Toyota explores blockchain to turn cars into tradable RWAs

Japanese automaker giant Toyota is exploring the financialization of car ownership, turning fleets into assets.

- Toyota has proposed a blockchain that links all key data on cars

- NFTs can represent vehicle ownership, and traders can bundle them in a portfolio

- The concept is especially useful in EVs, robo-taxis, and fleets

Toyota is actively exploring the concept of tokenizing cars. On Tuesday, August 19, Toyota Blockchain Lab released a white paper on the Mobility Orchestration Network (MON). This new blockchain would be able to track key vehicle data, potentially turning cars into tokenized assets.

The proposal explains that every vehicle, including logistic trucks, rental fleets, or even robo-taxis, leaves a trail of information behind it. This information, including registration, manufacturing, and maintenance, could be bundled as proof on the network into a token.

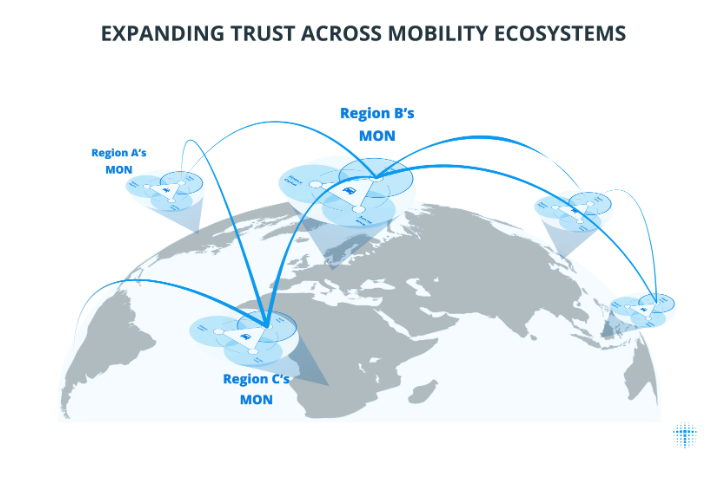

Diagram showing Mobility Orchestration Network connecting information across several regions | Source: Toyota Blockchain Lab

Diagram showing Mobility Orchestration Network connecting information across several regions | Source: Toyota Blockchain Lab

Each vehicle would have its own NFT, which comes together with all its history and key info. Potential buyers could then use this information to assess the car’s value. What is more, the network could enable users to buy these NFTs without having to physically control the vehicle.

How Toyota sees the future of car ownership

Toyota Blockchain Lab envisages several use cases for this network. For one, vehicles are expensive. However, unlike housing, they have so far eluded the trend toward financialization. With a blockchain network tracking their use, car ownership and use don’t have to be closely tied together.

For instance, carmakers could bundle multiple car NFTs into a fund, effectively enabling investment in car fleets. The same type of investment vehicle could be used to fund robo-taxi fleets or logistics fleets in emerging markets.

What is more, if cars can be securitized, fleet operators could be able to raise capital more cheaply than through loans. Still, the white paper does not go into how this financialization of car ownership could affect regular car owners or car prices.

Disclaimer: The content of this article solely reflects the author's opinion and does not represent the platform in any capacity. This article is not intended to serve as a reference for making investment decisions.

You may also like

Major Bank Offers Crypto Services After Securing Key MiCA License

Penske Logistics is transitioning from testing AI to putting it into practical use

Human.tech Kicks Off Season 2 of HUMN onchain SUMR

Morning Minute: Financial Advisors Show Unprecedented Optimism Toward Crypto