard of—what exactly is he betting on?

He made it clear: neither of these two applications is perfect, and there is still a long way to go to achieve true user experience and security.

Prediction Market Supercycle